|

Tourists bound for an overseas destination board an Air China flight at Beijing Capital International Airport. China is the world's largest commercial airplane market outside the United States. Bloomberg |

After battling with falling travel demand for months, many airlines began to fill their vacant seats this summer - a sign they might have passed through the worst turbulence.

But the seat belt sign is still on. The industry has yet to recover from the worldwide economic crisis, and airlines are worried it will take some time for things to return to the way they were two years ago.

The International Air Transport Association (IATA) said recently that worldwide passenger traffic is expected to decline 4 percent and cargo by 14 percent this year.

The Geneva-based association, which represents 230 airlines worldwide, said the global airline industry is expected to lose $11 billion this year.

The losses will continue in 2010, with the industry expected to report a $3.8 billion net loss, the association said.

"The bottom line of this crisis - with combined 2008-2009 losses at $27.8 billion - is larger than the impact of the Sept 11 terrorist attack," said Giovanni Bisignani, IATA's director general and CEO.

"This is not a short-term shock. The global economic storm may be abating, but airlines have not yet found safe harbor. The crisis continues," Bisignani said.

Despite the fact that passenger and freight volumes have stopped falling, rising costs and falling yields have squeezed airline cash flows. The sharp decline in yields will leave a lasting mark on the airline industry's structure, Bisignani said.

"Revenues are not likely to return to 2008 levels until 2012 at the earliest," Bisignani said.

US aircraft manufacturer Boeing made a similar forecast when it issued its annual long-term China market outlook in Beijing recently.

"Next year will be a year of economic recovery, 2011 will be a year of airline industry recovery and then in 2012, airlines will probably increase their demand for new airplanes," said Randy Tinseth, Boeing Commercial Airplanes' vice president for marketing.

Low yield

Latest statistics from IATA showed some signs of recovery but offered little relief to the battered finances of airlines, as average fares remain weak, the organization said.

The number of passengers on international scheduled flights fell 2.9 percent in July, a relative improvement over the 7.2 percent drop in June and the 6.8 percent decline recorded over the first seven months of the year.

The number of first-class and business-class travelers in international markets fell 14.1 percent in July compared with the same month last year, less than the 21.3 percent decline seen in June.

"Planes are full. Load factors are high. But revenues are way down," Bisignani said.

"Demand may look better, but the bottom line has not improved. We have seen little change to the unprecedented fall in yields and revenues. The months ahead are marked by many uncertainties, including oil prices," he said. "Spot oil prices have been driven up sharply in anticipation of improved economic conditions. The road to recovery will be both slow and volatile."

Frederic Kahane, general manager of Air France KLM for Greater China, shared Bisignani's view.

"It is difficult to say there is a recovery. There are many complicated factors to be taken into account," Kahane said.

"It looks like we have reached a stabilization, at least in terms of volume. But what's still worrisome is that demand remains pretty low in business class, and fares remain low in economy class. The combination of the two factors means that the unit revenue per passenger remains at a low level," Kahane said.

Premium seats are the most lucrative sector for airlines because first-class and business-class seats usually account for 15 per cent of a plane's total passenger load, but contribute 35 to 40 per cent of total revenues.

The global economic crisis has forced many business travelers to downgrade to economy-class or just shun air travel.

Singapore Airlines recently said it had agreed with Airbus to defer the delivery of eight A380 super-jumbo aircraft by six to 12 months.

The deferral suggests Singapore Airlines, a bellwether in the industry, is finding it increasingly hard to fill its premium seats on this plane, analysts said.

Singapore Airlines already has nine A380s in operation, and there are 60 business seats and 12 first-class suites on the A380. The airline, which has been one of the more profitable carriers globally, posted its first quarterly loss in six years during the June quarter.

To adapt to falling demand, some carriers such as Lufthansa German Airlines replaced part of their business-class seats with additional economy seats. Others are selling upgrades to travelers at the airport or slashing prices on premium seats to unheard-of levels. British Airways in May unveiled its first ever "buy one get one free" business class offer from China to London.

Air France is trying out new premium economy products. The airline will unveil the Premium Voyageur cabin on flights to Beijing and Hong Kong starting on Jan 18, 2010. The product will be gradually extended to the airline's entire international long-haul network by the end of 2010.

