Open the gate wider but raise the bar too

By Cecily Liu and Zhang Chunyan (China Daily) Updated: 2014-08-25 07:16

|

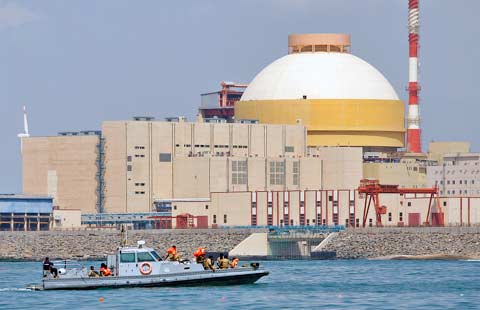

Sean Breslin, director of the Centre for the Study of Globalization and Regionalization, says foreign investment in China could have allowed a lot more local skills and technology transfer than it has. Zhang Chunyan / China Daily |

China needs more high-end foreign investors with advanced skills, expert says

A British expert on Chinese international relations says foreign direct investment into the country since it started opening up in the 1980s has failed to play as significant a part as the Chinese government had hoped in the upgrading of its domestic industries.

Sean Breslin, director of the Centre for the Study of Globalization and Regionalization at the University of Warwick's department of politics and international studies, says as the Chinese economy continues its structural shift to more consumption-led growth, foreign investment into the country could have allowed a lot more local skills and technology transfer than it has.

Breslin says the Chinese government must now open up its market wider to more foreign investment, and if it does so, it would increase its bargaining power to encourage more overseas companies to bring their skills and technology into the economy, which would in turn create many more jobs and raise skill levels.

After studying in China in 1984, Breslin has spent the past 30 years researching the politics, political economy, and international relations of contemporary China.

He is now an associate fellow at Chatham House, the Royal Institute of International Affairs, an independent policy institute in London.

He is also author of the 2007 book China and the Global Political Economy and many papers on the Chinese economy and its relationships around the world.

One of the biggest mistakes that many still make about China is to equate its GDP growth to its economic power, he says.

He argues that this is misguided because GDP growth very often includes the output value of foreign investors, but that the benefits gained by those companies are often not transferred to a host country.

FDI in China has failed to result in the higher levels of industrial modernization and upgrade that some suggest, he says.

As a result, before the most recent shift to a more consumption-based economy, the government had little bargaining power with the foreign companies that had invested in China, as many have simply arrived and set up cheap production and export operations, he says.

Breslin is confident the situation will gradually improve, but says the "crucial thing is to distinguish clearly between two kinds of investment" - those aimed at the Chinese market, and those that use cheap Chinese labor to produce export goods.

"If foreign investors want to access the Chinese market, they should be made to introduce new skills, technologies and standards to China. For some sectors, that has happened, but certainly not for the export sector."

Foreign companies would bring more skills and technology to Chinese if stricter government regulations insisted they do so, he says.

But this does not work on foreign investments aimed at exports, because instead that would simply drive investors to lower cost markets.

It is a trade-off the Chinese government must be prepared to accept, lower amounts of growth, but at a higher quality, he says.

There are hard lessons to be learned from past high-quality, technology investments into China, he says.

The Taiwan-based multinational manufacturer Foxconn, considered the world's largest electronics contractor and manufacturer whose clients include major American, European, and Japanese electronics and information technology companies, for instance, attracted some unwelcome attention when it invested in major high-tech operations.

|

|

|

|

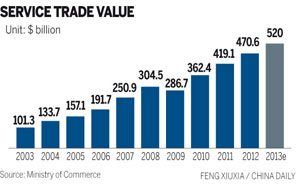

Services trade growth outpaces that of goods |

- China Southern Airlines' fleet hits 600

- Chinese OS expected to debut in October

- China's carmaker BYD profit falls 15.5% in H1

- Kung fu helps kick-start careers in assertive way

- Daughters take helm in family-run businesses

- Macworld/iWorld Asia 2014 exhibition kicks off in Beijing

- New railway construction is on track for this year

- Top 10 Chinese cities with best business environment