Nanjing further tightens control on property market

By Wu Xiaobo (chinadaily.com.cn) Updated: 2016-09-26 13:29

|

|

Potential homebuyers examine a property project model in Nanjing, East China's Jiangsu province, Feb 28, 2016. [Photo/VCG] |

Nanjing, capital of East China's Jiangsu province, adopted new rules restricting home purchases in a bid to cool the red-hot housing market on Sunday, according to a report by Shanghai Securities Daily.

The rules, effective on Monday, symbolize a restart of restrictive policies that were scrapped two years ago.

The regulations ordered a halt of property sale including new commercial residential houses and second-hand homes to non-local residents and a suspension of new commercial residential houses sale to local residents with two or more than two properties.

Real estate developers and brokerage agencies should not sell commercial residential houses to ineligible home buyers, the rules said, adding that realty transaction and registration authorities should not handle related procedures for home transactions that violate the rules.

Nanjing has witnessed the transaction of 105,600 units of new houses as of September 25 this year, exceeding the total volume of 105,000 units for the entire year of 2015, according to statistics from a local property transaction website. Second-home sales reached 116,600 units during the same period. Both new homes and second-home trading hit historic record-highs for the same period.

Two days before the rollout of the restrictions, Nanjing completed its first online land auction on September 23. As all the 20 lots of land for residential use were auctioned at the price ceilings, local authorities required that houses to be built on the land pieces should be sold only after the construction is completed. Such requirement means that new home supply will shrink in the next two years and the current home purchase restrictions will play a certain role in smoothing out the real estate market, said analysts.

Nanjing adopted the most stringent regulations on the property market in February 19, 2011, restraining local residents from buying more than two houses and allowing non-local residents with one full-year social security and tax payment to buy only one house.

Home sales and prices plummeted following the initial adoption of the regulations, but picked up later as people found ways, such as fake divorces or forging social security certificates, to bypass the restraints. In mid-2014, housing prices fell again as banks tightened mortgage loans. The local government then removed regulations on September 22, 2014. Since then, the property market has warmed up and the frenzy has continued.

On August 11 this year, the local government announced move to raise the down payment for second-hand home loans. The rules did not cool the market as a five-percent down payment increase meant little for speculators. Market observers are keeping an eye on the effects of the current restrictions.

- Didi invests in bicycle-sharing platform ofo

- China extends anti-dumping duties on US chicken for 5 years

- China's three property giants see sales hit $30b in 2016

- China's coal industry still plagued by overcapacity despite price rebound

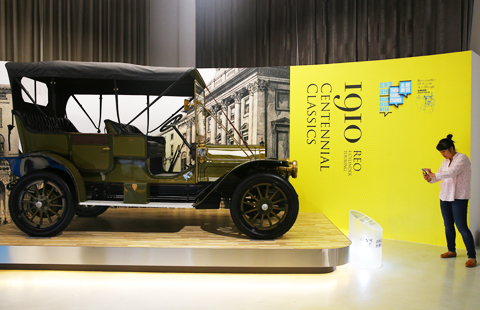

- Classic autos debut at Beijing Design Week

- Nanjing further tightens control on property market

- China to build first homemade luxury cruise in Shanghai

- China considers making mining rules closer to int'l standards