Editor's note: Due to consistent strategy and focus on emerging markets, Standard Chartered Group delivered exceptional performance in 2008, with income rising 26 percent to $13.97 billion despite the difficult operating environment around the globe.

Carrying the momentum forward, Standard Chartered recently announced record operating income and profit for the first quarter of 2009. In China mainland, Standard Chartered has grown by an average annual compounded growth rate of 80 percent over the past four years.

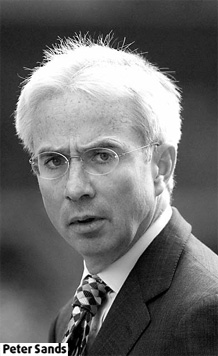

How did the bank achieve that? What will be its China strategy ahead? To find answers to those questions, China Business Weekly reporter Hu Yuanyuan spoke to Peter Sands, group chief executive of Standard Chartered Bank.

Q: You just announced a plan to raise up to 3.5 billion yuan by issuing yuan-denominated bonds. Could you elaborate, and do you have an exact timetable of the plan?

A: Well, it is just normal financing, and we would like to take advantage of the opening up of the domestic capital market. Meanwhile, we hope the issuance will assist in elevating the yuan's status as an international reserve currency while at the same time helping develop local capital markets.

As the money raised is local currency, we will use the proceeds to further expand our China business. It will take some time to fix details, so we don't have a definite timetable yet.

Q: Standard Chartered's China mainland's business has grown 80 percent over the past four years. What is your expectation for this year?

A: In 2008, our outlets over the country increased to 54 from 38, and we are going to maintain a 10 percent growth in network expansion this year. Though a number of multinational companies cut jobs last year because of the financial crisis, we added more than 1,000 new staff in 2008, and we will further strengthen our talent pool this year.

As for the new investment, we will definitely increase it but we cannot provide any figures.

Q: What is the proportion of China business in your global portfolio?

A: Currently, it is still a relatively small proportion. Last year China contributed $632 million of income to the group. But I am sure that the country will be the fastest-growing market in the coming years.

Q: It strikes me that you mainly rely on organic growth in China. Will you consider any acquisition opportunities this year as you remain financially strong despite the financial crisis?

A: Our core strategy worldwide is organic growth. We do make some acquisitions but we use them to complement what we do organically.

In 2008, around 80 percent of income growth came from organic growth. As for China specifically, we will continue to invest and grow business organically by expanding our network, adding staff and rolling out more products, We also have a stake in Bohai Bank.

Whenever we look at investment and acquisitions, we follow two criteria: Can they help to grow shareholder value? Do they take our strategy forward?

Q: Quite a number of foreign banks, such as HSBC and Bank of East Aisa, have expressed their hope to be listed in Shanghai in the near future. Do you have a similar plan?

A: We are looking at all options available. Once the regulator allows such listings, we will seriously consider it.

Q: Standard Chartered is quite strong in the SME business. Is this a core competence that differentiates you from major rivals?

A: First, we found that small and medium-sized enterprises are not as well served as other sectors and thus have great growth potential. Compared with big local banks, the SME business could be a niche market for us. But we also did a lot in financing overseas expansion by large Chinese enterprises.

When compared with other foreign banks operating in China, we are more deeply internationalized. We don't have a strong "home" market. Instead, we are very focused on Asia-Pacific, Africa and the Middle East.

Q: Industry surveys show that local customer confidence in foreign banks private banking business has taken a big fall because of the financial crisis. How's your private banking business doing in China?

A: The year 2008 was definitely a terrible period for investors. But we didn't roll out any extremely complicated products that burned out in the crisis. On the contrary, we took a pretty conservative approach and mainly followed our customer demands.

Standard Chartered China launched private banking centers in Shanghai and Beijing in 2007 and has received approval to offer full-scale local private banking services in south China's Shenzhen and Guangzhou and east China's Hangzhou and Suzhou, so our private banking network spans six cities in China and we aim to be in 10 cities by 2011.

(China Daily 06/22/2009 page4)