|

A department store in Beijing promotes sales. Retailers say Chinese consumers have become used to big promotions and no longer look at that not on sales. CFP |

On a recent shopping spree, He Yi, a 25-year-old fashion magazine editor, spent half of her monthly salary buying brand-name clothing, accessories and skin care products in just one morning.

Many well-heeled Chinese shoppers like He, who lives with her parents in Beijing and has a small car in her garage, are spending freely despite the global economic downturn.

"Like many of my friends, my job is stable and not affected by the financial crisis," she said.

"The big-name brands have not just offered some unusual promotions during the sluggish economy, but also launched new lines especially tailored for middle-income and fashion-loving consumers," He said.

For He, the financial crisis has been an advantage in making high-end brands more affordable and available.

He's observations reflect recent business headlines. Chinese consumers are now buying bigger flat-screen televisions and more vehicles than Americans. China Mobile's customer base recently crossed the half-billion mark. And the country is now among the world's fastest-growing luxury markets.

The headline stories suggest consumers are shifting gears from recessionary behavior to recovery mode.

Indeed, while recession-hit consumers in the United States and Europe are scaling back on showy purchases, Chinese consumers are flocking to domestic retailers, spurred by government stimulus measures such as rebates on home appliances and tax cuts for low-emission cars.

Retail sales increased in real terms by 15.3 percent in the first 10 months year-on-year, which is at least two percentage points higher than in the previous nine months.

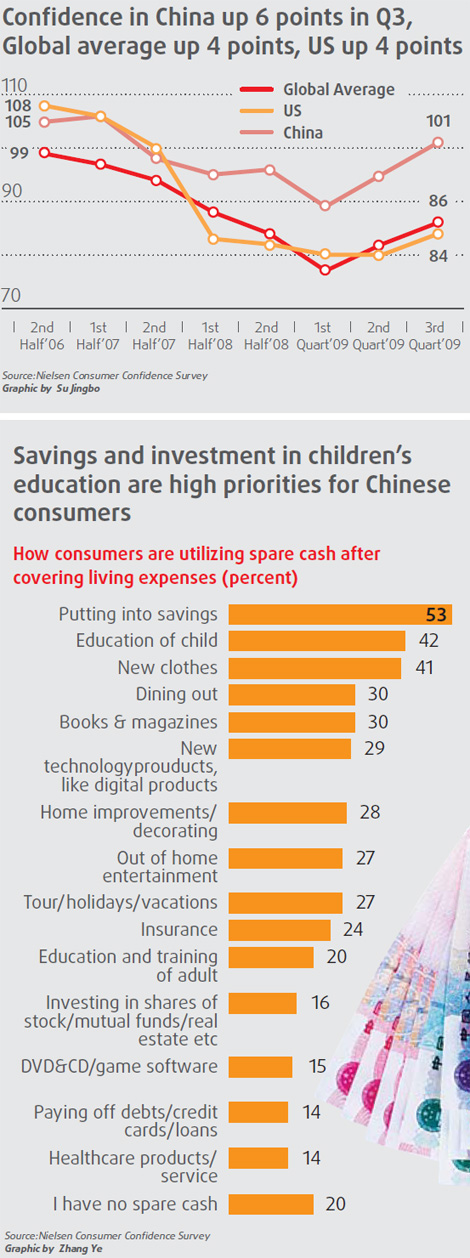

According to a consumer confidence survey released recently by Nielsen Co, consumer confidence in China in the last quarter reached its highest level since mid-2007, driven by a strong improvement in local job prospects in western China and in second-tier cities, as well as personal income increases across the country.

Fifty-seven percent of Chinese consumers who were surveyed described local job prospects as "good" or "excellent" for the next 12 months, a figure 14 percent higher than the second-quarter response.

Positive consumers

|

A couple look at a brochure at the 2009 Dalian Autumn Housing Exhibition. Nielsen research finds that home improvement, children's education and medical care are money concerns of Chinese consumers. CFP |

"In the previous survey conducted in July, we saw that consumers were beginning to feel that the economy had bottomed out and was on the road to recovery. In the third quarter, we see an extension of this optimism," said Mitch Barns, president of Nielsen Greater China.

"Consumers are gradually feeling more comfortable with their situation and feel that the economy is moving in the right direction," Barns said.

The World Bank China Quarterly Review late last month pointed out that continued increases in government transfers are likely to support income growth somewhat in 2010, including a 10 percent rise in pension commitments.

Moreover, in much of 2009, households benefited from negative inflation, which boosted their purchasing power. This will likely change next year with inflation expected to turn positive again, according to the World Bank.

Despite this renewed sense of optimism, actual behavior remains restrained, noted the Nielson report. Many consumers remain skittish about spending their money, and in some regions spending habits appear to have changed permanently, the market research firm said.

One of the bigger concerns for retailers is that consumers became used to big promotions during earlier months, and now they no longer look at not-on-promotion items. Instead, they tend to shift to lower-priced brands, the research firm reported.

