|

CHINA> National

|

|

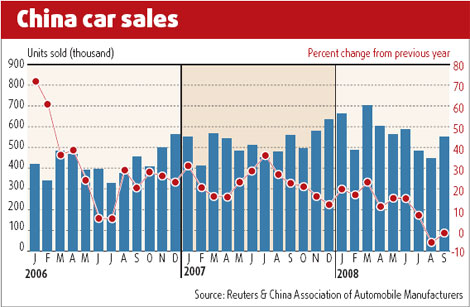

Car sales drop sharply due to world credit crisis

By Li Fangfang (China Daily)

Updated: 2008-10-20 08:00 According to CAAM, passenger vehicles sales in the first half of the year stood at 3.6 million units, 17.07 percent up from the same period last year. Inventories of unsold new vehicles in China rose about 50 percent to a four-year high at the end of June, as sales growth slowed unexpectedly while automakers boosted output.  The backlog reached 170,000 vehicles at the end of June, the highest since the previous peak of 200,000 at the end of June 2004, according to China Securities Journal, which quoted Cheng Xiaodong, chief auto analyst with the price monitoring center at the National Development and Reform Commission. "The fuel price hike, the slowing economy and the rising vehicle purchase tax mean that I'm not optimistic about a recovery in car sales in October," says Rao Da, secretary-general of the China Passenger Car Association. "A decline is very likely in the first half of 2009, but things could improve in the second half as government moves to relax monetary policy gradually take effect," Rao says in a research report released this month. He cut his estimate for 2008 China car sales growth to 5-6 percent, from 6-8 percent last month. "We have to say goodbye to the 20 percent-plus growth rate and our expectation that sales and production this year will break the 10-million-unit barrier," says Jia Xinguang, an independent auto analyst based in Beijing. "Production in the first eight months, 6.54 million units, still lags behind the 10 million target by 3.45 million units, which means the goal can only be reached if production exceeds 862,500 units in each of the coming four months. However, this seems to be impossible," says Jia. He forecasts 8 percent growth this year, with production reaching 9.5 to 9.6 million units, up from 8.88 million units last year. While China still accounts for much of the sales increase for the global players to make up for their slack in the West, analysts are unanimous in stating that this is the end of China's era of more than 20 percent annual growth in passenger cars sales. China's auto industry has applied the brakes to a certain extent, but its growth rate - expected to range from 10 to 15 percent between 2009 and 2015 - is still much faster than the global average. But Gao Heng, an independent auto analyst based in Beijing, warns: "Sales may be dented further from the first half of next year to 2010, particularly if the credit turmoil continues to slow China's economy and the oil price goes up more." |