Mapping geography yields some surprises

By Zheng Yangpeng (China Daily) Updated: 2014-08-19 13:50

|

|

|

Source: CBN [Provided to China Daily] |

South dominates to a much larger degree than many assume

Various methods are used to measure economic disparities among China's regions. The most common gauges are GDP and per capita GDP.

The results, however, could be skewed by disproportionately high industrial and infrastructure spending in some regions, which under current circumstance, could be a burden rather than an advantage.

China Business News used an alternative method, comparing regions' competitiveness through the number of listed companies. The idea was to find a better measure than those based on GDP.

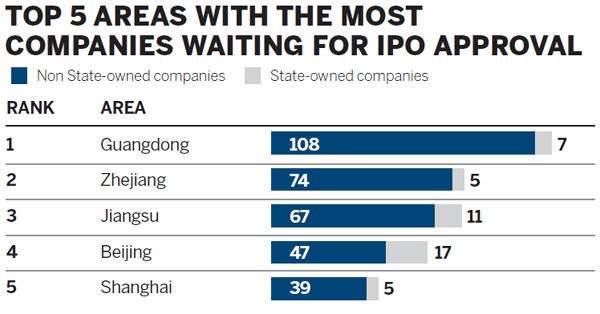

A long moratorium on initial public offerings left many competitive and fast-growing companies waiting on the sidelines. But in a way, it also divided large companies into two groups: companies that have been listed in the Shanghai and Shenzhen exchanges and those that are waiting for approval from the China Securities Regulatory Commission. If the first group represents the past, the latter represents the emerging forces of the future.

The study of 2,525 A-share listed companies and 596 to be listed (as of late July) revealed many things, many of which reinforced long-standing perceptions. And much dovetailed with what could be concluded from GDP analysis: Guangdong is still the largest economic powerhouse.

The Pearl River Delta, the Yangtze River Delta and the Beijing-Tianjin-Hebei cluster remained the three most important engines of China's economy.

But there were also surprises and nuances that foreign investors should bear in mind if they want to have a better grasp of this vast country's economic geography. For example, the economic center of gravity is tilted much more toward the south than most people think.

For example, the Yangtze River Delta and the Pearl River Delta accounted for 27.1 percent and 14.9 percent of China's listed companies, respectively.

The Beijing-Tianjin-Hebei cluster had only 12.5 percent.

The tilt is more obvious when one examines the number of companies waiting to be listed: the Yangtze River Delta and the Pearl River Delta were home to 33.7 percent and 19.3 percent, respectively, while the number for the Beijing-Tianjin-Hebei cluster was just 12.7 percent.

And except for Beijing, which topped all lists, there was no other northern city that made it into the top 10 list, either by number of listed companies or companies to be listed.

Tianjin, the much trumpeted "northern China economic hub", which led the nation in GDP growth in recent years, failed to make into the top 10. The city, with only 39 companies listed and eight awaiting a listing, was far behind other cities.

By comparison, the concentration of big industrial companies in Tianjin made its GDP in 2013 1.78 times that of Wuxi. Other rising stars in the north had just a dim presence on the CBN list. Shandong, which ranked third in terms of GDP nationwide, was dwarfed by smaller economies such as Zhejiang and Shanghai.

Shandong, 46 percent larger than Zhejiang in terms of 2013 GDP, had only 151 listed companies, while Zhejiang has 252.

Northern regions also generally lost to southern ones in terms of the vigor of private companies: Only 35.9 percent of the 39 listed companies in Tianjin were private, a ratio lower than the national average.

Shandong was even lower, and of the 28 to be listed companies in the province, 21 were in the manufacturing sector, while those in the new economy-represented by information technology, software, culture and entertainment-stood at four.

- Homegrown brands advised to stay relevant to customers

- Farmers climb bamboo ladder to riches

- Preferred shares may erode bank profits

- Mapping geography yields some surprises

- Ice bucket charity heats up Internet

- China to expand agro produce trade with Russia

- Chinese firm recruits nearly 2,500 Kenyans for rail project

- Mixing old and new recipe for success