Homegrown firms rule the roost in retail, report says

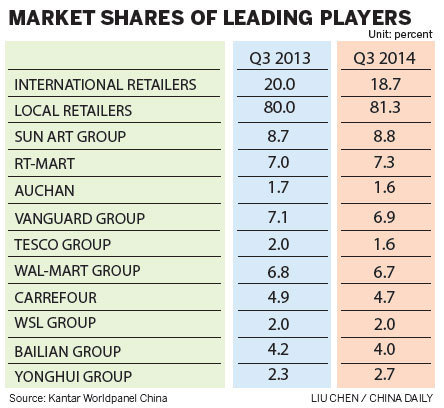

By Wang Zhuoqiong (China Daily) Updated: 2014-10-15 08:27International retailers continued to lose ground to local companies despite a rebound in the fast-moving consumer goods market during the third quarter, an industry report said on Tuesday.

Kantar Worldpanel, a global market leader in consumer panels, said in the report that the consumer goods market posted a value growth of 5.7 percent for the 52-week period ending Sept 5 this year, much lower than the earlier levels.

Sector growth, however, rebounded to 6.9 percent during the period, much higher than the 4.7 percent recorded in the second quarter and 4.6 percent in the first quarter.

The report also found that international retailers continued to lose market share to local players. At the national level, most of the international retailers reported declines in market penetration, due to stagnant shopper spending.

International firms lost ground to Chinese retailers in all the four regions of the country, with the biggest declines seen in the northern region, it said.

Local retailers maintained their penetration levels and benefited from higher shopper spending.

Wal-Mart China saw its year-on-year market share for the period under review fall from 7.1 percent to 6.7 percent. The Chinese division of the US-based retailer also dropped to fifth place in the list of top retailers in China. French retailer Carrefour SA saw its market share fall from 5.1 percent to 4.8 percent.

If China Resource's Vanguard Group Inc can successfully brand all the current Tesco stores, it will become the biggest individual banner with 8.4 percent value share in the third quarter, compared with the 7.3 percent of the current market leader RT-Mart of the Sun-Art Retail Group Ltd.

Retailers competing in the eastern region, where the environment is more challenging, showed the highest level of consolidation, according to the report. In the west the retailer became the third-largest player with a share marginally lower than the second-place Vanguard Group.

Kantar Worldpanel said that about 34 percent of the urban families in China now do their shopping online. E-commerce is also no longer a preserve for younger consumers. Kantar Worldpanel found that online shopping penetration is growing among older families, with 26 percent making online purchases during the period under review - a 49 percent increase over the levels seen in 2012.

|

|

|

| AMP Capital seeks China malls for slice of growing retail pie | China's major retailers lose shoppers |

- China's September PPI down 1.8%

- China's September inflation hits 4-year low

- TCM costs rise as donkey herds dwindle

- China sets up investment fund for integrated circuit industry

- China's provident fund loans tops 2.4t

- Kazakhstan mulls exporting oil to China

- Chinese bank, Tesla to build charging facilities

- China's business registrations surge