Appeal of ex-Everbright Securities executive rejected

By Cai Xiao (chinadaily.com.cn) Updated: 2014-12-26 13:58

|

|

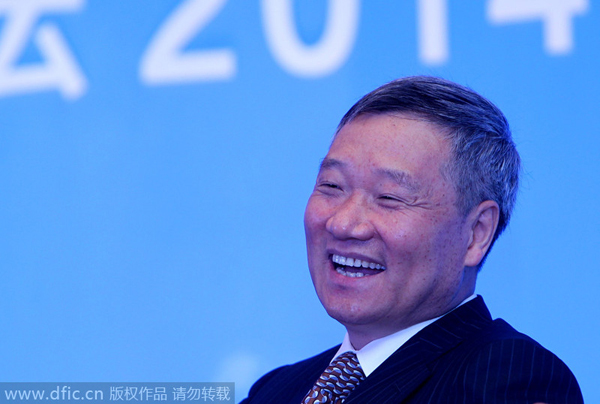

Xiao Gang, chairman of the China Securities Regulatory Commission, laughs at a sub-forum during the Boao Forum for Asia Annual Conference 2014 in Qionghai city, South China's Hainan province, April 10 2014. [Photo/IC] |

Tougher punishment for stock market offence

China's securities regulator on Saturday pledged to intensify punishment for severe stock market violations amid rising such offences.

Jiang Yang, vice chairman of China Securities Regulatory Commission (CSRC), told a listed-companies summit that in the first six months , 26 cases had been submitted to investigations, representing a hefty increase from the same period a year ago.

Stricter supervision and enforcement has played a positive role in promoting openness and fairness, and protecting small investors' interests, he noted.

In the next step, Jiang said CSRC will enhance preemptive oversight, streamline its administrative procedures, and rely on laws to regulate the capital market.

In addition to insider trading, CSRC will also enhance crackdown on false information disclosure, listing fraud and illegal activities by brokerages.

Systematic risks are the bottom line that can never be breached, he added.

CSRC head vows stronger effort on enforcement

Following up on strong words about enforcement, the head of the China Securities Regulatory Commission, Xiao Gang, said his agency would double its investigative team with 600 new staff.

The plan, disclosed by Xiao on the agency's website, is widely seen as a signal that the CSRC is taking serious steps to address deficiencies in the capital markets.

His call came amid the fallout of the Everbright Securities Co Ltd trading error last week, which exposed irregularities and structural flaws in the industry.

- BYD's chairman increases stake, may buy more

- New Beijing airport breaks ground

- China shares surge 2.77% Dec 26

- Urumqi-Lanzhou high-speed rail starts full operation

- High-speed railway reaches China's rugged southwest

- Upgraded 'Mao Zedong' locomotive ready for anniversary

- Appeal of ex-Everbright Securities executive rejected

- China may ease investment rules in FTZs