Why beef farmers struggle to cope, despite rising demand

By WU YUNHE (China Daily) Updated: 2015-07-23 08:48My mother recently spent nearly 100 yuan ($16) on half a kilogram of fresh beef tenderloin in a local market, but after cooking it, she found it was far from tender.

"It appears to be made of wood," she complained, perhaps a little harshly, but such things have happened to me too.

My family has always preferred beef to pork as our main dish during weekend gatherings.

But we have started to find that much of the fresh beef available in Beijing markets is of poor quality.

At a Daoxiangcun outlet, a local food chain store in Beijing, the cooked beef shank is priced at 252 yuan a kilo. With that money I could have bought four kilos of pork, even at the upmarket Ito Yokado store near my home.

Retail prices fresh beef was reported to be about $5 for 0.45 kilogram on average in December in the United States, but you can bet your bottom dollar that meat in the US is a lot better than it is here.

So why is this, given the country has managed to become the world's top producer of so many other food items, such as pork, poultry, and seafood products?

I called Lu Bairong, a friend who was an official at the Ministry of Agriculture but now retired.

He said that despite the retail price of beef rising, escalating production costs mean the profit margins on beef for cattle farmers is still low, and many are also fighting against rising competition from imported products, and the smuggling of illegal produce.

That sounds a sensible economic argument, but I was still curious about the poor quality of China's beef products.

Pork remains the dominant meat in China. However, along with the acceptance of and enthusiasm for many other types of Western food, demand for beef has been rising for years.

According to official data, the price of beef first began edging up at the turn of the century.

It increased by 50 percent from 2004 to 2008, and after the Beijing Olympic Games the trend has become irreversible.

Between July 2010 and June 2012, the retail price of beef increased by 30 percent, and jumped by another 30 percent from June 2012 to February 2013.

China's food industry produced 6.89 million tons of fresh beef in 2014, a 2.4 percent rise from the previous year, the National Bureau of Statistics said. But that still pales in comparison with pork output, which reached 56.71 million tons, an annual increase of 3.2 percent.

In 1980, China's per capita beef consumption was just half a kilo, but jumped to 5 kilos in 2008.

The Food and Agricultural Organization of the United Nations has predicted the country's growing beef-supply shortfall is expected to be about 6 million tons by 2020, if the current situation continues.

At the moment all eyes in China appear to be on the stock market and its fluctuations, and the information technology and environment sectors, but not on agriculture.

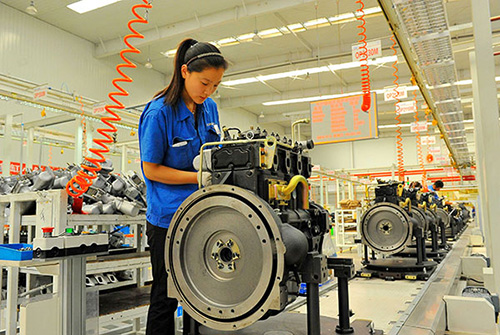

The country's cattle farmers have become increasingly vulnerable because of rising production costs, the challenge of imports and smuggled products, and weak government policy support to allow them to make the necessary investment, all of which add up to poor returns and poor produce.

The lack of quality beef on market shelves is a direct result of farmers simply trying to boost production, and make enough money to survive.

The most common type of cattle feed here is corn and bran. China's corn prices hit a record high in July last year, and then plummeted 30 percent this year. But price fluctuations like this are bad news for farmers. Unlike cattle, often very picky in what they eat, the pig is the ultimate omnivore.

It also takes at least two years for a calf to be ready for slaughter. In contrast, it takes a piglet only six months.

No wonder industry numbers show enthusiasm to be a beef farmer is waning.

The National Development and Reform Commission unveiled a blueprint for the national beef and mutton industries for 2013-2020.

Preliminary estimates suggest the government plans to pump at least 1.7 billion yuan into the sector during that period.

But because of the shortage in supply of Chinese beef products already building up, rising amounts of imported beef are already looking the better, cheaper, quality option, and that official blueprint will have to be widened significantly in its scope.

According to the US Department of Agriculture, China's beef imports were about 550,000 tons in 2014, up 138,000 tons from 2013.

Australia remains China's biggest source of imported beef.

US beef is currently barred from the Chinese mainland because of previous cases of mad cow disease. But industry sources say large amounts are still finding their way in, illegally.

Taking advantage of that ban, smugglers are believed to be selling at least 2 million tons of illegal beef on the black market annually. The smuggled meat is mainly from Brazil and India, often sold at a price of 40 percent less than the market average.

If the government fails to offer stronger policy backing to the country's struggling beef farmers, their situation is likely to get worse.

Contact the writer at wuyunhe@chinadaily.com.cn

- Quotable quotes on China's April exports, imports data

- China stocks plunge again as hopes for economic recovery fade

- Texas pipe plant to boost Chinese FDI

- Coach seeks to beat European brands

- BMW looks to young for China's future

- Lensman Jason Bell sees China as land of creative fashion ideas

- NEV plans get a head start

- Telecom operators saved subscribers $6b by boosting internet speed, cutting fees