Dragon claws leave mark

By China Daily (HK Edition) Updated: 2012-12-28 16:065. HKMA intervenes to curb HK dollar strength amid money inflows

The Hong Kong Monetary Authority (HKMA) stepped into the currency market on October 20 for the first time since December 2009 as hot money inflows caused the Hong Kong dollar to touch the HK$7.75 versus the US dollar level - the strong end of its permitted trading range.

In the following two months, the city's de facto central bank sold a total of $13.9 billion worth of Hong Kong dollars into the market as of Dec 11, 2012, as the local currency repeatedly hit the strong end of its trading range, inflating the value of the Hong Kong dollar and distorting its peg with the US dollar.

HKMA said it will defend the 29-year-old Hong Kong dollar peg to the greenback despite its interventions lifting the aggregate balance - the sum of balances on clearing accounts maintained by banks with the HKMA - to higher levels.

6. SFC proposes tough regulation for IPO sponsors

The Securities and Futures Commission proposed to make investment banks criminally liable for false statements in initial public offering (IPO) documents in a bid to better protect investors after a series of accounting scandals.

The proposals seek changes to Hong Kong's company law to ensure that sponsors of initial public offerings face the same civil and criminal liability as company directors if a listing prospectus is found to have misled investors.

The SFC's new recommendations on prospectus liability are not legally binding. The regulator will now have to apply to the government to put the proposals before the city's Legislative Council.

- Subversion of State: 'There's no place for outlaws'

- Lawyers should abide by law: Expert

- China, Russia eye crossings on border island

- Desert sands working magic on aches, pains

- China convicts four for state power subversion

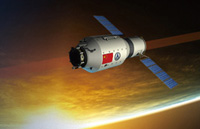

- China launches first mobile telecom satellite

- Regulation targets root of terrorism

- Activist accused of subversion pleads guilty

- Health certificate steps reduced for foreigners

- Guangdong police bust illegal fund-raising gang