Themed success

By Wang Zhuoqiong (China Daily) Updated: 2014-11-17 07:49Shanghai Shendi is a conglomerate of State-owned enterprises established by the municipal government to develop the park. Shendi has a 57 percent stake in the project, with Walt Disney holding the remainder.

The park will feature some of the most advanced rides and attractions in the industry, Yoshii said.

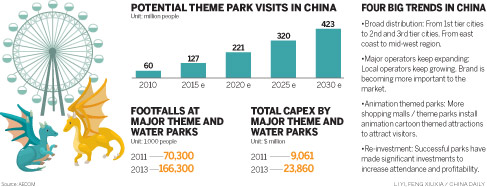

The theme park industry in Asia is expected to see organic growth, much in line with the region's economic growth, in the long term as more people achieve middle-class status, said a recent study conducted by AECOM.

The other top five theme parks in 2013 with the greatest attendance growth were Tokyo Disneyland at 15.9 percent, Tokyo Disney Sea at 11.3 percent, Hong Kong Disneyland at 10.4 percent, Lotte World at 15.9 percent and Seoulland at 8 percent.

There will be tough competitions among the business groups that run the theme parks, which in return will force them to continue beefing up investment and financing, said Qi Qing, senior economic adviser, Beijing Jiaxiao Tech Co Ltd.

Yoshii expects the industry to record strong performance in China in 2014, despite the slower growth last year, thanks to new expansion and additional investment.

That optimism seems to be shared by most of other theme park operators and owners.

"We don't see any reason for negative news. We are anticipating positive growth this year also," said Yoshii.

He said that the Shanghai resort, however, will not have much impact on the company's full year results in 2015 as it would be open for just one or two months. The real impact will be seen from 2016 onwards.

"There is lot of anticipation about the Shanghai Disney project, its opening and success. But it is also important to consider the operational challenges associated with such a huge project," said Yoshii, adding that it will require lots of training and planning as well as concerted efforts on crowd control.

The good thing is that the Disney team has already learned lessons from its experiences in Hong Kong on how to accommodate the mainland market including language and culture issues and how to adjust their services and programs for better results, Yoshii said.

Every year Walt Disney Parks and Resorts receive more than 120 million visitors across its five sites around the world, including millions of Chinese mainland tourists who visit Hong Kong Disneyland and other resorts.

Yoshii said several other international theme park brands are also trying to enter the Chinese market.

The US-based Universal Studio is one of the brands. It is planning a Universal Studio in Beijing, which will need to be more accommodating during the long winter and able to handle the very hot weather in the summer.

- Cash crunch fans expectation on RRR cut

- US extends antidumping duties on China's thermal paper

- Modern food van with ancient look in Shanghai

- China home prices continue to cool in November

- Asia's top 3 billionaires all Chinese

- Old investment remedy the treatment for China's "new normal"

- China's solar sector opposes US anti-dumping ruling

- BMW to recall 846 cars in China