The Causes and Impact of the Continuous Expansion of Current Account Surplus

2006-09-11

By Zhao Jingping

Research Report No 159, 2006

I. The Main Characteristics of China’s Current Account Surplus

The customs statistics show that in May 2006, China realized a trade surplus of 13 billion US dollars, setting a new high; from January to May, the trade surplus had reached 46.8 billion dollars, a rise of 16.8 billion dollars over the same period last year, an increase of of 56%. It is estimated that the trade surplus in the year may exceed the level of last year, continuing to aggravating the pressure from a continuous current account surplus increase.

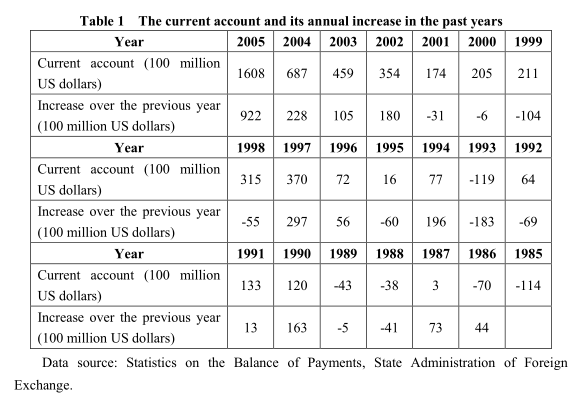

According to the balance of payments sheet announced by the State Administration of Foreign Exchange, the surplus of China’s current account in 2005 was 160.8 billion dollars, a rise of 92.2 billion dollars over the year before, which represented an increase of 134.2%. An analysis of the current account revenue and expenditure changes over the previous years can find that first, since 1994, China has maintained 12 years of surplus of current account with the surplus of 2005 reaching 21 times as much as that of 1994; second, the increased amount of surplus in 2005 was the highest, equivalent to 15 times as much as the annual average increased amount from 1994 to 2004 and 2.9 times as much as that in 2004; third, the year-on-year increase was only lower than that between 1996-1997, but 109.7 percentage points higher than the average annual growth rate of 24.5% from 1994-2004; fourth, of the 448.3 billion dollars of current account surplus in the 21 years from 1985 to 2005, the amount in 2005 alone accounted for 35.9%. In a word, one of the most prominent characteristics of 2005 balance of payments sheet was the drastic expansion of current account surplus.

II.The Causes of the Fast Increase of Current Account Surplus

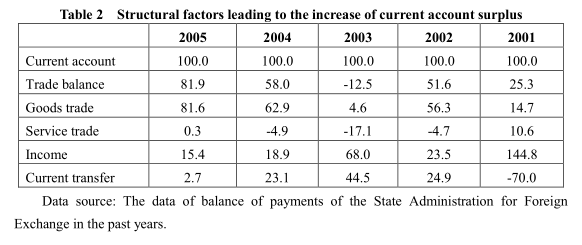

The current account revenue and expenditure is composed of trade in goods, service trade, income and current transfer. In 2005, except a deficit of 9.4 billion dollars in service trade, all the other three items were surplus, with the goods trade surplus as high as 134.2 billion dollars, which was an increase of 75.2 billion dollars as against 2004; an increase of 2.5 billion dollars in current transfer surplus; the income account changed from 3.5 billion dollars in deficit of the previous year to 10.6 billion dollars in surplus this year and the surplus in total current account grew by 14.2 billion dollars; although there was a deficit in service trade, it was 300 million dollars less. Two conclusions can be reached: first, the changes in the goods trade, service trade, incomeand current transfer revenue and expenditure have all pushed for the expansion of current account surplus in 2005; second, of the 92.2 billion dollars of increase in current account surplus, the goods trade surplus increase is the main cause leading to the rapid increase of current account surplus as the surplus of the four items respectively makes up for 81.6%, 0.3%, 15.4% and 2.7% of the total surplus. More analysis will be made on the cause of the surplus of goods trade.

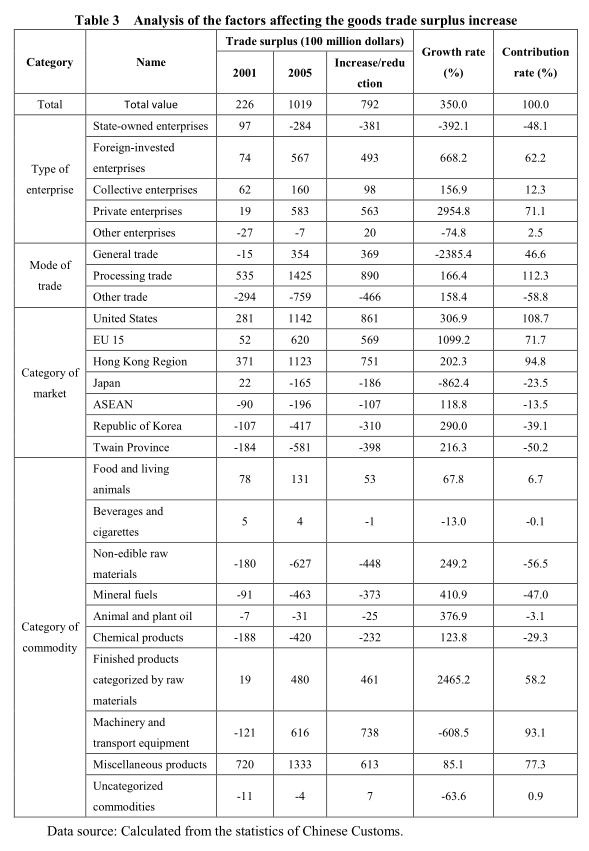

The above analysis mainly concerns the impact of short-term factors. We need to make a further study over the impact of trade structure changes on trade surplus increase in a relatively long period of time (2001-2005).

According to the calculation of the customs statistics (See Table 3), we can draw the following conclusions, first, private and foreign-invested enterprises saw fastest increase of trade surplus, contributing the highest proportion of overall surplus with respectively 71.1% and 62.2%; the state-owned enterprises changed from surplus to huge deficit. This indicates that the growth of surplus has been directly linked with the opening of foreign trade operation right and the global production layout changes of transnational companies. Second, in terms of mode of trade, processing trade is the main cause of drastic expansion of surplus with a contribution rate of 112.3%. It shows that the trade expansion due to the global industrial distribution changes and gradually intensified deep processing have led to the constant increase of China’s trade surplus. Third, country (region)-specific, the growth of foreign trade surplus in the leading European and American countries is a main cause of the overall increase, with a contribution rate of respectively 108.7% and 71.7%. At the same time, the trade deficit of Japan, ASEAN and the Republic of Korea have kept expanding. Such a structural imbalance is mainly due to the processing industry transfer in the East Asian region. China has become a processing transfer place for Japan, the Republic of Korea, ASEAN and Taiwan Region to export goods to Europe and America. Fourth, in terms of main commodities, commodities classified by raw materials, machinery and equipment and miscellaneous products under the finished industrial products are the main sources of trade surplus, respectively contributing 58.2%, 93.1% and 77.3%. They include the labor-intensive products with which China has traditional competitive edge as well as the machinery products made under the mode of processing trade and the arrangement of cross-border industrial work division. In the long run, the sustained surplus has been a result of China’s deepening of reform and opening up, traditional competitive advantages, industrial transfer of transnational companies and cross-border extension of international industrial chains. In a word, it has been brought about by globalization.

…

If you need the full text, please leave a message on the website.