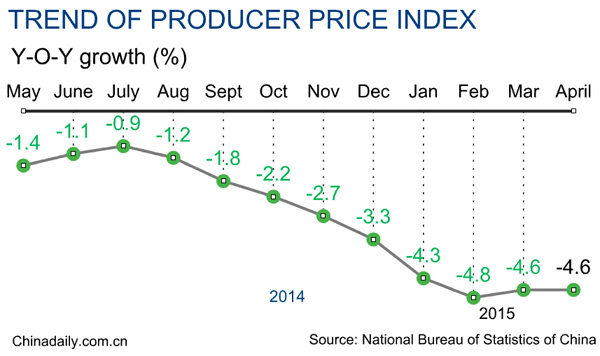

China's April PPI drops 4.6%

(Xinhua) Updated: 2015-05-09 10:42

BEIJING - China's producer price index (PPI), a measure of costs for goods at the factory gate, plunged 4.6 percent year on year in April, the National Bureau of Statistics (NBS) said Saturday.

The April PPI marked the 38th straight month of decline, suggesting continued weak market demand.

On a monthly basis, the April PPI dipped by 0.3 percent, widening from 0.1 percent registered in March.

"Lower fuel prices and coal production costs mainly caused the acceleration in the month-on-month PPI drop," said NBS senior statistician Yu Qiumei.

The HSBC/Markit PMI for China's manufacturing sector in April stood at 48.9, lower than the market expectation of 49.4.

Related Story:

Investors remain very confident of achieving goals by Cai Xiao from China Daily

Resounding 94% say they expect to reach 2015 targets; domestic market seen as 'best option'

Individual Chinese investors have become among the most optimistic globally when it comes to achieving their investment goals, according to a survey by Franklin Templeton Investments, the global investment management company.

The study, conducted between Feb 12 and March 2 this year, involved 500 respondents from China aged between 25 and 65 who have a minimum of 100,000 yuan ($16,100) to invest.

Seventy-one percent of respondents had positive market expectations for this year, up from 51 percent in last year's survey. Just 6 percent said they expected this year's overall market performance to drop.

Investors had equal confidence in the domestic equity and fixed-income investment sectors, while their expectations of the US and Canadian markets fell.

The report showed 66 percent of Chinese respondents believed the best equity returns will be gained at home this year while 57 percent said the domestic equity market would also be the best performer over the next decade.

"Although China's economy is slowing, it is still very strong and the nation's structural economic changes have worked, which may explain the high level of confidence in the country's equity market," said Amy Wang, chief representative of Franklin Templeton's Beijing office.

The same was true for fixed-income investment products, with more than half (54 percent) predicting the best returns will be gained this year in China, falling slightly to 51 percent in a decade.

The survey showed a resounding 94 percent of Chinese investors felt optimistic about reaching their 2015 financial goals, and 63 percent said they planned to continue investing aggressively.

Globally, the report showed Chinese investor optimism ranks only behind India, which enjoyed a 97 percent showing.

- Vice head of giant iron, steel corporation under probe

- China eyes reduced energy intensity in traditional sectors

- China not joining 'QE club'

- Customs slashes red tape along the Silk Road

- Funds pour in as Yao Ming turns to crowdfunding for winery

- Firms cash in on e-commerce with S. Korea

- China's April PPI drops 4.6%

- Car sales growing at the slowest pace in 5 months