|

CHINA> News

|

|

After 16 lackluster years, PSA courts new partner

By ng Zhengzheng (China Daily)

Updated: 2009-09-10 16:28

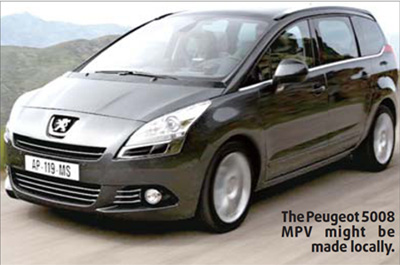

PSA Peugeot Citroen's plan to create a second joint venture in China raised eyebrows in the local industry after it was announced by its new chief executive Philippe Varin at the end of July. The French carmaker, which already has a tie-up with China's third-biggest auto group Dongfeng Motor Corp, wants to follow competitors, such as Volkswagen, General Motors and Japanese brands, to have two joint ventures in the world's top vehicle market as part of its efforts to boost overseas sales, Varin said without disclosing who will be the new partner. According to industry sources with knowledge of the negotiations, PSA Peugeot Citroen will form a 50-50 joint venture with Hafei, a micro van maker in Northeast China, later this year to assemble its multi-purpose vehicles (MPVs) in the southern boom city of Shenzhen. The plan has not been submitted to Chinese regulators.

"There are many foreign automakers with two partners in China and almost all of them do well. But PSA Peugeot Citroen doesn't have a success in its current relationship with Dongfeng," Zhang said. "Its top priority in China should be to concentrate on reviving its partnership with Dongfeng, instead of turning to others." When the venture with Dongfeng was established in 1992 in the central city of Wuhan, the French carmaker became one of the earliest foreign firms to begin production in China. Yet it has long underperformed in the market, falling far behind Volkswagen, which was also an early arrival. It has also been overtaken by latecomers General Motors, Honda, Nissan, Hyundai and even some homegrown brands including Chery, Geely and BYD. The French carmaker's China sales last year tumbled 14.3 percent to 179,1000 vehicles, less than one-fifth of the delivery from Volkswagen and General Motors. In the first six months of this year, its sales in China rose by 14.1 percent to 118,500 units, but that was a rebound from a very weak first half of 2008 and largely powered by government incentives on vehicle purchases. The Dongfeng joint venture has been in the red most of the past 16 years. In 2008, it posted an operational loss of 28 million euros, or about $40.2 million. For the new project with Hafei, Zhang said PSA Peugeot Citroen will no doubt face severe obstruction from Dongfeng, an influential State-owned auto group. "It's hard to say the project will be able to gain the nod from the government soon," he said. Two years ago, PSA Peugeot Citroen signed a memorandum of understanding with Hafei for the tie-up, but it came to a standstill mainly due to strong resistance by Dongfeng. Dongfeng even wanted to merge with Hafei to obstruct the project, but that plan also withered. If the French carmaker really wants to make a success in cooperation with Hafei, it needs to "keep a low profile" and listen more to its partner to catch the fast-changing vehicle market in China, said Julian Yang, a senior analyst with Beijing Polk-CATARC Co, the China unit of US auto consultancy R L Polk & Co. Yang also attributed PSA Peugeot Citroen's poor performance in China to a dearth of localization for its products as well as insufficient efforts at brand building to lure local buyers. If its plans for a joint venture with Hafei come to fruition, the French carmaker is likely to first put its low and medium-range MPVs - such as the Peugeot 3008 and 5008 - into local production, according to industry sources. MPVs have great potential to grow in China through continuing strong demand. PSA Peugeot Citroen, the MPV market leader in Europe, still has a lot of room in the MPV segment in China as there are only two main foreign-branded competitors - the Buick GL8 and Honda Odyssey. |