China's December inflation estimated at 1.4%

[2014-12-30 11:49]China's consumer price index (CPI), the main gauge of inflation, is estimated to grow by about 1.4 percent in December from a year earlier.

Housing market touches bottom, NBS figures show

[2014-12-19 08:20]There are clearer signs of stabilization in the property market since the central bank's interest rate cut, with apartment prices in fewer Chinese cities declining in November.

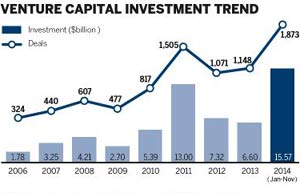

Investment by PE, VC firms reaches record

[2014-12-09 14:22]VC and PE deals made in China reached a record high in the first 11 months of 2014, benefiting from the rising number of startup companies and the restructuring of SOEs.

China faces more pressure as Nov imports drop, exports slow

[2014-12-08 13:53]China's imports shrank unexpectedly in November while export growth slowed, fuelling concerns that the world's second-largest economy could be facing a sharper slowdown and adding pressure on policymakers to ramp up stimulus measures.

Services get a lift from construction

[2014-12-04 07:48]The official services Purchasing Managers Index, a composite indicator covering operations in the service sector and the construction industry, climbed to 53.9 in November.

Home prices slide, but stability emerges

[2014-12-02 07:27]Despite the recent market stimulus measures, China's new home prices fell in November for the seventh consecutive month, private institutional data have revealed.

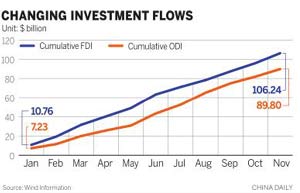

ODI may outpace FDI in investment flows this year

[2014-12-17 08:13]ODI could exceed inbound FDI for the first time this year as companies diversified their activity around the world from infrastructure projects to technology and brands.

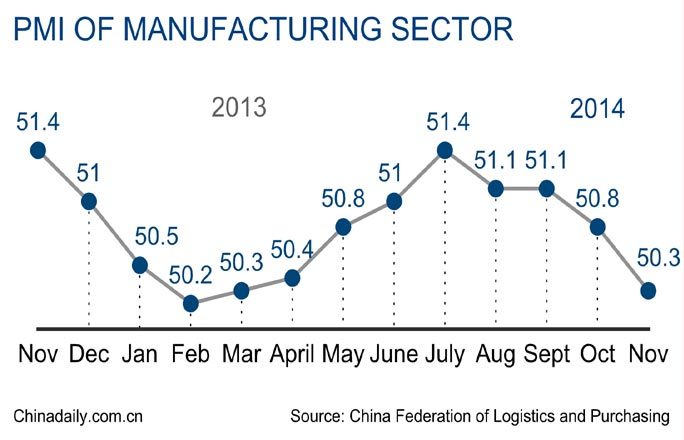

China Dec flash PMI falls to 49.5, 1st contraction in 7 months

[2014-12-16 11:42]It will reinforce investors' fears that the economy is losing momentum and add to bets that more strong stimulus measures are on the cards.

Small businesses take up 95.6% of Chinese firms

[2014-12-16 14:28]China had 7.85 million small and micro-sized enterprises as of the end of 2013 in the industrial and tertiary sectors, accounting for 95.6 percent of the total.

HSBC: China's manufacturing activity at 7-month low

[2014-12-16 13:49]China's manufacturing activity dropped to a seven-month low, according to the HSBC's preliminary purchasing managers' index (PMI) released on Tuesday.

China FDI inflows jump 22.2% in November

[2014-12-16 10:40]Foreign direct investment (FDI) into the Chinese mainland jumped 22.2 percent in November from a year earlier, settling at $10.36 billion, the Ministry of Commerce said on Tuesday.

NBS census reveals tertiary industry's growing power

[2014-12-16 10:30]The tertiary industry has become an important driving power of China's economy and a key to stabilize the labor market.

China's official manufacturing PMI wanes

[2014-12-01 09:51]The manufacturing purchasing manager's index, a key measure of factory activity in China, posted at 50.3 in November, down 0.5 percentage points from October.

China's Oct industrial profits down 2.1%

[2014-11-27 10:18]Profits of Chinese industrial businesses hit 575.47 billion yuan ($94.34 billion) in October, down 2.1 percent year on year.

China sees less service trade deficit

[2014-11-26 14:04]China's service trade deficit reached 105.6 billion yuan ($17.25 billion) in October, compared with 133.4 billion yuan in September.

China's imported iron ore stockpiles continue to rise

[2014-11-25 16:45]Stockpiles of imported iron ore at 33 major Chinese ports rose 0.78 percent over the week ending Nov 24 following a week of low demand.

State-owned enterprises post 6.1% rise in profits

[2014-11-25 13:26]State-owned enterprises in China recorded total profits of 2.084 trillion yuan ($339.41 billion) for the first 10 months this year, indicating a 6.1 percent year-on-year increase.

China's Nov manufacturing PMI at six-month low: HSBC

[2014-11-20 10:23]China's manufacturing activity moderated to a six-month low. The HSBC flash manufacturing PMI for November dropped to 50.0 from the October final reading of 50.4.

China FDI inflows rise 1.3% in Oct

[2014-11-18 10:12]Foreign direct investment (FDI) into the Chinese mainland rose 1.3 percent in October from a year earlier, standing at $8.53 billion.

Net FDI into Chinese financial organs hit $1.9b

[2014-11-18 09:38]China's financial institutions received 11.68 billion yuan of net direct investment from overseas investors in the third quarter.