By Xia Bin, Research Institute of Finance of DRC

Research Report No.072, 2008

I. Two Thought-Provoking Questions in Comparing Two Historical Periods

If the collapse of the Bretton Woods System in 1971 is taken as the demarcation line, the post-war period from 1946 to 2008 can be divided into two periods: the 24-year period from 1946 to 1970 and the 37-year period from 1971 to present. The international monetary system in the former period was characterized by fixed exchange rates, while that in the latter period by floating exchange rates. In the two historical periods with the different exchange-rate systems, the growth of the global international reserves and the phenomena of financial crisis respectively assumed drastically different features.

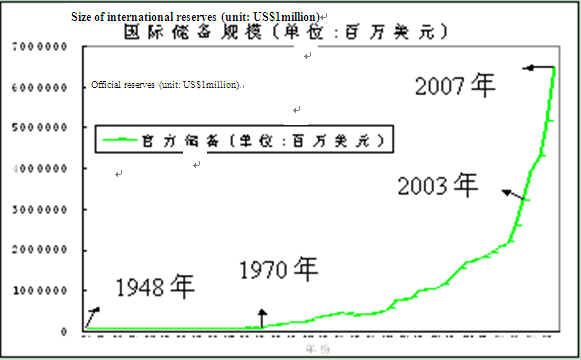

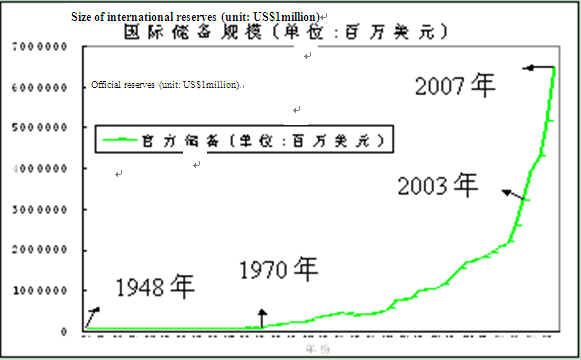

1. Global international reserves

The global international reserves, which stood at US$47.8billion in the post-war year of 1948, rose to US$93.2billion in 1970, an average annual growth rate of only 3% during the 22-year period. The growth rate was as high as 12% during the 37-year period from 1971 to 2007. In the absolute term, the global international reserves rose from US$93.2billion in 1970 to US$6,489.2billion at the end of 2007, a 70-fold growth. During the same period, the global GDP growth was about 16 folds (the relevant data are based on the data of the United Nations and the IFS data of the International Monetary Fund).

Size of International Reserves

Size of International Reserves

2. Phenomena of financial crisis

First, the world economy and finance basically maintained a fairly steady development in the 22 years before 1971. But financial crises appeared repeatedly in the 37 years after 1971. Moreover, the interval between financial crises has become shorter and the frequency of outbursts has become higher. A World Bank report at the beginning of this century once noted that 112 systematic bank crises hit 93 countries and 51 semi crises occurred in 46 countries from the late 1970s to the end of the last century (the data originate from relevant research report of the World Bank: Finance and Growth – Policy Options amidst Turmoil, the Chinese translation was published by the Economic and Scientific Publishing House). Second, financial crises, which used to occur in developing countries and less developed countries, began to infect the United States, the largest and most developed economy in the world, since the beginning of this century. These phenomena of financial crisis included the burst of the network stock bubble at the beginning of this century and also the subprime crisis that still affects global economic growth.

II. Origin of Two Questions

Why was the growth rate of the global international reserves far higher than the global GDP growth rate after 1971? And why did the financial crises spread from poor countries to rich countries and from small countries to the world’s largest economy?

First, the Triffin Dilemma and the system foundation for the floating exchange rates provided a possibility. Although the gold-dollar standard collapsed in 1971, the continuous growth of world trade still used dollar for international settlement. This allowed the U.S. government to always maintain a recurrent deficit within a certain range. Added with the floating exchange rate system, the U.S. government could constantly use dollar revaluation and devaluation to continuously provide the world with excess dollars in the course of solving domestic economic contradictions and expanding trade deficit.

Next, the economic latecomers and some developing countries in the age of floating exchange rates realized from the lessons of the financial crises in their own and other countries that it was important for them to possess certain amounts of international reserves due to currency mismatch and other financial fragilities. Accordingly, they were forced to continuously increase their holding of international reserves. After the Asian financial crisis, in particular, some emerging economies and some oil-exporting countries were in a better position to rapidly increase their holding of international reserves.

Third, the Chinese economy began a gradual integration with the world economy after Chinese Chairman Mao Zedong and American President Richard Nixon shook political hands and especially after China began to reform and open up in the 1980s. Worldwide, the former East European and Soviet countries and some countries in Latin America also began to integrate with the world market economy in the 1980s and 1990s. With the appearance of new information technologies, the wave of economic integration and globalization resurged 100 years after World War I began in 1914. Global division of labor underwent major changes, and made it possible for global economic development to fully enjoy the "dividend of globalization" and the "dividend of population". As a result, the world economy entered a new period of rapid growth. Taking advantage of the Triffin Dilemma, the floating exchange rate system and the opportunity arising from the economic growth cycle in the new round of globalization, the U.S. government used its policy tools and innovative financial derivatives and once again flooded the world with huge amounts of dollars in the course of stimulating a high growth of the U.S. economy and partially pushing a high growth of the global economy. The result was that the international reserves, mainly in the form of the U.S. dollar, rose from US$2.57trillion in 2002 to US$6.49trillion in 2007, posting a 1.5-fold growth in five years. The financial derivative contracts also rose from over US$100trillion in 2002 to US$516trillion in 2007, a growth of more than five folds.

However, the explosive development of the information technologies and the financial derivative technologies often helped the villain in evildoing in a sense. In the Greenspan age, the U.S. government took full advantage of the so-called "elasticity of the American financial market", and skillfully used the exchange rate, interest rate and new financial technologies to flood the world with the American dollar to meet the need of the structural distortion in the economic growth of China and other emerging countries. At the same time, the U.S. government excessively amplified the scale of the virtual economy which could not be supported for long by the U.S. real economy and enjoyed the cheap consumer goods arising from the rise in the prices of assets. Although these measures temporarily supported the continuous growth in a new economy cycle, they eventually sowed the seed of a subprime crisis that still affects global economic stability even today. To some extent, they fostered the current global inflation.

…

If you need the full text, please leave a message on the website.