BYD offers $400m in new shares; proceeds to help expand car output

By Bloomberg (China Daily) Updated: 2014-05-24 07:27

|

|

|

A man walks past a BYD store in Wuhan, Hubei province, March 20, 2014.[Photo/Agencies] |

BYD Co, the Chinese automaker partially owned by Warren Buffett's Berkshire Hathaway Inc, is offering $400 million in new stock, according to a term sheet obtained by Bloomberg News.

The Hong Kong-listed shares are being offered at HK$35 ($4.50) to HK$37 each, according to the document. That's as much as 15 percent below the last trading price for BYD, whose stock was halted from trading in Hong Kong and Shenzhen Friday pending an announcement.

|

|

|

|

The company has an option to increase the offering by $100 million, according to the term sheet. Cary Wei, a Shenzhen-based BYD public relations manager, declined to comment on the pending announcement.

Pranab Kumar Sarmah, an analyst at AM Capital Ltd., wrote in a report in March that BYD would probably need to raise money from capital markets because of its deteriorating financial health and rising spending needs.

BYD has gained 8.3 percent in Hong Kong trading this year, while the Hang Seng Index has fallen. Shares of companies typically fall when they disclose large issuances of new stock because they dilute the value of existing shares.

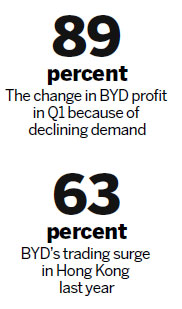

The sale comes after BYD reported profit tumbled 89 percent in the first quarter because of declining demand for its gasoline-fueled vehicles. Last year, profit jumped almost sevenfold after its billionaire founder and chairman, Wang Chuanfu, completed a three-year reorganization during which he cut the number of dealerships and narrowed losses at the solar business thanks to state incentives.

The company has reason to raise funds via shares over bonds or loans. BYD's net debt, or interest-bearing borrowings minus cash and equivalents, climbed 34 percent to a record 20.3 billion yuan ($3.3 billion) at the end of last year. Dividing that by equity, which is how BYD calculates its key gearing ratio for monitoring capital, the proportion of net debt bloated to 94 percent from 71 percent a year earlier.

The company has reason to raise funds via shares over bonds or loans. BYD's net debt, or interest-bearing borrowings minus cash and equivalents, climbed 34 percent to a record 20.3 billion yuan ($3.3 billion) at the end of last year. Dividing that by equity, which is how BYD calculates its key gearing ratio for monitoring capital, the proportion of net debt bloated to 94 percent from 71 percent a year earlier.

The offering would also revive a plan shelved about a year ago, according to a person familiar with the matter. The company suspended plans to sell the stock in 2013 after Bloomberg News reported on the share-sale plans, according to the person. At the time, BYD said it wasn't "currently" planning to issue new shares. Bloomberg reported on the revival of the share sale on March 27.

Waiting may have helped the stock. BYD surged 63 percent in Hong Kong trading last year and is this year's fourth-best performer on the Hang Seng China Enterprises Index. On March 17, it climbed to a three-and-half year high of HK$55.35.

While that's short of the record HK$85.50 the stock reached in October 2009, it's still profitable for MidAmerican Energy Holdings Co, the unit of Buffett's Berkshire Hathaway that bought 225 million Hong Kong-listed shares of BYD for HK$8 each about five years ago. The Berkshire unit is BYD's biggest strategic partner by owning 28 percent of the Hong Kong-listed stock.

- Reports of property easing lift listed firms

- BYD offers $400m in new shares

- China raises retail prices of oil products

- Real estate fair kicks off in Tianjin's Binhai New Area

- China registers April service trade deficit

- Iron alloy futures to be issued

- From waste container to fastest skipcar on earth

- Cooperation, not conflict on solar energy