Top 10 events that moved the stocks

(China Daily) Updated: 2016-01-05 07:08

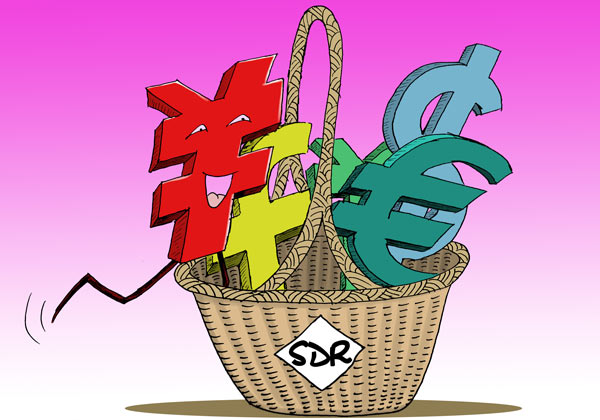

2. The renminbi's inclusion in the IMF's SDR basket boosts investor confidence

On December 1, the International Monetary Fund announced that Chinese currency yuan renminbi will be included in its Special Drawing Rights basket, with a weighting of 10.9 percent. That put the renminbi ahead of the yen (8.3 percent) and the pound sterling (8.1 percent). Analysts said the stock market would benefit from this inclusion as it boosts investors' confidence in China.

The yuan is anticipated to stay strong and support the equity and bond markets, although the effect of inclusion in the SDR basket may take time to manifest. The SDR inclusion may also help push the A-share market into the MSCI Emerging Markets Index, which will bring more liquidity into the Chinese equity market. Corporate entities and countries with significant business with China will increasingly retain reserves in the yuan as trade settled in the currency continues to increase. Authorities in China are likely to respond by further increasing international investors' access to the domestic market.

- Stocks eke out gains amid State-backed buying

- COFCO's Ning to lead Sinochem for international growth

- SPD Bank reveals good performance

- Highlights of CES 2016

- Govt to issue new rules to regulate share sales by top investors

- LeTV eyes stake in soccer club Beijing Guoan

- New World wine, tastes so divine for Chinese

- Future goes on display at Las Vegas tech show