China buys Colombian oil as global glut deepens

(Agencies) Updated: 2014-10-25 08:37Colombian oil output has increased about 10 percent since 2011 and the nation is seeking sales in Asia to compensate for the weakening in short-haul exports as US production increases, said Bernard Leung, a Bloomberg oil strategist in Singapore.

China's supplies from Colombia cost an average of $94.56 a barrel last month while Saudi shipments were purchased for $102.30, according to data compiled by Bloomberg.

Saudi Arabia, the world's largest oil exporter, earlier this month reduced the price of its Arab Light crude for Asia to the lowest level since December 2008, sparking speculation that a price war was set to start among members of the OPEC. OPEC members Kuwait, Iran and Iraq also cut official selling prices this month.

Refiners including PetroChina processed 42.02 million tons of crude in September, or about 10.3 million barrels a day, according to data from the National Bureau of Statistics in Beijing, that was up 9.1 percent from a year earlier and the most since a record 10.5 million in February.

China National Petroleum Corp's Economic and Technology Research Institute said in a report in January that China's refining capacity will rise 20 percent to 800 million tons a year by 2020, from about 668 million tons at the end of this year.

Brent crude futures slid 8.3 percent on London's ICE Futures Europe exchange in September, the biggest monthly loss since May 2012. They had slumped a further 8.7 percent to $86.40 by Friday after touching $82.60 on Oct 16, the weakest since November 2010.

"Chinese buyers are jumping on the opportunity to buy crude on the cheap at the moment," David Wech, the managing director of JBC Energy GmbH in Vienna, said in an Oct 17 e-mail. "Refining margins have surely benefited from weak outright crude prices."

The US imported 7.62 million barrels of crude a day in July, 29 percent less than the peak in June 2005, data from the Energy Information Administration show. Shale oil has boosted the country's crude output to the highest since 1985.

European consumption is also shrinking as refineries shut or convert to storage depots at the fastest pace since the 1980s.

The Paris-based International Energy Agency said that crude that may have previously found a buyer in the US or Europe is now available for Asia and competing with traditional suppliers from the Middle East.

Asia will account for almost 80 percent of global demand growth this year, with China alone responsible for one-third.

"The next area we see being backed out, if US production continues growing, is some of the Latin American producers such as Colombia and Venezuela," said Chauhan of Energy Aspects.

PetroChina's Liaohe refinery had processed about 30,000 tons of Colombian crude by Monday, its parent company, China National Petroleum, said on its website.

The plant ran 792,000 tons of imported oil last year, or about 15 percent of its total throughput. Suppliers included Russia, Brazil and Venezuela.

China Petroleum and Chemical Corp's Maoming refinery processed crude from Brazil's Ostra field for the first time last month, the company known as Sinopec said on its website on Sept 17. China's purchases of Russian crude increased by 57 percent in September, the customs data show.

"China will continue to import more crude from Russia next year," said Wech of JBC. "Imports from Latin America are also likely to increase as Mexican and Venezuelan volumes are gradually eased out of the US Gulf Coast."

|

|

|

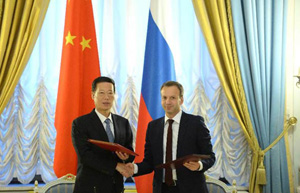

| China, Russia to start construction of joint gas pipeline | Weak demand for refined oil, gas hits CNOOC, PetroChina |

- Investors turning to Chinese bonds for better yields

- Amway planning national network of centers

- Ford plans network of Lincoln showrooms

- Limited impact from 'HK-SH through train' delay

- China buys Colombian oil as global glut deepens

- New home prices continue to fall

- Sony taps high-end segment for growth

- Time for all Apple products to enter China