Macro-control Is Tangible But the Basis Is Unstable ——An analysis of China’s market situation in the first half of 2004

2004-09-11

Zhang Junkuo

Research Report No 107, 2004

The market operation in the second quarter of 2004 was characterized by a slow increase in investment, credits and price hike, and tangible results in the macro-control policy. The key to correctly recognize and master the overall situation and development trend of the current market operation requires an analysis of the following three issues: 1. How to analyze and judge the degree of the fall in the increase range of investment in May and June; 2. How to understand the reason why the current CPI went up fast year-on-year; and 3. how to see the tension of the present supply and demand of energy and transport capacity and the meaning of the policy. After making comprehensive analysis of various factors, the macroeconomic policy for next step should focus on tackling deep-rooted contradictions in the economic operation on the premise of maintaining the basic stability of macroeconomic policy.

I. Investment Increase Range Falls Close to the Normal Standard, But the Basis to Maintain Steady Increase Is not Strong.

1. Investment increase range falls tangibly after a rise.

With the appearance of the results of the macro-control policy since the second quarter of 2004, a projecting feature of the market operation was the sharp fall of the investment increase range after a rise.

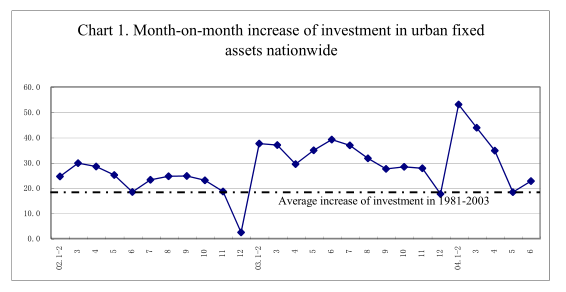

The investment in society-wide fixed assets from January to June went up 28.6 percent, a drop of 2.5 percentage points year-on-year. The investment in urban fixed assets nationwide was 31.0 percent up with the increase range down 16.8 percentage point from the first quarter of this year. Included was 53 percent in the first two months of this year on record, 43 percent in March, 34.8 percent in April, 18.3 percent in May and 22.7 percent in June (Chart 1). The fall in investment increase range of major controlled industries was prominent. The investment increase range for steel products, aluminum and cement in the first half of this year fell 52.5 percentage points, 29.5 percentage points and 44.9 percentage points respectively from the same period of last year.

In line with trace of alteration of monthly increase range of investment in China’s urban fixed assets in 2002 and 2003, the investment increase range was generally higher in early 2004 and then fell to various degrees. In view of the trend this year, the momentum fell quickly from the previous two years. The increment in May and June was lower than the level in the same period of 2003 (34.5 percent and 36.9 percent), and maintained the level in the same period of 2002 (24 percent and 22.2 percent). In addition, in the 23 years from 1981 to 2003, China’s nationwide fixed assets investment went up 19.5 percent annually in accordance with current price. In consideration of the lagging effect of the macroeconomic policy and the inertial role of economic growth, one may draw a conclusion that the monthly increase of the present investment has approached the normal standard.

2. The base to maintain sustained increase is not stable due to the fact that the drop in the increase of investment mainly relies on administrative measures and the profound contradictions have not yet been solved.

There is no doubt that the factors promoting sharp fall in investment increase contain economic as well as administrative means. In general, it is administrative means which have forced the large scale drop within a short period of time. Starting from April 27, the State Council called on all localities, departments and units to check up on investment projects of fixed assets, which are under construction or planning, in an all-round way within one and a half months with focus on iron and steel, electrolytic aluminum and cement projects, the Party and government institutional buildings and training centers, urban high-speed rail communication facilities, golf courts, conference and exhibition centers, logistics parks and large shopping centers as well as all projects under construction in 2004. Meanwhile, strict administrative and quasi-administrative control measures also applied to the proportion of capital fund in investment projects, land-use trade and bank credits. Administrative measures exert tangible efficiency in controlling the trend of the expansion of investments in fixed assets within a short period of time, but they still have shortcoming: (1) Their policy lacks flexibility and will hurt normal investment and development if it continues for quite a long period of time; and (2) They merely alleviate the symptoms and can hardly effect a permanent cure. The investment in fixed assets will be expanded once the administrative measures are lifted.

In addition, 68,000 fixed assets investment projects started to be built in the first six months of this year, an increase of 4.5 percent over the same period of last year. The planned investments totaled 2,400 billion yuan, up by 30.8 percent. This indicates the great potential pressure from the investment increase.

3. There is possibility for investment to rebound because of the rapid increase of the medium- and long-term loans.

The increase of RMB loans made by banking institutions in the first half of this year was 350.1 billion yuan less than last year. According to a detailed analysis, the increase of short-term bank loans and note discounts cut 168.4 billion yuan and 212.8 billion yuan from the same period of last year. The medium- and long-term loans with close relation to fixed assets investment did not go down, but increased 73.8 billion yuan thus offering monetary support to the rebound of investment increase objectively. It is worth mentioning that such situation began to be improved starting from June this year with the amount of medium- and long-run loans being reduced 30.9 billion yuan. Included were loans for capital construction, which were 16.1 billion yuan less.

From this one can see that the tendency of investment expansion has been checked under the strict administrative measures, and the monthly increase rate has basically returned to the normal level. However, the deep-rooted issue on investment expansion has not yet been solved, and the control of credits and loans for investment in fixed assets has not yet been really tightened. Once the administrative measures are loose, the investment in fixed assets will be expanded again.

...

If you need the full context, please leave a message on the website.