Analysis of the Status of Non-government Investment*

2002-12-13

Lu Zhongyuan Research Report No 139, 2002

Abstract: This article first analysed the statistic indicators, including the growth rate of domestic non-government investment, its proportion in total social investment and its proportion of contribution to the growth of total social investment. It reaches the conclusion that the growth of non-government investment has been accelerating and the autonomous investment growth ability has been gradually increasing. It then analysed the factors that promoted or currently restricted the growth of non-government investment, and eventually put forward several proposals to further accelerate the growth of non-government investment.

Key words: non-government investment status proposal

Statistical analyses demonstrate that non-government investment has been accelerating in recently years and its proportion in total social investment is already close to that of the state economy. Its contribution to the growth of total social investment is gradually increasing, and its autonomous growth ability in the national economy is rising. These are positive results of the economic reform, the restructuring and the macroeconomic readjustment policies. They also created conditions for economic development and readjustment of macroeconomic policies. Meanwhile, the growth of non-government investment still faces a few restrictive factors that need to be tackled.

I. The Changing Status of the Growth, the Proportion and the Contribution of Non-government investment

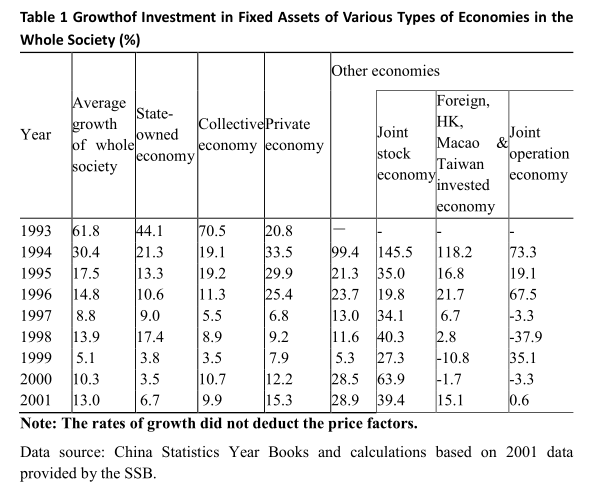

1. The growth rate of domestic non-government investment is higher than that of investments made by the state economy, the foreign, Hong Kong, Macao and Taiwan investors and the total society; of which, the growth rate of investment made by the joint stock economy is the fastest.

Since it adopted the proactive fiscal policy in 1998, China has successively issued treasury bonds in the investment sector to pull the growth of overall demand for investment, which has achieved remarkable results. In 2001, total social investment increased by 13%, which is higher than the growth in the previous two years. Meanwhile, with major beneficiary being the state economy, treasury bonds investment fully reflected the purpose of government non-government investment. Therefore, people have been worrying about the crowding off or weakening of non-government investment. In fact, however, it was only in 1998 that the growth of investment made by the state economy was higher than that of non-government investment and total social investment. During 1999-2001, the respective rates of growth of investments made by the collective, private and other economies were all higher than that of the state economy in general; of which, the growth of investment made by "other economies" was over 28% for two consecutive years (see Table 1). Among various types of economies, the joint stock economy achieved the fastest growth in investment. During 1997-2001, it rose from RMB 138.721 billion to RMB 566.349 billion, representing an average annual growth as high as 32.5% in the five-year period. Meanwhile, investment made by the foreign, Hong Kong, Macao and Taiwan investors grew from RMB 289.308 billion to RMB 299.869 billion, representing an annual growth of only 0.7%.

The average growth rate of domestic non-government investment is not only higher than that of the state economy, but also higher than that of the total social investment. During 1998-2001, the growth of investment made by the state economy dropped year by year from 17.4%, 3.8%, 3.5% to 6.7%; while that of the total domestic non-government investment rose by 20.4%, 11.8%, 22.7% and 20.3% per annum, giving a sharp contrast to the slowing down growth of state investment.

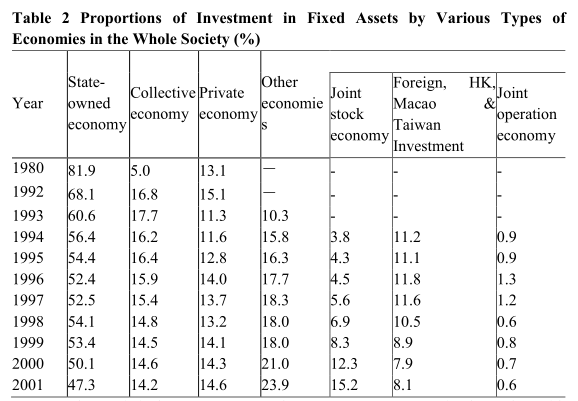

2. The proportion of domestic non-government investment is approaching that of the state investment, the proportion of investment made by joint stock economy is growing remarkably, the proportion by investment by foreign, Hong Kong, Macao and Taiwan investors is dropping, while the dependency level of the whole social investment on government direct investment is decreasing

In the past few years, the proportion of domestic non-government investment in the total investment of the whole society continuously demonstrated a growing trend, while the proportions of investment made by the state economy and the foreign, Hong Kong, Macao and Taiwan investors gradually shrunk. From 1997 to 2001, the proportions of state investment, domestic non-government investment and foreign, Hong Kong, Macao and Taiwan investment changed from 52.5%, 35.9% and 11.6% to 47.3%, 44.6% and 8.1% respectively. At present, the proportion of domestic non-government investment in total social investment is close to that of the state economy.

Since the 1990s, the proportion of state investment has decreased at a fast speed. Compared with 1994, it dropped by 9.1 percentage points in 2001. Meanwhile, the proportion of investment of the collective economy fell slowly by 2 percentage points, and the proportion of investment of foreign, Hong Kong, Macao and Taiwan investors decreased by 3.1 percentage points. However, the proportion of investment of private economy, especially that of the joint stock economy, increased significantly by 3 and 11.4 percentage point, respectively. With large treasury bonds investment, the proportion of state investment in the whole society grew marginally in 1998 and 1999, but the overall trend is still falling. During 1998-2001, the proportions of state investment dropped from 54.1% to 47.3%. Meanwhile, among changes in the proportions of non-government investment, the proportion of collective investment decreased slightly from 14.8% to 14.2%, that of private investment rose from 13.2% to 14.5%, and that of other economies grew from 18% to 23.9%, of which, the proportion of investment of joint stock economy jumped from 6.9% to 15.2% (see Table 2). This indicated that while treasury bonds investment concentrated in the state sector, domestic non-government investment was getting more and more active, and the investment of the joint stock economy was especially vigorous and saw the fastest of growth.

Data source: China Statistical Year Books and calculations based on the 2001 data of the SSB.

...

If you need the full context, please leave a message on the website.

--------------------------------------------------------------------------------

* The non-government investment in China analyzed in this article refers to investment in fixed assets made by all the non-state economies in China, including the collective, private, joint-stock and joint-operation economies. It does not include investment made by the foreign and the Hong Kong, Macao and Taiwan investors. The current statistical definition of investment in fixed assets by the State Statistics Bureau (SSB) includes investment by the state economy, collective economy, private economy and other types of economies. The "other types of economies" include joint-operation economy, joint-stock economy, economy with foreign investment, economy with Hong Kong, Macao and Taiwan investment, and economies other than the collective and private economies.