Sorting out and Creating a Policy and Institutional Environment for Enhancing Chinese Enterprises’ International Competitiveness*

2005-06-01

Chen Xiaohong& Zhang Zhengjun, Enterprise Research Institute of DRC Research Report No.047, 2005

I. It Is an Important Task to Enhance the International Competitiveness of Chinese Enterprises during the 11th Five-Year Plan

It has always been a strategic task which catches the high attention of the government to enhance the competitiveness of the domestic enterprises (Enterprises controlled by its own country’s capital and based in China). Although the world economy is getting more and more integrated, people are hard to move about freely. The state interests and political structure will not be changed in a short period of time. This has made it an urgent task to enhance the competitiveness of these enterprises.

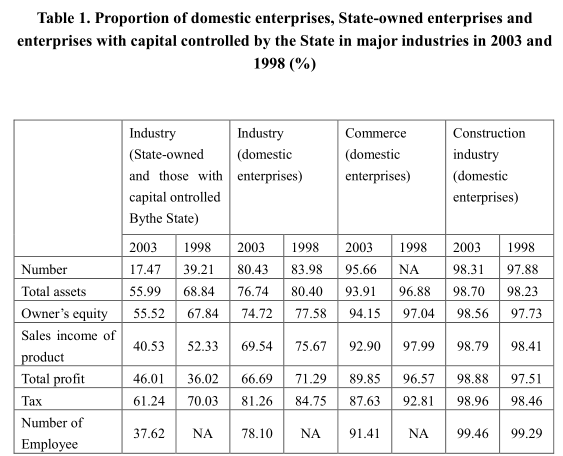

The competitiveness of Chinese enterprises is not strong enough in the international arena. Despite the fact that domestic enterprises still take a dominant status in the Chinese economy, its status is fading. According to the output (income and profit) and assets of the domestic enterprises (Enterprises with its capital controlled by its own country or by investors within the mainland), Chinese enterprises take a dominant status in various industries. Among the industries that such enterprises weigh less in terms of output and assets, the proportion is still higher than 70 per cent. However, the proportion is continuously dropping, particularly in industries which dropped six percentage points between 1998 and 2003. Although China’s export volume is increasing in the world trade, the exports are mostly carried out by foreign-funded enterprises, which have already become the main channel of the mechanical and electrical products exports. (See Table 1)

Notes:1. Statistics are from China Statistics Yearbook 2004 and 1999: The domestic enterprise in the table is same as the domestic enterprise categorized in the China Statistics Yearbook which includes domestic enterprise, enterprises with investment from Hong Kong, Macao and Taiwan and foreign-funded enterprises.

2. Industry is calculated on the basis of all the State-owned or scaled non-State-owned enterprises above designated size whereas commerce is calculated on the basis of enterprises above designated quota including wholesales, retails, trading and catering sector.

3. Total commercial profit is calculated on the basis of wholesale, retails, trading commerce and catering sectors.

4. The industrial tax includes the sales tax and value-added tax; the commercial tax includes commodity sales tax and business tax; the construction industry tax is the total tax.

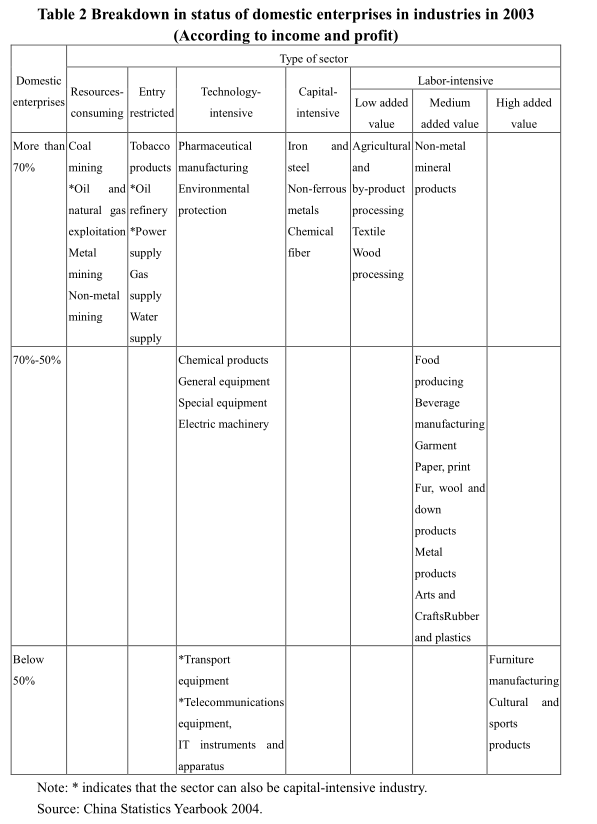

Whether it is high or low in the industrial proportion of the Chinese enterprises is related to the characteristics and policy of the industries. Taking industry as an example, those with income and profit of domestic enterprises accounting for more than 70 per cent are in the sectors that consumers resources, with strict entry restriction, labor-intensive or regional and public utilities. Those accounting for between 50 and 70 per cent are in the sectors that are relatively low and medium labor-intensive, medium in technology content and capital-intensiveness. Those accounting for less than 50 per cent are the fashion sector, the labor-intensive sector and technology-intensive sector taking the leading role (See Table 2). Industries with high proportion are mainly resources-consuming and entry restricted sectors. This demonstrates that if these sectors are opened, the proportion of domestic enterprises will further drop.

Among the world top 500 enterprises, there are only a few Chinese enterprises. There were only 18 Chinese companies listed among the Fortune 500 in 2004. In addition, most of these companies are in the sectors with policy restriction or in monopolized sectors.

The input-output ratio of Chinese enterprises is not high. Statistics from 2003 indicate that the input-output ratio of domestic enterprises was not high. Apart from the industrial added value rate, the contribution rate of total assets, turnover of current assets, overall labor productivity are all lower than that of foreign-funded enterprises and enterprises with investment from Hong Kong, Macao and Taiwan. In comparison with the enterprises abroad, the productivity of Chinese enterprises is only one 1/10 of that of US and Japanese enterprises.

…

If you need the full text, please leave a message on the website.

--------------------------------------------------------------------------------

l This report is one of the series of reports on "Guiding Principles for the Eleventh Five-Year Plan and Long-Term Goals by 2020".