Oceanwide agrees to buy Gemworth for $2.7 billion

By WU YIYAO in Shanghai (China Daily) Updated: 2016-10-25 07:23

|

|

Lu Zhiqiang, chairman and president of China Oceanwide Holdings Group Co, Sept 8, 2009. [Photo/IC] |

Chinese family-owned company China Oceanwide Holdings Group said on Sunday that it agreed to buy US mortgage insurance and long-term care insurance Genworth Financial Inc for $2.7 billion in cash, one more move by Chinese enterprises leveraging from global resources to expand their business and diversify their investment portfolio.

China Oceanwide's investment platform will pay $5.43 per share for New York Stock Exchange-listed Genworth, 4.2 percent higher than Genworth's closing price last Friday.

China Oceanwide also promised to provide $600 million to Genworth to cover the US insurers' debt maturing in 2018 and another $525 million to strengthen its life insurance business.

The two companies said the transaction would bring a win-win situation which would benefit the growth of both parties.

"China Oceanwide is an ideal owner for Genworth going forward. They recognize the strength of our mortgage insurance platform and the importance of long-term care insurance in addressing an aging population," Tom McInerney, president and chief executive officer of Genworth, said in a statement.

Beijing-based China Oceanwide has diversified into businesses including financial services, energy, culture and media, and real estate.

Shan Xue, an analyst and investment expert with JIC Group, said an increasing number of Chinese companies are now targeting services and consumption-driven sectors when buying overseas companies.

"In the past Chinese companies preferred to acquire resource assets, and now they attach more importance to technologies, expertise and market expansion," said Shan.

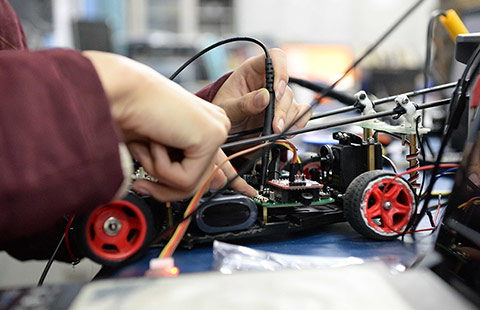

- DJI's drones to home in on specific industries

- Major lenders prepare for yuan internationalization

- Oceanwide agrees to buy Gemworth for $2.7 billion

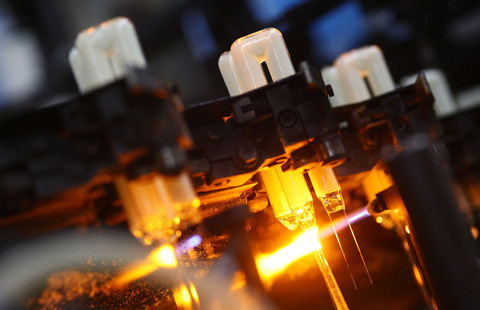

- Huawei earns Europe's trust with excellence in high-tech

- Factors that set ICT giant apart

- Top 5 property destinations for Chinese investors

- China set to fulfill annual railway investment target

- Banking reforms making headway: Official