Chinese carmakers sticks to new-energy drive

By DU XIAOYING (China Daily) Updated: 2016-05-27 08:24

|

|

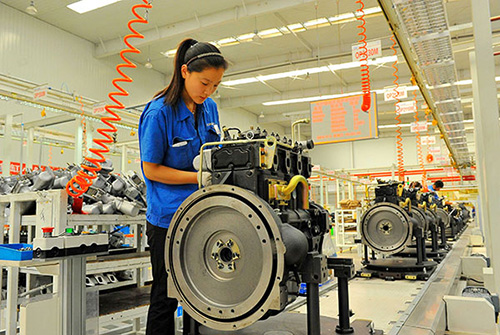

A production line of Anhui Jianghuai Automobile Co in Hefei, capital of Anhui province.CHINA DAILY |

Despite the challenges posed by the limits of current battery technology, Chinese carmakers remain persistent in exploring ways to expand their businesses into the fast-growing new-energy vehicle market.

The latest twist involves combining the concepts of green vehicles together with the country's hot-selling sport utility vehicles, in what automakers hope is a canny move. Chery Automobile Co plans to launch an electric SUV next year and Anhui Jianghuai Automobile Co plans to release a hybrid SUV in two years.

"We have invested a lot in the NEV business and will keep doing so," said Ni Shaoyong, vice-president of Chery New Energy Automobile Co.

"The market will be a battlefield for all the major carmakers in the foreseeable future, and only the best ones can survive."

As one of the early birds researching and developing NEV products, Chery launched its first electric minicar eQ at the end of 2014. The company sold 15,000 electric cars last year, and plans to sell 35,000 this year. In 2020, it aims to reach 200,000 units in annual sales.

Chery also set foot into e-car rental services. It teamed with rental firm Eakay and provided 1,164 eQ cars in Wuhu, Anhui province, priced at 15 yuan ($2.29) per hour and 65 yuan per day.

Although believing in the potential of NEV market, Ni said his company still faced challenges such as battery technology and a subsidy policy, which favors battery makers.

"Battery technology is the biggest problem," Ni said.

He said as a result Chery's long-term strategy on NEV is to make pure electric cars for short ranges. As for long range cars, electric plus range extenders (powered by petrol or fuel cell) will be used.

Ni said that his concerns on batteries were underscored in speeches by industry experts in a number of panel discussions last week during the Sino-American technology and engineering conference, held from May 16-18.

Hosted by the State Administration of Foreign Experts Affairs and the government of Anhui province, the conference offered a platform for information exchange between local companies and experts from the United States, Canada and China.

Last week, a dozen experts visited NEV-related firms including Chery, JAC, energy technology firms, as well as several battery and electric motor producers in Wuhu and Hefei. After the visit, they made some suggestions to the local companies.

"Electric cars with a range extender have wider market potential," said Yan Shouli, engineering director of high voltage integrated circuits with ON Semiconductor Corp, a US semiconductor-based solutions provider.

Huei Peng, professor of mechanical engineering and director of the mobility transformation center at the University of Michigan, said non-monetary policies were better than direct subsidies.

He said when a subsidy was lucrative, some battery companies rushed in to deploy technologies that may be ready, but which manufactured inferior batteries, which was not what the government intended to encourage.

Non-monetary policies such as a privilege to drive in high-occupancy lanes or dedicated bus lanes, and dedicated parking, were proven to work well. These, he said, attracted many consumers to clean vehicles in places like California and Norway.

- Heir of change

- Passwords should be a safeguard, not a hindrance

- Smartphone-sized drone launched for selfies addicts

- Chinese carmakers sticks to new-energy drive

- ZTE unveils new smartphone and matching VR devices

- Siemens targets more partnerships

- Chinese buyers line up to bid for Stellar Group

- Report says China still plays key role in US trade