Macao’s Development

Closer mainland ties boost Macao's growth

(China Daily)

Updated: 2009-12-21 08:58

|

Large Medium Small |

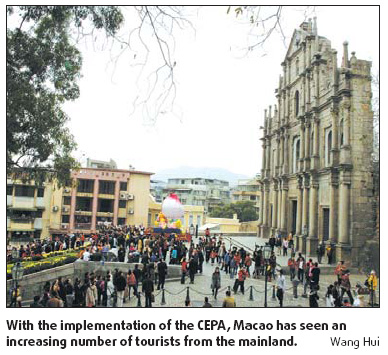

The Closer Economic Partnership Arrangement (CEPA) between the Chinese mainland and the Macao Special Administrative Region (SAR) has proved a major boost to Macao's economic growth since coming into force in 2003, according to a recent report by China's Ministry of Commerce (MOC).

The report, issued to coincide with the 10th anniversary of Macao's return to China, concludes: "Economic and trade exchanges between the Chinese mainland and Macao had been on the rise since the two sides signed the CEPA and its six additional agreements, thus bringing Macao's economic development to a new high."

The Macao SAR was established on December 20, 1999. In October 2003, the mainland and Macao, which, at the time, had been hit hard by the SARS, signed the CEPA. Six additional agreements were signed in the following six years.

The CEPA has reduced or removed barriers to exchange between the mainland and Macao in a number of economic sectors. According to Francis Tam Pak Yuen, secretary for economy and finance of the SAR government, these agreements have been key in promoting the flow of capital, goods and human resources between the two.

After the CEPA came into effect in 2004, the Chinese mainland removed all tariffs on 273 commodity items made in Macao. In the same year, the trade volume between the mainland and Macao reached $830 million, a 25 percent increase year-on-year. Since 2006, all commodities manufactured in Macao have been subject to zero tariffs.

Tam said: "The CEPA doesn't only mean saving tariffs for Macao businesses, it also means being able to access the 1.3 billion people who constitute the mainland market. It has also helped implement Macao's industrial restructuring."

The Chinese mainland is currently Macao's largest trading partner and source of imports, as well as its third largest export market, according to statistics from the MOC. The 2008 trade volume between the mainland and Macao totaled $2.91 billion, more than triple that of 1999.

The Chinese mainland is also Macao's third largest investor, according to the most recent figures, with a non-financial direct investment of $623 million. In the financial sector, with the sanction of China's central bank, 14 out of 22 eligible banks in Macao have now started providing renminbi services, including deposit, exchange, bank card and remittance facilities.

At the end of October 2009, renminbi deposits in Macao stood at 1.77 billion yuan. This followed a number of initiatives taken by mainland financial institutions at the end of last year aimed at supporting Macao through the downturn.

Commenting on the role played by the CEPA in recent developments, Su Tim Peng, a senior executive of Macao Economic Services, said: "The CEPA and its supplementary agreements have helped broaden the platform for Macao's development. They have greatly boosted economic integration and the mutual advancement of the Chinese mainland and Macao."