Dragon claws leave mark

By China Daily (HK Edition) Updated: 2012-12-28 16:067. HSBC, StanChart fined in US

Two British banking giants reached settlements with US regulators in December, with HSBC forfeiting $1.25 billion, and paying another $665 million in civil penalties, while Standard Chartered agreed to pay a $327 million penalty, for violating US sanctions in money-laundering probes.

HSBC, the largest bank by market value in Europe, was accused by US authorities of giving Iran, terrorists and drug dealers access to the country's financial system.

Standard Chartered was accused of helping Iran launder about $250 billion in violation of federal laws, keeping false records and handling lucrative wire transfers for Iranian clients. The $327 million charge was on top of the $340 million settlement fee paid to the New York State Department of Financial Services (NY DFS) in the third quarter.

8. Yuan-denominated investment products flare up

More yuan-denominated investment products are flaring up in the city, as the depth and the breadth of the product range are becoming increasingly diversified.

The city's first deliverable yuan currency futures contract traded on the Hong Kong Exchanges and Clearing Ltd made its debut in September.

The new yuan-denominated derivative product will provide mainland institutions, qualified overseas institutional investor fund managers, mainland and overseas companies engaging in cross-border trade settlements, as well as overseas institutions who want to make direct investments on the mainland, with a financial tool to hedge the yuan currency fluctuation risk.

At the same time, the investment quota and profile of renminbi qualified foreign institutional investors (RQFII) are also growing.

- Subversion of State: 'There's no place for outlaws'

- Lawyers should abide by law: Expert

- China, Russia eye crossings on border island

- Desert sands working magic on aches, pains

- China convicts four for state power subversion

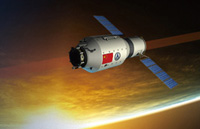

- China launches first mobile telecom satellite

- Regulation targets root of terrorism

- Activist accused of subversion pleads guilty

- Health certificate steps reduced for foreigners

- Guangdong police bust illegal fund-raising gang