Chinese Enterprises' Overseas Acquisitions: Basic Conditions, Overall Evaluation and Policy Options

2010-06-08

By Zhang Wenkui, Enterprise Research Institute of DRC

Research Report No 145, 2009

I. Basic Conditions

With the growth of China's economic strength, the corporate upgrading and transformation and their growing awareness about international operations, more and more Chinese enterprises have made overseas investments in recent years. Their overseas investments include green field investments and investments through acquisitions. In particular, the investments through acquisitions have risen rapidly in the past two years. Due to the serious impacts of the international financial crisis on the enterprises in Europe, America and other developed regions, Chinese enterprises have been pursuing overseas acquisitions since 2008. This has sparked widespread attention.

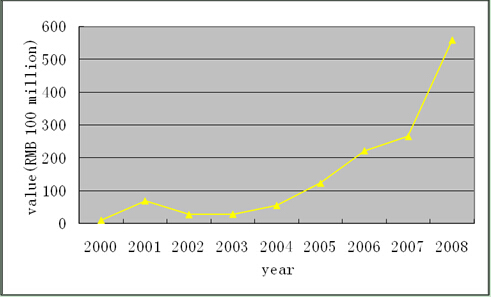

Figure 1 Changes to China's Overseas Direct Investments since 2000

Source: Based on the Statistical Bulletins on China's Overseas Direct Investments in 2007 and in 2008 published by the Ministry of Commerce.

Overall, Chinese enterprises' overseas investments and overseas acquisitions have been on the rise annually. According to the bulletins published by the Ministry of Commerce, China's overseas direct investments in 2007 rose 25.3% to US$26.51 billion, of which the non-financial overseas direct investments rose 40.9% to US$24.84 billion. Its overseas direct investments in 2008 rose 110.9% to US$55.91 billion, of which the non-financial overseas direct investments rose 68.5% to US$41.86 billion. The above figure shows the changes to China's overseas direct investments since 2000.

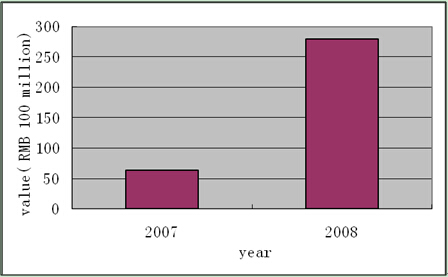

Figure 2 Changes to China's Overseas Acquisitions in 2007 and 2008

Source: Based on the Statistical Bulletins on China's Overseas Direct Investments in 2007 and in 2008 published by the Ministry of Commerce.

According to the bulletins published by the Ministry of Commerce, the growth of China's overseas direct investments through acquisitions has grown faster. The investments through acquisitions in 2007 were only US$6.3 billion, accounting for 23.8% of the country's total overseas direct investments. In 2008, the investments through acquisitions rose sharply to US$28 billion, making up 50% of the country's total overseas direct investments. In terms of both regional and industrial distributions, the investments through acquisitions have diversified, rising rapidly in both developing and developed countries and being very active in both upstream resource enterprises and downstream processing and manufacturing enterprises. The above figure shows the changes to China's overseas acquisitions in the past two years.

In 2009, Chinese enterprises' overseas acquisitions became even more vigorous. According to the statistics of ChinaVenture, a risk investment data service company, China's overseas acquisitions in the second quarter of 2009 alone reached US$11.48 billion, a record quarterly high. In particular, not only the central state-owned enterprises and large enterprises performed remarkably well in overseas acquisitions in 2009, but also the medium-sized enterprises, especially the regional ones and private ones, became exceptionally active. According to the date published by the Department of Commerce of Hunan Province, the province's overseas direct investments in the first half of 2009 ranked first among all Chinese provinces. A total of 58 enterprises were approved to make overseas investments, with a total contractual value of 5.17 billion dollars and a paid-up value of 960 million dollars. In particular, three overseas acquisitions, including the Hualing Group's acquisition of a 17.3% stakes from Australia's FMG Company, became the largest of its kind in the province's history. According to the statistics of the www.investide.cn, Chinese enterprises completed 71 overseas acquisitions from early 2008 to the end of July 2009, of which 33 or 46% of the total transactions were initiated and completed by private enterprises. This has been a rare phenomenon in recent years.

