Analysing accounts

In practice the work of a management accountant is rather like that of a detective. The task is to sift through evidence and to extract meaningful messages that will help managers make effective business decisions. The starting point is often the basic accounting documents that record the progress of any business.

There are two key documents:

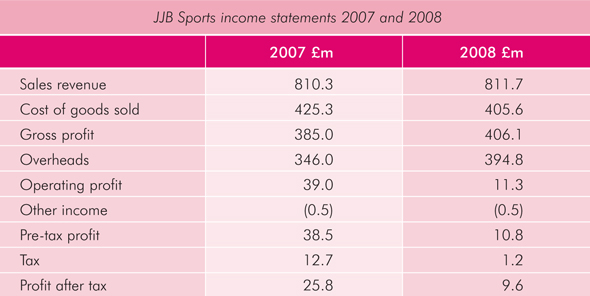

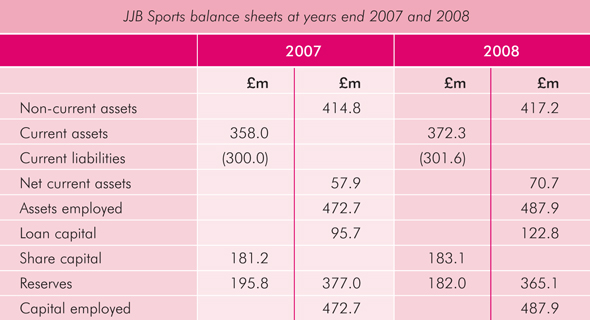

the income statement is an aggregated record of all sales and all corresponding expenses over a given past period – typically a year the balance sheet explains how the business is currently using its resources and how those uses have been financed. It 'balances' the assets employed (all long-term resources in the business) against the capital employed (the long-term finance in the business). These documents are closely related and need reading together. The balance sheet is a snapshot of a business at one point in time. The income statement is dynamic and describes the flow of money through the business over a period of time.

This example focuses on JJB Sports, one of the UK's largest sports retailers. It shows how management accountants were able to use information from the company's accounting documents to identify potential problem areas. JJB Sports was formed in 1971. The business started out with just one shop. The company expanded rapidly and it was floated on the London Stock Exchange in 1994. However, the business began to falter during 2007.

Financial data in isolation is not meaningful. To say that JJB Sports made a pre-tax profit of almost £39 million in 2007 reveals little. By comparing data over time and by calculating financial ratios a management accountant would identify a different picture. The data shows that the company's financial position weakened in some respects in 2008. Although sales remained fairly constant, the income statements show that pre-tax profits fell from £38.5 million to £10.8 million. JJB Sports' return on capital employed also fell significantly. This is an important financial ratio, as it is a measure of how well the company is exploiting the assets at its disposal. It is calculated by expressing a company's net (pre-tax) profit as a percentage of the capital employed.

This analysis suggested that, although JJB Sports was making sales, it was not getting value from those sales. Management accountants can compare the financial performance with other businesses in the retail and sports goods sectors for context.

They would analyse the data further to highlight those areas where JJB Sports managers should take action. They would be concerned that: