|

CHINA> Focus

|

|

'It's all just IDOL speculation'

By Zhang Ran (China Daily)

Updated: 2009-10-16 09:29 Yao Jingyuan, chief economist at the NBS, echoed his comments by saying: "Despite signs of life, the Chinese economy, the third largest in the world, still faces uncertainties as growth was boosted mainly by investment, not consumption." China has announced a batch of measures to jack up domestic consumption and offset the exports slump, including policies to boost house and car sales, policies to raise pensions and minimum allowances for low-income families, and discount vouchers in several cities. Zhu said the measures are far from enough. After a drop off in exports, domestic consumption accounted for more than 50 percent of China's growth in the first half of this year. However, this is far below the 70-percent mark recorded in the US, he said. He is also worried that the "positive signs of economic recovery" indicated by recent economic data may result in the central government returning to its old model. "Judging from data collected last month among renminbi in circulation, new loan growth and consumption, Chinese enterprises are getting more active and people's willingness to consume is increasing," said Ding Zhijie, an economist at the University of International Business and Economics in Beijing. Zhu remains unconvinced and said he will be redirecting his energies away from the stock markets and into expanding his business, with plans to open 14 more stores across Beijing within two years. He also warned individuals and small firms to think twice before dabbling in the markets.

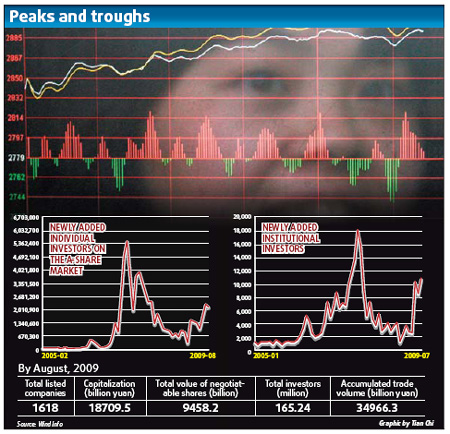

His comments followed an announcement by the China Securities Regulatory Commission on Sept 23 that it will investigate the Shenzhen Stock Exchange-listed Wuliangye Yibin, one of China's largest alcohol manufacturers, over discrepancies in its stated core revenue. The firm is accused of not properly disclosing an investment loss. "A stock market is like a big ocean and only when your skin has turned bronze can you really possess good swimming skills," said Zhu. "With the stock market, individual investors are small fish and are doomed to be eaten by bigger fish, such as institutional investors. In an immature market such as China's, institutional investors can easily manipulate the market, deal with insider trading and disseminate fake information to cheat the public." Institutional investors hold more than 50 percent of China's stock market's current 8-trillion-yuan value, according to Wind Info, a Shanghai-based financial information provider. However, a shortage of experienced fund managers is hampering the market, say experts, because small firms and individual investors are unwilling to trust their money with the majority of fund firms. The average age of fund managers in China is 35, a good 10 years younger than those on Wall Street in New York. And of the 376 professional mutual fund managers with Chinese firms, only three have worked in the field for more than a decade, according to Morningstar, a domestic fund information provider. Around 50 percent have less than two years of experience in the job, while 22 percent have less than one year, Morningstar reported. Money is also a major factor. A standard fund manager makes between 300,000 and 3 million yuan a year, but a private equity fund manager's salary can hit 10 million yuan. Therefore, seasoned managers prefer to launch their own funds, enabling them to enjoy 17-percent commission on profits and less pressure because they do not need to worry about regular performance rankings. The Investors, a Beijing-based financial magazine, reported that more than 100 fund managers have left posts to join private equity companies in the past eight months. "As China's stock market develops, new companies and new funds, especially private funds, will continue to create a huge demand for fund managers, which is the main reason many fund managers are leaving their posts," said Xu Xingfu, an analyst with Industrial Securities in Fujian province The decision by Zhu to drop out of the race could prove a mistake if predictions by Jia Wei, another hotly tipped candidate for "investor idol" from Beijing, are correct. The duo stand in stark contrast, as Jia feels confident China is now witnessing the early stages of resurgence in its Shanghai and Shenzhen stock exchanges. He has experienced many ups and downs since quitting his job as a human resources manager at NCR, a leading US manufacturer of automated bank tellers, for life as a full-time trader in 1999. However, whether it is a bull market, an extended period of stock price rises, or a bear market, a long-term downtrend, good trading techniques will always win out, said the ambitious 39-year-old, who has competed in the investor contest since its conception in 2007. "The competition will prove the unique investment style I have devised over the last 10 years is successful. I want to prove I am the best. The contest will also help me develop contacts with other highly skilled traders," he said. He believes independent traders can only survive in China's chaotic stock markets by making their own rules. He sticks to a rigid regime that involves studying market waves for 19 hours a day and regularly uses the forums on jrj.com, a Nasdaq-listed Chinese Web portal offering information on the market trends. "It is fun and a big part of my life. I could easily beat my rivals with my personal techniques," said Jia. "The only challenge for me is sticking to my principles. Market waves occur every minute, so there is huge real-time pressure and it is easy to change your mind in the heat of the moment, although this can often prove a huge mistake later on. "It is like a talented archer being made to fire his bow from the edge of a cliff. The fear can affect a person's focus on the target." But despite his optimism, he supported Zhu's warning to individuals and small firms about the market. "Individual investors always think they are smart and can make easy money trading stocks, but that is usually when the trouble starts because they are never smarter than institutional investors," he said. "If I could choose again, I would never pick this life. Nothing is more important than a healthy lifestyle, but you will certainly not find it by working as a stock market trader."

|