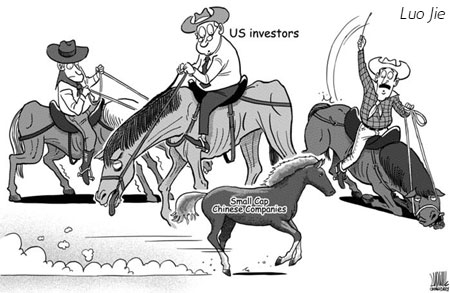

Few investors who have owned a portfolio of US-listed Chinese equities for the past year would dispute the notion that we have plunged into an abyss, an inferno, a place of apparent damnation and despair. But for all the wailing and gnashing of teeth among hedge fund managers and retail investors who have been long and wrong on China since November of 2007, there is also a sense of bewilderment and mental confusion. After all, these China names have, in general, produced stronger growth, higher margins, and more robust cash flows than small cap names in the US during the same period, and yet their valuations have plunged far beyond the already brutal toll on the broader US indexes.

The Halter China Index of all Chinese stocks listed on a senior US stock market lost 68.3 percent of their value since October of 2007, from a peak of 8,884 to close at 2,820 on Friday March 6, 2008. By comparison, the Dow has lost 52.4 percent of its value. As with any investment craze, those who boarded the China train last got smashed up the worst, while investors who started investing in these names back in 2005 have more or less broken even for their troubles.

The fundamentals of most Chinese issuers actually remain intact. While many export-driven businesses in southern China have been shuttering factories, and industries such as steel, coal, commodity chemicals and autos are under pressure, the majority of these small cap Chinese names have continued to produce reasonable top-line growth and steady margins, while certain sectors such as consumer, food, pharmaceutical, infrastructure and government services have seen little change in demand from the heady days of 2007.

In fact, despite their strong fundamentals, the management, investors and advisors of these small cap Chinese companies have worked quite effectively in concert to help drive the confidence in and valuations of these names beyond any reasonable or established valuation parameters.

First, one of the most pervasive investment themes since the beginning of 2008 has been "flight-to-safety", and everything from equities to high yield on down is to be abhorred.

More seriously, there have been and continue to be many Chinese issuers whose quality of accounting, disclosure, and corporate governance is vastly below the mark of most US or European public companies. As a result of the sins of a minority of China names, a Bad Company Discount has been applied to the valuation of every Chinese company - and in particular to those that had their origins as reverse takeovers, or RTOs, in which they merged into an existing US shell company, rather than going public via a traditional initial public offering.

The troubles of these small cap China stocks have been compounded by the fact that their shareholder base was largely concentrated with a handful of hedge funds, many of which experienced massive withdrawals at the end of 2008, if not outright liquidations. With the markets off to a nasty start in 2009, many of the surviving funds are expecting to be hit with another wave of cash calls by their investors at the end of the year. As a result, many are building cash by selling anything that trades.

Sins of the issuers

The sins of the Chinese issuers are perhaps the most understandable (if not necessarily forgivable for investors deep in the hole). Most Chinese management teams have had to make enormous adjustments to their systems and management style after becoming a US public company, and very few avoid some bumps along the way. The quality companies will move up this learning curve very quickly and show a dedication and persistence in building up the staff, systems and communications practices to be seen as a world class company. Unfortunately, many Chinese companies never made it very far up the curve, and now are sliding back into oblivion.

Some common sins for Chinese companies include the "Take the Money and Run" Syndrome, where the chairperson and management team appear intensely committed to being responsible public companies and promise frequent disclosures while the deal is being negotiated - only to lose all interest in talking to their investor base once the funds are wired into China.

Another chronic issue is "Underinvestment in the Personnel and Systems" required to meet their obligations as a US-listed company or obtain the confidence of overseas investors. Chinese management has built such successful and profitable businesses because they are great at two things - growing revenues like crazy and fighting like mad to contain expenses. Unfortunately, that same cost fanaticism, when applied to public company infrastructure, often results in late filings, frequent accounting restatements, under-qualified CFOs, and boards whose independence is in name only and with unimpressive backgrounds.

