China's HNA to buy 25% stake of Hilton for $6.5b

(chinadaily.com.cn) Updated: 2016-10-25 10:09

|

|

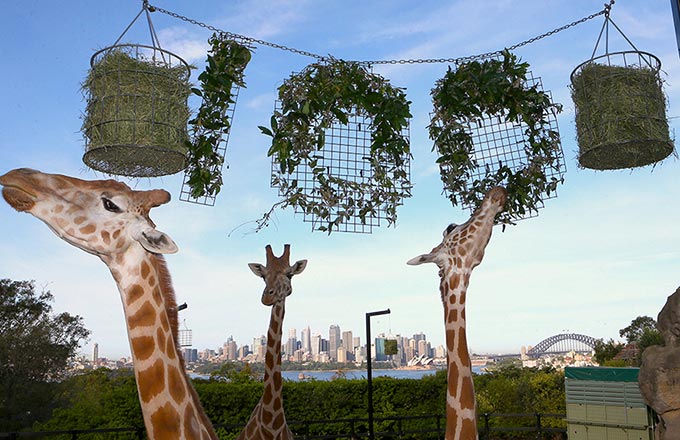

A Hilton Worldwide Holdings Inc Grand Vacations Club hotel stands in Las Vegas, Nevada, US, Feb 24, 2016. [Photo/VCG] |

China's HNA Group plans to buy 25 percent of Hilton Worldwide Holdings Inc from its biggest shareholder Blackstone Group LP for $6.5 billion, the Wall Street Journal reported.

HNA, China's fourth-biggest airline, will pay $26.25 a share in cash for the stake, a 15 percent premium to Hilton's closing price of $22.91 on Friday, according to the journal.

Under the deal, Blackstone's stake in Hilton will reduce to 20.75 percent and HNA will replace the former to become the biggest shareholder of Hilton.

The move comes as Hilton's planned spin-offs of Park Hotels & Resorts and Hilton Grand Vacations are under way. According to the terms, HNA will own about 25 percent of all three companies when the spin-offs are completed at the end of this year.

Blackstone took Hilton private in 2007 for $26.7 billion, including debt. In 2013, the private equity firm listed the company in the biggest-ever hotel IPO.

The deal will allow HNA to appoint two directors to Hilton's board, bringing the total to 10 members. Blackstone will continue to have two seats on Hilton's board, including Jonathan Gray who will remain as chairman.

The HNA-Blackstone transaction is expected to close in the first quarter of 2017, the journal added.

This is HNA Group's second investment in the US hospitality industry this year.

A unit of HNA Group, HNA Tourism Group Co, agreed in April to buy Carlson Hotels Inc, the owner of the Radisson hotel chain, including its 51.3 percent majority stake in Rezidor Hotel Group AB, for an undisclosed sum.

Agencies contributed to this story.

- China's HNA to buy 25% stake of Hilton for $6.5b

- Chinese yuan weakens to 6.7744 against USD Tuesday

- US sets final dumping and subsidy rates on iron mechanical components from China, Canada

- Bearish traders lose big on milk

- Yili shares surge on Shengmu purchase

- SOEs hit reduction goal

- University tie-ups unleash innovation

- Pledge on AT&T offers fees and risks