China to boost public investment due to lackluster private capital

(Xinhua) Updated: 2016-07-25 16:58 |

|

A labourer cuts steel bars at a railway bridge construction site in Lianyungang, Jiangsu province, Sept 12, 2015.[Photo/Agencies] |

BEIJING - China will likely boost public investment to offset the effect of lackluster private capital, which has been discouraged by uncertainty amid the ongoing economic restructuring.

"Given the slowdown, the government should begin to invest more, partly through special construction funds, to stimulate investment and stabilize the economy," Zhang Yong, deputy head of the National Development and Reform Commission, China's top economic planner, said during a press conference on Monday.

Government investment will continue to focus on infrastructure construction and projects that affect quality of life, he said.

Zhang's remarks came as Chinese entrepreneurs appeared to remain reluctant to invest during the current economic downturn.

Private investment increased only 2.8 percent in the first half of the year, down from 3.9 percent growth in the first five months and 5.7 percent in the first quarter, official data showed.

In the past decade, private investment saw stellar year-on-year growth of over 20 percent.

"As private capital is concentrated in traditional industries, it needs more time for investors to find new bright spots in the economy during the current economic transformation," Zhang said.

In response, China has channeled more energy into infrastructure improvement, with growth of investment in the sector accelerating to 20.9 percent in the first half.

- China to boost public investment due to lackluster private capital

- China's Sansha launches maritime ecological protection fund

- China built thermal power plant on trial in Vietnam

- Chinese yuan weakens to 6.686 against US dollar Monday

- Broad steps needed to sustain inclusive growth: G20 officials

- UK explores free trade deal with China

- 12 Chinese firms debuted in Fortune 500

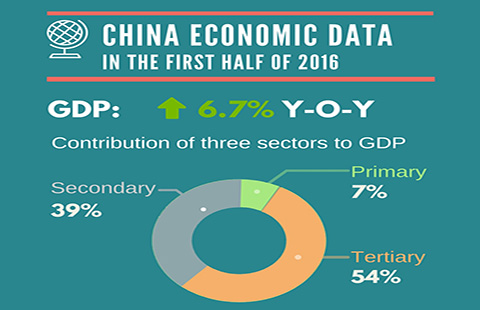

- Infographics: China economy data in H1