Open the gate wider but raise the bar too

By Cecily Liu and Zhang Chunyan (China Daily) Updated: 2014-08-25 07:16Its labor practices came under hefty global scrutiny when 13 employees committed suicide at its Chinese plants in 2010, and then three years later when it admitted student interns had been working shifts that were in violation of its company policies.

Breslin says Foxconn should certainly have implemented more acceptable corporate social responsibility measures, but that the conditions of its investment were muddied by the fact the company was both a high-tech mass producer and an exporter.

Breslin says one reason behind labor law violations by major investors still happen in China is the country's speed of growth, meaning the enforcement of rules and practices is sometimes ignored.

He hopes the shift in economic focus away from cheaper exports toward domestic consumption has started to address that particular issue, but it is difficult to convince some international investors to go to China, even with the effects of Chinese currency appreciation and a reduction in export tax.

However, what is now working in China's favor, as it attempts to raise the standard of its manufacturing base, is that its supply chain is becoming more sophisticated, manned with a better qualified and educated workforce - the direct result of increased government spending on training of industrial technicians, researchers and designers, for instance.

The fact the country not only weathered the 2008 financial crisis better than many of its competitors, too, means its global economic power has grown, Breslin says.

"China started developing its overseas financial power before the financial crisis, but it really took off after then, and that's been a real game changer for the country."

China's careful investments into other developing countries, particularly in Latin America and Africa, have also allowed those economies to recover quickly, while its acceleration of investment in troubled Europe - including significant sums in European debt - encouraged countries there to address their sovereign debt crisis, and helped avoid the world from slipping into recession.

According to a report from the Rhodium Group, the New York-based consultancy, China's annual investment in Europe tripled from 2006 to 2009, and tripled again to $10 billion (7.7 billion euros) in 2011.

The number of deals with a value of more than $1 million doubled from less than 50 in 2010 to almost 100 in 2011.

The report says that Europe can expect new Chinese investment of about $250 billion to $500 billion by 2020, if it continues to attract investments at the current pace.

Breslin says China's growing power on the international economic stage was no better illustrated than in October 2011, when Klaus Regling, chief executive of the European Financial Stability Facility, the continent's bailout fund, traveled to Beijing, just a day after eurozone leaders had agreed to leverage the 440 billion euros EFSF to 1 trillion euros.

At the time Europe had reportedly been toying with the idea of asking China and other emerging economies to help, possibly by investing in the rescue fund.

That gave such a powerful message to the world, Breslin says, that almost everything that might have been said about China's global political influence before the financial crisis became irrelevant.

|

|

|

|

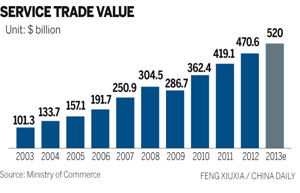

Services trade growth outpaces that of goods |

- China Southern Airlines' fleet hits 600

- Chinese OS expected to debut in October

- China's carmaker BYD profit falls 15.5% in H1

- Kung fu helps kick-start careers in assertive way

- Daughters take helm in family-run businesses

- Macworld/iWorld Asia 2014 exhibition kicks off in Beijing

- New railway construction is on track for this year

- Top 10 Chinese cities with best business environment