Chinese companies also frequently have been tarnished by "Related Party and Insider Shenanigans", including relatives on the payroll, asset transfers with minimal board oversight or independent valuations, massive option or share grants to insiders, and aggressive application of accrual accounting to achieve the targets agreed to with investors as part of an initial financing.

More recently, perhaps the greatest point of contention between global investors and Chinese management teams appears to revolve around issues of "Capital Allocation". Many Chinese companies appear not to understand or care about the basic principles of earning the highest possible returns from available cash. Thus you see management teams who are unable to explain their return hurdles for making new investments or acquisitions; you see companies issuing stock and then buying other companies at higher earnings multiple than they received for their shares; and most frustratingly, you have seen many Chinese companies announce sizable share buybacks - but never actually repurchase a single share on the open market. Is it any wonder fund managers are running for the exits?

Sins of the investors

Ironically, the funds that have invested in China deals, and especially in RTOs, have done just as much to destroy value of fundamentally sound companies as the Chinese management teams - although they would seem to have the greatest motivation to see these deals succeed.

One frequent sin of China investors is overly dilutive and complex capital structures. Taking advantage of the naivety of Chinese management, many funds have loaded their convertible preferred paper with an additional 400-500 percent warrant coverage. While in the most bullish of bull markets this structure may produce exponential returns for the investors (along with exponential dilution for the chairman), in a sideway or downwards market it results in a toxic equity product no other fund manager wants to touch.

Inadequate due diligence was another hallmark of the late phase of the China investment fad. Beyond not understanding the motivation of management, many "China-focused" funds skipped the basics of deal diligence when the market was hot - neglecting site visits, customer and supplier interviews, legal due diligence, background checks, and accounting due diligence. It is hard to feel too sorry when one of these bombs explodes.

One area where leading China investors have gotten much smarter is in creating mutual incentives and milestones to make sure that management and investor interests remain aligned over time. Because most Chinese CEOs are so cost sensitive and operations focused, it is very easy for them to lose sight or lose patience with the tremendous amount of accounting and legal work and board oversight expected of a US public company. Holdbacks, escrows, penalties, and "make goods" provide a range of carrots and sticks to ensure both sides live up to their commitments made in the heat of the deal.

What is to be done?

It is my strong belief that as many as one-third of the companies in the Small Cap China universe will produce five to 10 times investment returns for investors who buy them now over the next several years. This belief is founded on the opinion that China will muddle through 2009 much better than the rest of the world, that growth will reaccelerate to a fairly robust (yet more sustainable) level in 2010, and that stocks of quality Chinese companies are cheap beyond belief and will revert to the mean at some point in the future. This opinion is worth exactly what you paid for it and is by no means reliable.

It is also my strong belief that as many as one-third of the Chinese companies that went public via a reverse merger will either go to zero or be re-privatized at disadvantageous terms over the same period.

The question for those of us who retain conviction on the China space (assuming there are any others) is how to avoid the mistakes of the past so as to participate more successfully in awesome growth of China during the next market cycle. In that spirit, I would make the following proposals so that we might all one day breach the gates of China small cap heaven:

Companies that wish to achieve reasonable valuations and liquidity must recommit to more transparent operations, more frequent communications and more scrupulous governance than their US peers to succeed in the global market - Chinese management teams will be held to a higher standard than peers in the US or Europe due to others' sins. Fair or not, that is the market reality.

Investors that wish to benefit from the coming surge in US listed China stocks must up their game by hiring Chinese staff, making frequent trips, creating workable structures with strong mutual incentives, and treating management fairly. You cannot make money in China for the long term unless you commit to China for the long term.

Agents and Finders who want to stay in business need to raise their standards, burnish their reputation, and have world-class execution if they want to survive. You know exactly what I am talking about, so no need to elaborate.

China is the growth story of the modern era. Do things right, we will all prosper greatly - do things wrong, we will have missed the opportunity of our lifetimes.

The author is president of US-based CCG Investor Relations

(China Daily 04/06/2009 page2)