|

CHINA> National

|

|

Housing price spike dashes people's dreams

By Wang Ying (China Daily)

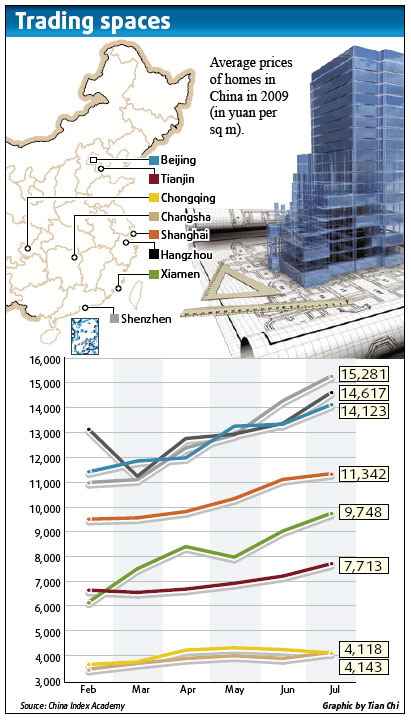

Updated: 2009-08-25 10:49 The average housing price in Shanghai hit 15,675 yuan per sq m in July, an increase of 20 percent in June and a 12-month record high, figures from real estate consultants E-House's CRIC database system showed. Across China, prices rose for the fifth straight month in July, as well as by 1 percent year-on-year in 70 large- and medium-sized cities, said officials at the State Development and Reform Commission and the National Bureau of Statistics.

A newly built complex on the outskirts of Hangzhou, capital of Zhejiang province, was met with lines of people waiting for the chance to snap up one of its apartments. "When I received the call from the salesman saying a complex was about to start offering units for sale, I dropped everything and immediately took a taxi to the site," Miao Jie said as she recalled the days before she bought an apartment in the Songjiang district of Shanghai in 2007. "I got there to find it was a false alarm. That happened another two times before I finally bought my place. "And on the day I did go to buy my home, the tension in the queue led to a mass brawl. The property developers eventually had to draw the potential buyers in a lottery. I was one of the lucky ones." The question on every homebuyers' lips, though, is: Where is the housing market heading? According to Chen Sheng, director of property research institution China Index Academy, the answer is "up", for the next several months at least. "The slow supply of new properties will keep the housing prices high, while the overpriced properties will help maintain the demand," he explained.

His fellow analysts say fears over a high inflation rate have driven many investors to restock on luxury properties as investment tools, which could push the average housing price even higher. However, to prevent an overheated market, Liu Mingkang, chairman of the China Banking Regulatory Commission, said there would be no relaxation on the second-home mortgage policy launched last year. The appreciation of property assets is one of the clear indicators of China's growth. But it also challenges the traditional Chinese mindset that people should live in their original areas. "Property is not just expensive in China, but almost everywhere in the Western world," explained Shi Jiangang, professor with Tongji University in Shanghai. "The difference is, most foreigners don't buy their first property until they are in the 30s or 40s. "About a third of the populations in foreign countries live in rented accommodation, while the instances of someone buying a home in their 20s is rare, even in places like Singapore." This convention is not easily changed in China, added Chen, who cited the fact families usually must scrape together combined savings to buy a home for newlywed sons and daughters. A poll of 2,000 homebuyers and loan applicants by the Shanghai Provident Fund Management Center this month showed 51 percent had received financial support towards their home from their parents, while 10 percent said their down payment was entirely paid for by their parents. With an eye on tradition, the central government has attempted to cater to the various income groups and, last year, broke ground on more than 90 million sq m of affordable housing projects across the country and cut the ribbons on another 20 million sq m.

Even in Shanghai, a city famous for shunning the affordable for the luxurious, plans have been instigated to build 20 million sq m of low-rent housing by 2013. "The city has sped up construction of its affordable housing and low- to medium-income families are likely to be able to snap up the first batch this year," said Chen. The apartments will be up to 60 sq m and cost no more than 60 percent of the market average, said officials at the municipal authority. A recent report by a Shanghai-based property consulting institute showed that land prices make up 70 percent of the total housing costs inside the city's downtown, which is in sharp contrast to the central government's limit of 25 percent. Shi said this is because Shanghai is far more developed than most other parts of the country, making the land far more precious. "Of course, the land bidding system has lots of room for improvement," he continued, adding he was a member of a group invited by the municipality government to brainstorm a practical solution for future land sales. For the time being, homebuyers like Zheng remain in limbo. He added: "I have to make a decision sooner or later. I just hope when I do I am not going to end up spending more than the property is worth."

|