The Growth of Energy Demand Will Slow Down andthe Supply and Demand Situation Will Improve in 2005* (Abridged)

2005-06-01

Deng Yusong, Institute of Market Economy of DRC Research Report No. 015, 2005

II. The Energy Demand Growth Will Decline to a Certain Extent, and the Tense Situation of Supply and Demand Will Be Alleviated

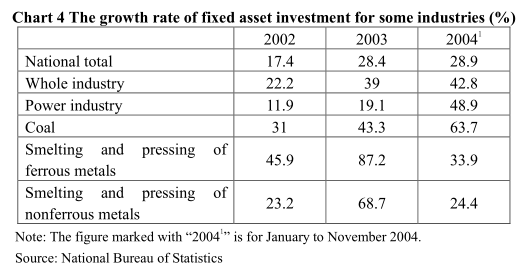

In 2005, the state will continue to intensify and improve macro control, adopt a prudent financial policy and monetary policy and curb excessive growth of fixed asset investment. It is estimated that in 2005, the growth of GDP, fixed asset investment and industrial value added will tend to decline. The growth rate of energy demand is mainly affected by economic growth, especially the industrial growth of the current period. As the development of the national economy relatively slows down, the growth of energy demand will also somewhat decrease compared with the year 2004. An analysis of the potentials of growth supply indicated that in 2004, the fixed asset investment in power and coal industries grew obviously faster (See Chart 4), and in 2005, the newly added production capacity will be further increased. So the power and coal industries will maintain fast growth. In general, the supply and demand of the energy market in 2005 will noticeably improve over the previous year.

1. The power shortage will be substantially eased, and the power price will rise steadily

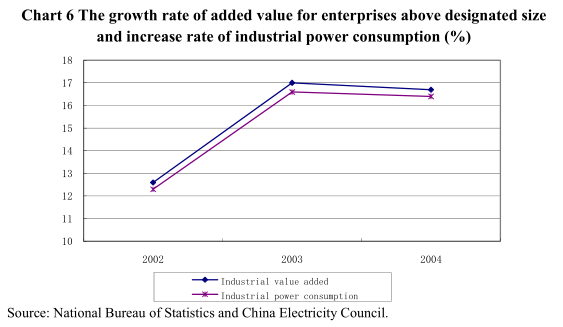

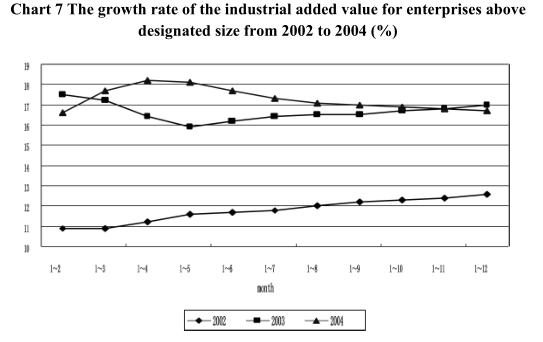

Power demand is mainly affected by economic growth, especially industrial growth. Due to the fast growth of industrial production, the proportion of power consumption by the industry has been raised in recent years. In 2004, the rate reached 74%. The situation of industrial production and industrial consumption of electricity in recent years indicates that growth rate of the added value for the enterprises above designated size is highly related to the growth rate of the increase of industrial power consumption (See Chart 6). In 2004, the profits of the main power-consuming industries, such as metallurgy, chemicals and building materials, continued to increase drastically, which was very much driven by the demand. As a result of the rapid growth of fixed assets in these industries these years, the production capacity will be further raised in 2005, and the main power consumption will also increase steadily. But compared with 2004, the industrial power consumption growth will also somewhat decline. Two reasons: first, since May 2004, the industrial growth has tended to drop steadily (See Chart 7); the industrial added value for enterprises above designated size in December increased 14.4% year-on-year, which was already 5 percentage points down from 19.4% in March. In 2005, the state will continue to deepen and improve macro control. Then the growth rate of industrial production will slow down compared with the year before. Second, the adjustment of electricity prices since 2004 as well as the coal-electricity joint pricing arrangement will also be conducive to giving better play to the pricing mechanism. So the main power-consuming industries will ease the fast-growing trend. If the weather conditions remain normal throughout the year, it is estimated that the power demand in 2005 will reach 2,430 billion kilowatt-hours, a rise of about 12% over 2004, of which the industrial power consumption will see a year-on-year increase of nearly 13.5%.

Since 2004, the capacity of electricity generation has entered a period of fast growth. As the investment in power increased substantially faster along with the power equipment industry, it is expected that the total installed power generating capacity will be about 70 million kilowatts, and the shortage of installed capacity will be greatly eased.

As the supply and demand situation of electricity and coal is relatively tense, the prices will still be rising. The coal-electricity joint pricing arrangement will result in the price rise of electricity in 2005. The annual price is estimated to rise by 4%.

2. The coal is generally in short supply, and the price will continue to rise

Industrial coal makes up more than 90% of the total coal consumption. The power, metallurgy, building materials, petroleum and coking and chemical industries are the five major coal consumers and use more than 75% of the coal. As the power production will maintain fast growth in 2005, the fast growth of investment in high power-consumption industries like metallurgy will also upgrade the production capacity. It is estimated that the coal demand will grow steadily. The new demand will be mainly coming from power and metallurgy industries. The former will have an estimated new demand for 120 million tons while the latter 30 million tons. The demand from other industries will be relatively stable. The annual new demand will be about 150 million tons.

Since 2002, the fixed asset investment in the coal industry has seen year-on-year increases. From January to November 2004, it rose by 63.7% year-on-year, which was greatly higher than that of the total fixed asset investment growth and industrial investment. The coal production capacity will keep increasing. Due to high demand, prices will remain high, which will also stimulate coal production. It is estimated that in 2005, the newly added output will be around 120 million to 180 million tons, and the annual output will stand at 2 billion tons, an increase of about 8.5% over 2004.The increase rate of output will be somewhat slower. In general, the newly added coal output will basically match the demand. But it should be noticed that the transportation bottleneck still remains, and the country’s total coal inventory is obviously lower than the normal level. And the safe production situation is still harsh, there exists a certain degree of uncertainty in coal supply. So the country will see a relatively tight coal market.

Internationally, as the net export from China will decrease, the newly added international demand will rely more on Australia and other countries. The negotiations between Japan, a main importer and Australia, a major exporter, and other countries indicated that the price of steaming coal would rise by about 20% in 2005. As the international coal prices are generally on the rise, the domestic coal prices will be demand-driven in 2005, and the annual prices would go up by more than 10% due to the fact the coal inventory remains at a low level and the demand is still high. The raw coal prices in the first quarter will rise by more than 15%.

…

If you need the full text, please leave a message on the website.

--------------------------------------------------------------------------------

*This paper is one of the research reports on "Analysis of China’s Market Situation in 2004 and Forecast for 2005" by Research Institute of Market Economy of DRC.