In 2009, some new elements associated with Chinese enterprises' overseas acquisitions have appeared. In addition to acquiring resource enterprises, Chinese enterprises have grown fast in acquiring famous corporate brands and technology-intensive enterprises in developed countries. In the first half of 2009, Jili Group, a private automaker in China, completed the acquisition of Australia's DSI Company, a world famous auto-gear producer and a long supplier to the American Ford and other multinational automakers. A private enterprise in China already acquired the use right of the world famous fashion brand Pierre Cardin in come regions. If these acquisitions can smoothly integrate and produce synergy effects, they can effectively benefit Chinese enterprises in overcoming their short-board effect in brands and technologies, promoting their corporate upgrading and transformation and enhancing their international competitiveness.

II. Overall Evaluation

It is quite natural that Chinese enterprises have become growingly active in overseas acquisitions. First, it is determined by the different development stages of Chinese enterprises and their counterparts in developed countries. Over the past three decades, most Chinese enterprises have rapidly expanded their operational scales. Not only some monopolistic sectors now have state-owned enterprises, with their operational revenue being as high as RMB100 billion yuan, but the competitive sectors also have enterprises, with their operational revenue being as high as RMB100 or 50 billion yuan. In particular, many of them are private enterprises, often with their operational revenue being RMB10 billion yuan. However, the rapid expansion of corporate scale has also concealed some in-depth problems, such as low technological level, lagging brand building, low product quality and added value, and outdated channel and supply chain management. As a result of macroeconomic adjustment in the past two years, Chinese enterprises have also switched from the stage of scale expansion to the stage of upgrading and transformation. This has been in striking contrast with the enterprises in developed countries. While the enterprises in developed countries have long been successful in technological innovation, product research and development, brand building, quality control and supply chain management, they have been plagued by weak local market demand and scale bottleneck. In particular, the outbreak of the global financial crisis in 2008 has aggravated the weak market demand and made them difficult to expand or even maintain their operational scale. Since 2008, the auto and parts enterprises, the machinery and electronics enterprises and the daily necessity enterprises in Europe, America and other developed regions have all been troubled by drastically shrunk demand and diving production and sales, and many of them have seen their operational scale being close to the dividing line between profit and loss. If they very much emphasized value upgrading in the past, they now must emphasize operational scale. In other words, they have temporarily switched from the stage of value upgrading to the stage of scale maintenance. In this case, Chinese enterprises' overseas corporate acquisitions can produce some synergy effect, benefiting both themselves and their counterparts in developed countries. Second, it has something to do with the resource constraints facing Chinese enterprises. Over the past three decades, China's industrialization has become faster and faster, rapidly increasing the consumption of minerals, energies and other natural resources. After joining the WTO this century, China has become an international manufacturing base and Chinese enterprises have in fact performed the task of providing finished industrial goods for the whole world. This has further increased their consumption of natural resources. But China is a country with scarce resources. With the rapid expansion of Chinese enterprises' manufacturing capacities, importing overseas resources has become a pressing task. At the same time, the dramatic rise and drastic fluctuation in the market prices of mineral resources and other bulk commodities have promoted Chinese enterprises to acquire overseas resource enterprises so as to obtain steady supply of resources at reasonable prices. Third, it is also related to the continuous growth of China's foreign exchange reserve. At present, China's foreign exchange reserve has exceeded US$2 trillion, and purchasing American national debts and making investments in current assets cannot digest this foreign exchange reserve. For this reason, both the enterprises and government have the initiative to spend part of the foreign exchange reserve on overseas acquisitions. Of course, the plummeting stock prices of overseas enterprises arising from the 2008 global financial crisis have further stimulated the enthusiasm of Chinese enterprises to acquire overseas enterprises at rock-bottom prices. However, most overseas acquisitions have been prompted by the above inevitable factors.

...

If you need the full context, please leave a message on the website.