Bottoms up! A healthy wine market

China is the world's largest Bordeaux wine importer in terms of both volume and value, far ahead of its nearest followers. During the period, China's imports reached 63 million liters, more than twice the volume of Germany, which ranked second globally.

Meanwhile, China's import value stood at 649 million euros, 55 percent higher than the United Kingdom, which came second in value, CIVB data showed.

In the meantime, despite the impact caused by the economic slowdown on the retail market, China's imports of Bordeaux wine registered much stronger growth than traditional markets such as Germany and the UK.

The import volume to the Chinese mainland surged by 55 percent during the period from a year earlier, while value growth reached 38 percent year-on-year, CIVB said.

"China has evolved into a mature wine market," said Thomas Jullien, CIVB Asia manager.

Jullien's observation was partly based on a survey recently conducted by the council, covering wine buyers in five Chinese cities including Beijing, Shanghai and Guangzhou. According to the survey, CIVB found that Chinese wine buyers now attach less importance to price and brand than before and more to quality and production region.

Another improvement of the industry in the country is the mature supply chain. Thanks to the rapid development of transportation, storage and other facilities, built from scratch within the last decade, Bordeaux wine now can be delivered to even third- and fourth-tier cities, Jullien said.

The market order also improved. During the first few years when imported wine entered the country, traders could easily sell a bottle of Bordeaux for more than double its price in the market.

"The period of chaos and fat profits is gone," said Liu Liming, who has eight years of experience in the wine business and is now North China general manager at the Wine Art Co, a Chinese wine trader. "You might still be able to trick some people over one bottle nowadays, but once you get a bad reputation, you will never sell another, no matter at what price," he added.

Others in the business concurred. Wang Mingjie, beverage director at the East Wine Cellar Co, a wine trader that also runs a high-end restaurant in Beijing, said: "The buyers are now very shrewd. They stick to their own preferences and make decisions accordingly."

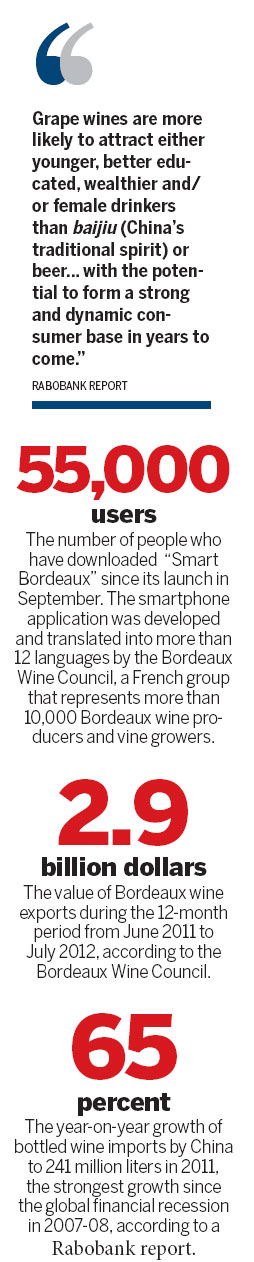

And wine sellers such as Wang and Liu are likely to face savvier customers in the years to come. According to a recent report by Rabobank, wine drinkers in China today are mainly aged between 20 and 39 and earn more than 4,000 yuan ($630) a month in a skilled profession.

"Grape wines are more likely to attract either younger, better educated, wealthier and/or female drinkers than baijiu (China's traditional spirit) or beer... with the potential to form a strong and dynamic consumer base in years to come," the report said.

CIVB's Jullien also noticed this emerging wine generation and is trying to attract its attention. France has been by far the domineering leader among foreign wine suppliers in the Chinese market.

More on drinks