|

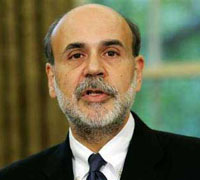

| Bernanke takes reins at the Fed |

White House adviser Ben Bernanke won Senate approval on Tuesday to assume one of the world's most influential economic posts chairman of the US Federal Reserve just after the central bank raised interest rates a 14th straight time.

In 19 minutes that marked a new era at the Fed, Capitol Hill lawmakers approved Bernanke by voice vote to succeed retiring Alan Greenspan, and policy-makers lifted short-term rates a quarter percentage point to 4.5 per cent.

It was the 149th and final policy meeting for the outgoing Fed chief after over 18 yearsin charge. Bernanke wassworn infor a renewable four-year term as chairman and a 14-year board term at a private ceremony at the Fed yesterday.

"I know this institution will go on doing extraordinary things, and I will look on from the sidelines and cheer," Greenspan told 180 guests at a farewell luncheon after Tuesday's rate meeting.

Greenspan has agreed to to be honorary adviser to British finance minister Gordon Brown on global economic change after stepping down.

Global financial markets will watch closely to assess what changes Bernanke, a former Fed governor, will make at the central bank now that he has the top job.

Treasury bond prices fell after the meeting on the prospect the Fed has not finished a cycle that began in mid-2004, but later recovered. The dollar shook off early weakness while stocks closed lower.

Bernanke's nomination was so uncontroversial that some senators were quoted in newspapers expressing surprise that hearings on it had already been held.

"Ben has provided wise counsel and good advice as a member of my economic team, and he will serve our nation with great distinction," President George W. Bush said in a statement.

Bernanke, 52, is a widely respected monetary economist and avocalproponent of inflation targeting at the Fed, a move that would create more formal policy rules than practised by Greenspan, who relied heavily on intuition and flexibility.

(Agencies)

|