|

CHINA> National

|

|

China leads world toward recovery

By Zhang Ran (China Daily)

Updated: 2009-07-17 07:20 China's economic growth rate shot up in the second quarter fueled by government spending and bank lending, boosting hopes that the biggest emerging economy will lead the way out of the worst global downturn since the 1930s.

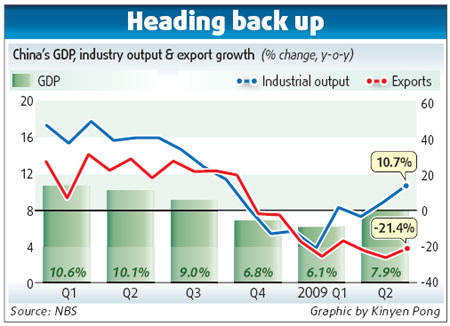

Gross domestic product (GDP) growth accelerated in the second quarter, to 7.9 percent from 6.1 percent in the first quarter, the National Bureau of Statistics (NBS) said Thursday. A string of accompanying NBS data for June depicted an economy successfully making up for a slump in exports through domestic demand, especially capital spending, generated by a 4 trillion yuan ($585 billion) pump-priming package and record bank lending. The data laid a foundation for hitting the year's growth target of 8 percent, the minimum deemed necessary to hold down unemployment, NBS spokesman Li Xiaochao said.

"We see more people shopping and prices beginning to rise. The economy is recovering and the recovery is intensifying. All the government's policies have worked together to help us overcome the financial crisis," Li said. Economists had forecast 7.5 percent growth, and several promptly responded to Thursday's figures by raising their projections for this year and next year. "We see clear upside risks to our current GDP growth forecast of 8.3 percent for 2009," said Song Yu and Qiao Hong at Goldman Sachs. They said the second quarter's 7.9 percent growth translated into a 16.5-percent pace compared with the first quarter when expressed as a seasonally adjusted annualized rate.

The analysts said if they simply keep the previous quarter-on-quarter assumptions for the third and fourth quarters, the implied annual GDP growth will reach 8.9 percent, comparable to its level in 2008. The recovery, however, was not yet on a solid footing and the economy was growing below potential, the NBS spokesman warned. "Prices were still falling; overall demand was weak; some industries faced overcapacity; and the industry use rate was low," Li said. The consumer price index declined by 1.7 percent year-on-year in June from a negative 1.4 percent in May, while the producer price index fell by 7.8 percent year-on-year in June from a negative 7.2 percent a month earlier. But analysts said that while prices would likely continue to fall in the coming months on a year-on-year basis, deflation is unlikely to become a long-term trend. "China's expansionary monetary policy, coupled with rebounding commodity and asset market prices, suggest that China will emerge from deflation in the second half of 2009," Li Jianfeng, an analyst with Shanghai Securities, said. Reuters contributed to the story |

|||||