Economy

State firms told to exit real estate sector

By Hu Yuanyuan (China Daily)

Updated: 2010-03-19 06:41

|

Large Medium Small |

BEIJING: In a move to curb soaring property price, the State-assets watchdog on Thursday told major State-owned enterprises (SOEs) whose core business is not real estate to quit the market.

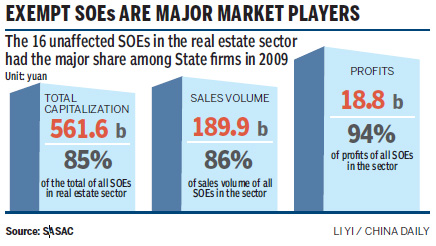

Except for 16 SOEs which are purely real estate developers, 78 enterprises under the direct supervision of the State Assets Supervision and Administration Commission (SASAC) will speed up restructuring and pull out of the property sector.

| ||||

"This is important to control skyrocketing land prices. But it will not have an immediate effect of cooling down prices," said Carlby Xie, associate director at property firm Colliers' North China division.

With easier access to bank loans and buoyed by the $586 billion stimulus package unveiled in late 2008, the SOEs have set many records in land auction bids. Many believe the SOEs have pushed up land prices, which in turn sent house prices soaring.

Half of the proposals put forward during the recently-concluded annual sessions of the top legislature and the political advisory body were targeted at rising housing prices.

But they do not appear to have dampened the enthusiasm of land-thirsty developers.

In the past several days, three pieces of land up for auction in Beijing were grabbed by SOEs, all for record prices.

Meng Qi, market analyst with US-headquartered real estate brokerage Century 21, said the SASAC's new policy is more symbolic than substantial.

The SOEs under SASAC are not major players in the real estate market, he said.

Official figures show that such SOEs' sales income from real estate business stood at 220.9 billion yuan ($32.4 billion) last year, accounting for only 5 percent of the country's total. In terms of floor space sold, the figure was only 3 percent.

If the central authorities really want to rein in housing prices, "what is important" is to put curbs on State firms at the local level, Meng said.

But he interpreted the latest move as a warning to SOEs that "the watchdog has noticed serious problems in the property sector".

Prices in 70 major cities rose 10.7 percent year-on-year in February, the fastest pace in almost two years, fueling concerns that an asset bubble is forming.