Coal industry faces bleak future as mergers and reshuffle loom

By Cai Muyuan (chinadaily.com.cn) Updated: 2016-01-05 16:07

|

|

After being in a tight spot for over three years and writing off more than 80 percent of losses, China's coal industry faces another tough year with its overcapacity, Securities Daily reported Tuesday. [Photo/China Daily] |

After being in a tight spot for over three years and writing off more than 80 percent of losses, China's coal industry faces another tough year with its overcapacity, Securities Daily reported Tuesday.

Authorities have stressed steps to accelerate the merger and reorganizations of the 'zombie' enterprises, or large-scale sectors with excessive productions suffering long-term losses and have little hopes turning the situations around.

Coal sector has become the main target in the sweep.

Starting from 2012, the coal price saw continuous slumps with a drop over 30 percent. Even though the price fell lower even than potatoes, many companies would rather lose profit than halt production in order to expand the market share. Industry insider told the newspaper that when production stops, the cash flow stops too which puts the companies in a more difficult situation.

Statistics show that the coal sector suffers from an average asset liability ratio of 67.7 percent, the highest point in 16 years.

Many coal companies are swamped. Hidili Industry International Development Limited, the biggest private owned coal mining company in Sichuan, has reportedly defaulted on its $183 million debt. China Shenhua Energy Co Ltd, the nation's biggest coal producer by volume, has seen a 40 percent salary cut.

The China National Coal Group Corp (ChinaCoal), the nation's second-largest producer of coal by output, sold its low-profitable assets in hard cash worth 927 million yuan to reduce the debt and keep the cash flow. Half of the assets were sold by the end of 2015, but it only reduced the debt by one percent, which stood at 79 percent by Sept 30 last year.

According to the company's third-quarter report, the miner has gained 44.8 billion yuan in the first three quarters of last year, a 13.8 percent decrease year on year. The net profit loss was about 1.67 billion yuan, a 352.8 percent slump year on year.

It's also the company's first loss in seven years.

With the bigger players having their hands tight, small fish find it harder to keep it together in the industry winter.

Deng Shun, an analyst with ICIS, told the newspaper that many coal firms keep the wheels running by loaning and will not stop the production any time soon.

Deng said that this situation won't last long as the government's accelerates reforming the sector which means that many small- and medium-sized companies will drop out while bigger ones will merge and reorganize.

China will accelerate the closing and reorganizing of the coal productions of old and low quality and control the capacity tightly, said Lian Weiliang, deputy director of the National Development and Reform Commission, at 2016 China Coal Trade Conference in December last year.

Premier Li Keqiang said that China will lessen the pollution by 60 percent in electric power industry through upgrading, saving around 100 million tons of raw coal demands.

According to statistics, 49 cases of mergers had taken place in coal mining industry in the first 11 months of 2015, a 58 percent of increase from the previous year.

An industry report released by Goldman Sachs Group showed that the reshuffling of the coal sector isn't enough to save the downward trend, more solutions on reforming and reorganizing the industry are still called for.

- No new coal mines to be approved for three years to cut stockpiles

- Combined coal, wind power grid approved for national pilot program

- China cuts coal-fired power price

- New energy must be cheaper for China to end its reliance on coal

- Clean coal to keep emissions at bay, propel use of renewable energy

- Growth to hit 6.7% due to woes in manufacturing, export

- Qiku's Dazen handset reaches 5m units shipped in 2015

- Dalian Wanda clinches deal for Legendary Entertainment: source

- Vanke says progress in revamp but halt in trading to continue

- Tianhong's assets under management exceed $165 billion

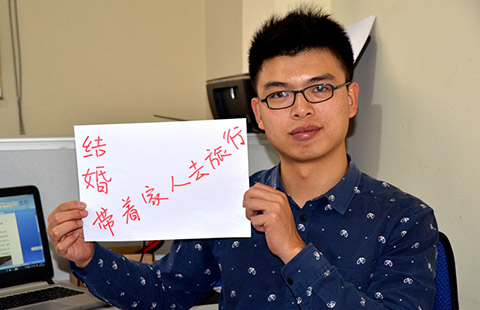

- New Year's wishes from Chinese expatriates

- 'Circuit breaker' important to stabilize market: regulator

- Slump in home market drags down US-traded Chinese stocks