With easy access to credit cards, it's no surprise that more and more people are using them for all their requirements. But at the same time it has also opened the doors to innumerable frauds and scams. China, like other countries, also has seen an explosive card growth and so also scams. The POS scam is one such scam that is doing the rounds now.

The scam runs in such a way that a person who owns a point of sales (POS) machine can make a fortune by simply allowing people to swipe their credit cards on it.

Zhang Ran, who obtained a POS machine a few yeas ago for his paint retailing business, "lends loans" to hundreds of cash-strapped credit holders every month. Without any collaterals or credit record checks, people can get money as much as their credit limit from Zhang as long as they use the credit card to finish a business transaction in equal value at his POS machine.

"I charge customers about 2 percent of the funds they get. This is absolutely a risk free business for both of us," Zhang said, adding that he could lend as much as 200,000 yuan each day to credit card holders in need of cash.

Dozens of customers come to Zhang every day for this service, because the fees POS machine merchants charge are lower than what banks charge for cash advances at ATMs. Another draw is cardholders can get the full amount of cash as per their credit limits whereas at the ATMs they can get money equivalent to half of their permissible credit limit at most.

Business is now booming and Zhang typically earns at least 100,000 yuan every month. The charge slips at the POS machine ensure that Zhang gets the money due to him from the banks.

The trick Zhang plays is a popular credit card fraud scheme in China that falls in the grey area of the country's credit card regulatory system. If you type, "credit card cash advance service in Beijing" on Baidu.com, China's largest search engine, you will get 474,000 search results advertising such services. The scheme has taken the center stage of credit card related crimes in China.

According to Zhang it is a good deal for everybody as long as credit card holders pay the bill on time and in full. But the real risks come when customers default on payments leaving the bank in the lurch.

"Cardholders who turn to cash advance at POS machines are usually not as creditworthy as normal credit card holders," said Zhao Xijun, professor of finance at Renmin University of China.

"The aggregate defaults as a result of such illegal practices could be a big threat to banks," he said.

Indeed, the scheme has magnified credit card related risks into credit risks for investment and speculation, according to the credit card business center of China Construction Bank (CCB).

"Taking advantage of such illegal schemes, credit card holders can circumvent bank supervision and get free loans without providing collateral, while banks cannot trace for what purpose the funds have been used," CCB said in an email to China Business Weekly.

In fact, credit card related frauds haven't gone unscrutinized in China. The banking watchdog has warned commercial banks of the potential risks of credit card related crimes and rolled out a number of new rules to tackle such crimes from last year.

The People's Bank of China, China Banking Regulatory Commission, Ministry of Public Security and the State Administration for Industry and Commerce jointly released guidelines in May, under which commercial banks have to check the identity of POS machines and bank card applicants as well as previous credit records and also monitor business transaction using credit cards on a real time basis.

Credit card related advertisements must also be carefully reviewed before circulating while promotions for cash advance services are strictly forbidden, according to the guidelines.

Swelling business

Behind the mounting credit card related risks is the rapid growth of plastic purchase in China, as more and more Chinese realized the advantage of credit consumption and began to pay through credit cards.

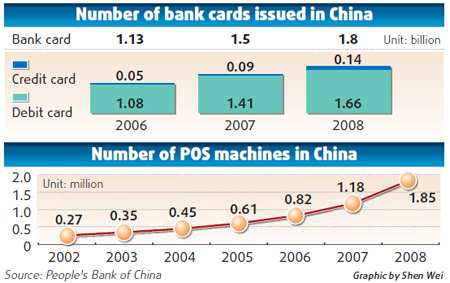

Chinese banks have so far extended 1.8 billion bank cards, including over 150 million credit cards, said Xu Luode, president, China Unionpay, the only domestic credit card organization in China. That compares to the 3 million credit cards issued by 2003.

With the expanding credit card business market in China, commercial banks have also seen their card business related income booming in recent years.

China Merchants Bank (CMB), the country's sixth largest lender and one of the few banks which issue details of their credit card business, generated 1.85 billion yuan as interest income and 2.28 billion yuan in non-interest income from its credit card business in 2008, up 70.3 percent and 50.2 percent respectively from a year ago.

Loopholes

China's fledging credit card market began to balloon after 2000, when commercial banks were racing to issue new cards in a bid grab a bigger share of the market. They handed out credit cards by lowering issuance requirement and loosening credit record checks, thereby sowing the seeds for more defaults in future.

Scamsters easily lure credit card holders as Chinese banks levy a fixed 18.25 percent annual percentage rate for cash advances.

"The credit card delinquency rate at Chinese banks has surged to about 3 percent, tripling from 1 percent two years ago," said Guo Tianyong, head of the research center of the Chinese banking industry with the Central University of Finance and Economics.

Although there is not much data showing how much of the credit card defaults are caused by malicious cash withdrawals at POS machines, Guo warned it was necessary to give special attention to such illegal activities and strengthen supervision on credit card issuance.

At the same time, banks were also not prudent in allocating POS machines, analysts said. "Even a bogus company which does not do any real business could obtain a POS machine. Indeed, its only 'business' is making money from helping cardholders get cash through a POS machine business transaction that never took place," Guo said.

Analysts said the best way to prevent such instances is to keep strict tabs on cardholders and POS machine clients and also strengthen the supervision mechanism.

Another pitfall in the supervision system is the absence of a clear judicial interpretation on how to handle such cases, according to a source with China Unionpay who declined to be identified. It is necessary to draft relevant laws as soon as possible to solve this issue, the source said.

Bank insiders who are familiar with the credit card business said the high costs that banks need to pay to trace their mammoth credit card business data in order to catch the culprits is the deterrent. Until then people like Zhang Ran will continue to make hay.

(China Daily 06/15/2009 page12)