The new cabin seats offer 40 percent additional space compared with economy-class, but are much cheaper than business-class tickets.

For example, round-trip tickets between Paris and Beijing cost 16,586 yuan per person, including tax, while round-trip business-class tickets cost about 28,000 yuan, excluding tax.

"Generally speaking, the price elasticity in business-class is lower than that in economy-class. If a company implements a travel policy forbidding business-class travel, it is not a matter of fares any more. We are confident the new product will become an anti-crisis absorber for us, as we now offer something in between," Kahane said.

China focus

Despite a volatile road ahead, most industry players have agreed that China will lead the global aviation recovery, thanks to the country's fast-growing domestic air travel market.

"China is the world's most dynamic market for commercial airplanes. The strong domestic air travel growth in China in the first half of 2009 gives us confidence that the world aviation industry is beginning to recover," Boeing's Tinseth said.

China will remain the world's largest commercial airplane market outside the United States, Tinseth said.

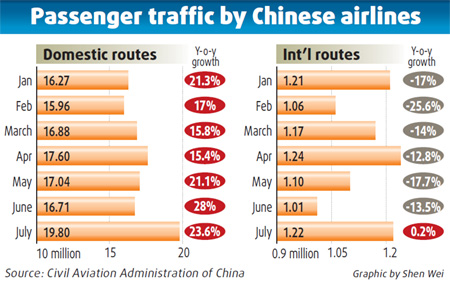

China's domestic passenger air traffic increased by 20 percent year-on-year in the first half of this year despite a worldwide slump, thanks to the government's economic stimulus packages, according to the Civil Aviation Administration of China (CAAC).

The CAAC said China's domestic passenger traffic will witness full-year growth of more than 20 percent this year that will be further driven by a traditional peak travel season in the third quarter.

China's three largest airline groups all experienced significant year-on-year growth in passenger traffic in August.

Air China's domestic passenger traffic soared 42 percent in August, with China Eastern Airlines' skyrocketing 52 percent and China Southern Airlines' surging 34 percent.

Besides the government's economic stimulus package, another driver for the increasing traffic is low ticket prices. Average revenues from each seat sold in the year's first five months were 20 percent lower than during the same period last year, according to a People's Daily report.

Although China's three largest airline groups all posted profits in their interim reports, fuel-hedging gains and government subsidies were the major reason for their profitability and helped offset plunging international travel business.

The total number of passengers carried by Chinese airlines on international routes contracted 14.6 percent in the first seven months of this year.

Long-term strategy

Although China has not escaped the worldwide economic crisis, major foreign airlines still regard the country as a strategic core market.

"China is still growing at nearly 8 percent while other countries have negative or zero growth. Our long-term strategy with China remains the same," Air France's Kahane said.

The French airline recorded a 95 percent load factor on its flights to Beijing in August, which was the highest among its Asian routes.

Korean Air has increased its marketing in China's provincial capitals this year. The company recently installed huge outdoor advertising boards in Kunming, Zhengzhou and Wuhan and planned to continue doing so in Xi'an and Changsha for the rest of this year.

"Our passenger traffic in China's provincial capitals and some second-tier cities all recorded double-digit growth in the first eight months of this year. We expect huge market potential in those cities," said Lee Seung Bum, managing vice president for regional headquarters in China for Korean Air.

The number of Chinese travelers who transferred via Seoul in the year's first eight months surged 45 percent year-on-year, Lee said.

"Under the current economic situation, confidence is the most important thing. We are particularly confident about the Chinese market," Lee said.

Emirates Airlines, whose luxurious cabin interior has been favored by business travelers, said Chinese outbound leisure traveling is another strategic gold mine.

The United Arab Emirates (UAE) last month was granted Approved Destination Status (ADS) by the Chinese government.

The ADS system simplifies visa application procedures for tourists, and they can use ordinary passports to apply for tourist visas if they want to visit an approved country.

"We have been waiting for this for a long time. Chinese travelers used to make just a one-night stop in Dubai on their way back home after finishing their trip in Europe. Now we can promote Dubai as a unique travel destination," said Adam Li, Emirates Airlines' sales manager in Beijing.

(China Daily 10/12/2009 page1)