China's Agricultural Policy: Supporting Level and Structural Features

2011-12-06

By Cheng Guoqiang, General Office of DRC

Research Report No 116, 2011

Since the 1990s, with the rapid growth of the Chinese economy and its structural change, significant changes have taken place in China's agricultural policies. Those changes are radical, realizing gradually getting industry to nurture agriculture and subsidizing agriculture from previous discrimination against and expropriation of agriculture. This paper has used PSE of OECD to systematically appraise the level of support and structural features of China's agricultural policies in a bid to provide a basis for policy-making for further improving China's agriculture-friendly policies.

I. Principal Agricultural Policies and Measures of China at Present

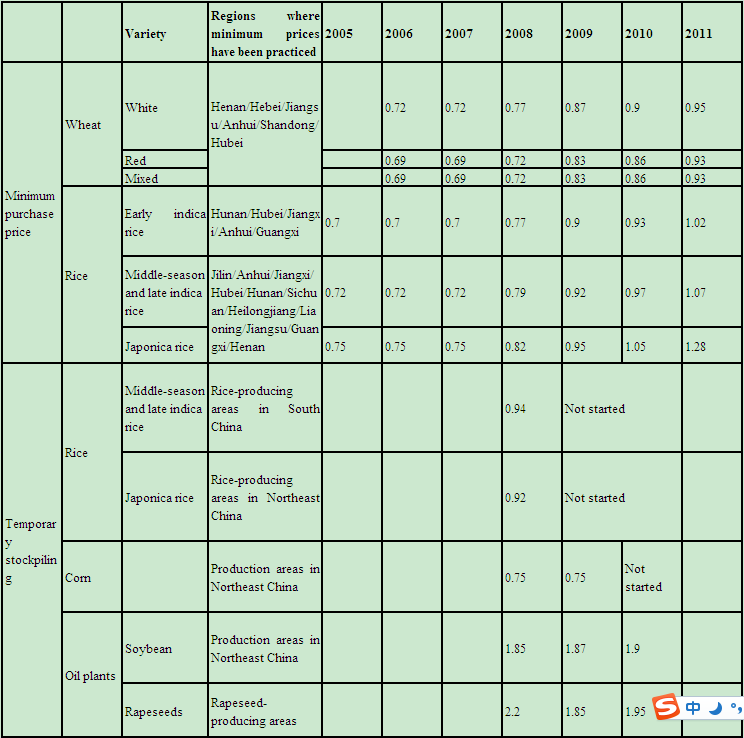

In 2004, the central government made a significant judgment that "China has on the whole entered into the stage of industry stepping up agriculture and urban development bringing along rural growth" and formulated a number of agriculture-friendly policies mainly aimed at repealing agricultural taxes, animal slaughter tax, livestock tax and taxes on special agricultural products, leaving farmers exempted from a tax burden of 120 billion yuan each year; explored ways for offering subsidies to farmers, including direct subsidies for grain producers, general subsidies for purchasing agricultural supplies, subsidies for purchasing superior crop varieties and agricultural machinery and tools (known as "Four Subsidies") and agricultural insurance premium subsidies. Of those subsidies, the amount of the "Four Subsidies" increased rapidly from 100 million yuan in 2002 and 14.52 billion yuan in 2004 to 134.49 billion yuan (Table 1) in 2010; all control over grain market prices and grain purchase and sales were lifted and the policy of purchasing and temporary stockpiling major agricultural products at the minimum prices were implemented. Since 2008, the minimum grain purchase prices have been raised continuously. Up to 2011, prices of white wheat, red wheat and mixed wheat have been increased by 31.9%, 34.8% and 34.8% respectively and those of early indica rice, middle-season and late indica rice and japonica rice have been increased by 45.7%, 48.6% and 70.7% respectively (Table 2); fiscal support for agricultural budget has been increased by a wide margin, incentive measures have been practiced over major grain-producing, oil-producing and pork-producing counties and the subsidies have been increased to support such projects as key water conservancy projects in large and medium-sized irrigated areas, irrigation facilities like small water conservancy works, agricultural technical innovation, seed stock breeding and the relevant technology popularization system, agricultural technical service, prevention and control of plant diseases and insect pests and the protection of agro-ecological environment.

Table 1 Funds for the "Four Subsidies" Spent in China Since 2004

(Unit: 100 million yuan)

|

|

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

|

Direct subsidies for grain producers |

116 |

132 |

142 |

151 |

151 |

151 |

151 |

|

General subsidies for purchasing agricultural supplies |

- |

- |

120 |

276 |

716 |

795 |

835 |

|

Subsidies for purchasing agricultural machinery and tools |

0.7 |

3 |

6 |

20 |

40 |

130 |

154.9 |

|

subsidies for purchasing superior crop varieties |

28.5 |

37.52 |

40.2 |

66.6 |

120.7 |

198.5 |

204 |

|

Total |

145.2 |

172.52 |

308.2 |

513.6 |

1027.7 |

1274.5 |

1344.9 |

Note: ① Only subsidies for purchasing superior crop varieties were provided in 2002 and 2003, reaching 100 million yuan and 300 million yuan respectively; ② Data for the year 2010 come from the Ministry of Finance's Report on Budget Implementation by the Central Government and the Local Governments in 2009 and the Draft Budgets by the Central Government and the Local Governments for the Year 2010.

Source: Ministry of Finance.

Table 2 Minimum Grain Purchase Prices and Temporary Stockpiling Prices in China (Unit: yuan/jin)

Note: ① The minimum purchase prices and the temporary stockpiling prices are among the national third-grades and the price spread between every two grades is 0.02 yuan/jin; ② Guangxi has been designated since 2008 as one of the regions where the minimum purchase price of early indica rice has been implemented, and Liaoning, Jiangsu, Guangxi and Henan have been placed among the provinces since 2008 where the minimum purchase prices of middle-season and late indica rice and the japonica rice have been implemented; ③ The production areas in Northeast China include Heilongjiang, Liaoning, Jilin and Inner Mongolia; ④ The temporary stockpiling prices of corn implemented in different production areas vary, of which the price practiced in Inner Mongolia and Liaoning is 0.76 yuan/jin, that of Jilin 0.75 yuan/jin and that of Heilongjiang 0.74 yuan/jin.

Source: According to relevant policies and documents formulated by National Development and Reform Commission.

II. Level of Support of China's Agricultural Policies and the Subsidy Effect

1. Method of calculation for the supporting level of agricultural policies

The method of Producer Support Estimate (PSE), adopted by this paper, is used by OECD to calculate the subsidies obtained by agricultural producers after the implementation of the agriculture-friendly policies by various countries, which is called "subsidies to agricultural producers" in this paper. The subsidies can be divided into (1) Price support, namely, the subsidies provided to farmers and for farm produce through such measures as pricing policy and market intervention, with the cost to be borne by both the government and consumers, which is measured by MPS, Market Price Support; (2) Direct subsidies, namely, the subsidies given directly to farmers based on some standards and conditions, which are borne by the government. Direct subsidies can be divided into subsidies linked to the output of the farm produce, the use of such inputs as agricultural supplies, the cultivated area, the number of animals and operating income and the subsidies not linked to the above-mentioned subsidies. In addition, evaluation indicators are as follows:

…

If you need the full text, please leave a message on the website.