However, the Nielsen survey also showed that there is still a willingness to spend on new products.

"Companies that focus on innovation and introducing new products to the market will be the ones to drive consumption throughout China," Barns said.

It's not just the well-off consumer on a spending spree. Experts said that affluent Chinese consumers are spending a smaller proportion of their income than the poor.

"The poorer people tend to consume higher proportions of their income than richer people," said Athar Hussain, director of the Asia Research Center at the London School of Economics and Political Science.

"So if China shifts the distribution of income in favor of lower-income groups, consumption will increase," Hussain said.

Encouraging consumers

In many economists' views, China must significantly reform its social programs before more people will part with their money.

However, Hussain described building such a social security system for a country with 1.3 billion people as "a bigger task than building the Great Wall".

Chinese families save for buying apartments, their children's education and medical expenses. And many save for the marriages of daughters or sons.

"You cannot subsidize marriage, but you can certainly subsidize education costs. You can also increase the proportion of health expenditures which is refunded," said Hussain, who has been watching the Chinese economy for the past 20 years.

Hussain added that the government also should increase the country's minimum wage and minimum pension levels.

In addition, the government should more strictly enforce the regulation to ensure people living on a minimum wage salary are getting paid on time, he said.

Hussain said that China also could increase the proportion of the mortgage loans made to homebuyers.

"The mortgage loans which people get in China are low by Western standards, and they have to put down a larger deposit. The government can reduce the deposit and give loans for a longer term," he said.

According to Hussain, the average mortgage loan term in China is about 10 years, while in Britain, it is 25 years or even 30 years.

"The shorter the term to pay the mortgage, the more chances the person defaults on not paying it back," he added.

Urban demand

Urban demand, meanwhile, is being boosted as millions move into the $4,000 to $6,000 income bracket in China and shift from spending only on essentials to buying more expensive goods such as apartments, cars and electronic appliances.

The next 10 years will witness a boom in the number of small and medium-sized enterprises (SMEs), said Zhou Tianyong, deputy director of the Research Office of the Party School of the Communist Party of China Central Committee.

Such a trend will bring more people up to the wealthier echelon, as SMEs tend to provide more job opportunities than capital-intensive State-owned companies.

Since more residents of rural communities are moving to the cities, their spending patterns will be influenced by their fellow urban dwellers, he said.

In the coming decade, Zhou said, people will continue spending to improve their living standards, and they will continue buying cars, electronic devices, healthcare products and beauty products.

In addition, they will start consuming more service products provided by educational institutions, domestic workers, travel agents and the entertainment sector, he said.

Therefore, economists and experts are arguing that China should try to keep migrant workers in the cities, as they will be the future spenders.

Fan Jianping, a senior analyst at the State Information Center, suggested that China should issue certain residence policies to give migrant workers incentives to buy apartments and to include them in the social security safety net enjoyed by their counterparts born in cities.

These efforts are needed to encourage migrant workers to stay in the city where they have been working, Fan said.

Rural markets

Much of China's rural markets remain untapped. In his recent field trip to the countryside in Hebei province, Wang Bin, an official with the Ministry of Commerce, found that the consumption patterns of the local rural people are 10 years behind their urban counterparts and that sales network development is at least 20 years behind.

"China should improve its sales network, especially in the countryside," Wang said.

However, Ji Xinyu, general manager of the strategic development division of Hainan Airlines Retailing Holding Co Ltd, said his company encountered problems when trying to move business to the rural area. The company recently set up a few branches in some counties and townships to sell travel services to rural residents.

"The sales revenues in rural areas are not stable, as rural people's shopping patterns are unpredictable. In addition, the cost to set up a vendor store in rural areas is rather high because the company has to pay more compensation to send their more experienced city-based staff to work in the countryside," Ji said.

Under-consumption?

Despite a popular notion that China over-invests and under-consumes, many experts believe China's under-consumption is actually overstated.

Spending by Chinese households as a percentage of GDP is roughly half the US consumption rate and remains significantly below consumer spending levels in Europe and Japan.

Despite sales of items such as automobiles and household appliances, the ratio of consumer spending to GDP in China today has actually fallen relative to Chinese spending levels of a decade ago.

In 1952, household consumption accounted for 69 percent of China's GDP. That proportion fell in the 1990s to 46 percent, and is about 35 percent today. By comparison, US household consumption in 2007 was 72 percent of GDP.

A key source of the under-estimation of service consumption in China is housing, said Morgan Stanley analysts Qing Wang and Steven Zhang in a report released in September.

Based on official statistics, it is estimated that consumer spending on housing accounts for only about 3 percent of personal consumption in China, whereas spending on housing represents about 16 percent of personal consumption in the US and 6.6 percent in India.

"This is too low to be even close to the reality," the report said about the China figures, pointing out differences in how countries estimate housing costs to consumers.

(China Daily 11/16/2009 page12)