Agreements with UK to give boost to wider use of yuan in London

|

|

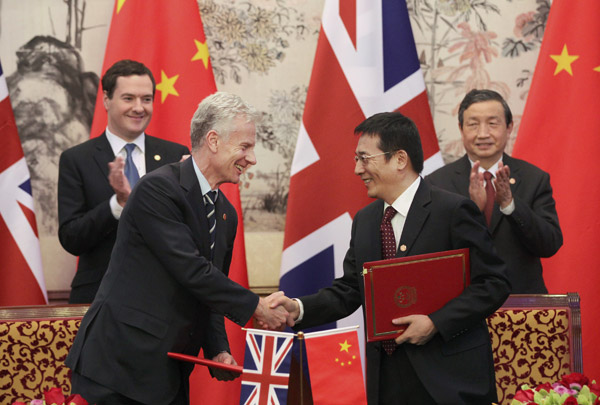

Vice-Premier Ma Kai (right) and UK Chancellor of the Exchequer George Osborne oversee the signing of an agreement between the two countries in Beijing on Tuesday. The UK is the most popular destination in Europe for Chinese investment. Zou Hong / China Daily |

China and the United Kingdom signed on Tuesday 59 cooperation projects ranging from areas such as infrastructure and civilian nuclear power to yuan internationalization, marking the largest economic cooperation effort by the two countries despite previous political spats.

The deals — signed during UK Chancellor of the Exchequer George Osborne's five-day trip to China — include a memorandum of understanding on civilian nuclear projects and deals to facilitate UK visa applications for staff working on infrastructure-related projects and customs clearance of equipment and materials.

Also, China agreed to grant London an 80 billion yuan ($12.7 billion) initial quota for institutional investors to use yuan to invest in China, giving a further push to the internationalization of the currency.

"I think the 80 billion yuan quota is more than what Osborne had expected," Vice-Minister of Finance Zhu Guangyao said during a media briefing, adding that China would like to harness the UK's experience and expertise in the financial sector to advance the internationalization of the yuan.

The quota will materialize when investors in London apply for licenses to invest yuan directly into China's securities market under the Renminbi Qualified Foreign Institutional Investor, or RQFII, pilot program, Zhu said.

"How the quota will be specifically used will have to go through the Chinese government's approval procedures. We hope that British institutional investors will seize this opportunity," he added.

The move will put London ahead in the race to get a share of the yuan-denominated business, analysts said.

"My ambition is to make sure London is the Western hub for yuan business," Osborne said. "More trade and more investment mean more business and more jobs for Britain."

London is already a major global offshore center for yuan trading, with over 60 percent of all yuan payments outside of the Chinese mainland and Hong Kong. But Zhu said that Hong Kong will remain the major offshore hub for yuan trading.

Meanwhile, Chinese banks will be allowed to expand their operations in the UK and to set up wholesale branches.

On the civilian nuclear energy front, though an MOU was signed, the details are yet to emerge. Osborne declined to provide information on how much the deal is worth and on China's specific role.

Earlier media reports said that China General Nuclear Power Group has entered a deal with Electricite de France SA for a planned nuclear plant in southwest England's Hinkley Point. EDF and the UK government had said that the talks over the financial terms of the deal were ongoing.

"The memorandum of understanding on civil nuclear cooperation provides an umbrella where specific commercial deals can take place. We've seen Chinese investment already in London's water supply and Heathrow Airport and we found through all the investments that the Chinese are a very straightforward and transparent partner," Osborne said.

He stressed that investment is a "two-way street", suggesting that UK companies could also participate in China's civilian nuclear projects under the deal.

Regarding infrastructure, Beijing Construction Engineering Group International Co Ltd formed a joint venture with Manchester Airports Group and other partners for a huge real estate development deal near Manchester Airport. The deal is worth 800 million pounds ($1.28 billion) and is expected to create 16,000 jobs.

The UK is already the most popular destination in Europe for Chinese investment, and the country is the second-largest European investor in China.

In the past five years, bilateral trade increased 38.3 percent and investment soared 98 percent.