China's automotive industry has sustained robust growth despite the global economic slowdown, making the world's major automakers pay increasing attention to investing in the China market. Software companies are paying attention, too.

The world's third-largest independent software company, Infor Global Solutions, is planning to expand its presence in a country expected to surpass the United States to become the world's largest automobile market this year.

Tobin Alexander, Infor's vice president for automotive industry sales in Japan and Asia-Pacific, said consumer demand for automobiles in China is also pushing up demand for software systems used by carmakers and parts suppliers.

"Software demands for China's automakers, especially the small and medium-sized ones, are booming," Alexander said.

He said the company plans to increase business in China's automotive industry and profit from the rise of the country's car manufacturers.

China's automotive industry has benefited from this year's government stimulus package.

Under the package, the government lowered the purchase tax on cars with engines under 1.6 liters from 10 percent to 5 percent.

The government also allocated allowances to farmers to upgrade farm vehicles and to mini-truck and mini-van owners to upgrade their vehicles.

As a result, the country's auto output surged 78.85 percent year-on-year to 1.36 million units in September, while total sales hit a new monthly high of 1.33 million units, up 77.88 percent from a year earlier, according to figures released this month by the China Association of Automobile Manufacturers (CAAM).

However, Alexander said there are still about 30 percent of small and medium-sized carmakers and part suppliers in China that do not have ERP (Enterprise Resource Planning) software systems, which can help increase company efficiencies via integrating data and processes.

According to the domestic research firm CCW Research, the ERP market of China's manufacturing industry, of which the automotive market is a major subset, has been severely affected by the global economic slowdown.

The market turnover is expected to reach 4.34 billion yuan this year, an increase of 14.8 percent over 2008.

However, the research firm said the ERP market in China's automotive industry is not affected by the economic turmoil, as demands remain robust under the government's subsidy plan.

Alexander said Infor expects double-digit growth in China this year. The company also has plans to increase its Chinese staff, which currently numbers more than 400.

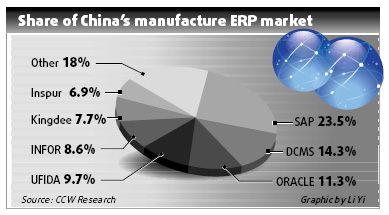

According to CCW Research, Infor accounted for up to 8.6 percent of China's manufacturing ERP market in April, following SAP, DCMS (Data Center Management System), Oracle and domestic player UFIDA Software.

Alexander said Infor tends to focus on small and medium-sized Chinese carmakers in need of more software systems.

He said Infor also foresees a huge market from automotive part suppliers, as "more consumers keep their cars longer than expected". Among Infor's customers in China, about 70 percent are private companies, Alexander said.

Alexander said China has long been interested in building up the position of its domestic automakers in the world market.

"They've never hidden that. That's why they want to establish joint ventures with the world's top companies," he said.

With the rise of Chinese companies such as Geely and BYD Auto, Alexander said, it will only take four to five years for Chinese auto makers to join the ranks of the top car manufacturers around the world.

(China Daily 11/09/2009 page5)