Healthy waters

By Zhang Haizhou and Meng Jing ( China Daily )

Updated: 2013-01-11

|

|||||||||

China banks on blue economy to build sustainable, strong maritime future

'A strong nation faces the sea while a weak one turns its back on it," is how Lin Zexu described Britain's victory and China's defeat in the First Opium War (1839-42).

Lin, a Chinese scholar and Qing Dynasty (1644-1911) official then, was well known for his crusade against opium smuggling in Guangzhou. His confiscation of more than 20,000 chests of opium and their destruction is believed to have been the trigger for the First Opium War.

China's ocean dreams date back to the Ming Dynasty (1368-1644) and the seven voyages led by Admiral Zheng He in the early 1400s. The high point of Zheng's voyages was when he reached the coast of east Africa, a maritime milestone in China's history.

But sadly, the momentum pursued by Zheng was not maintained by his successors, and China remained completely shut to the rest of the world until its defeat in the Opium War.

Two centuries later, Lin's words seem more than relevant, as China's blue economy is not only giving a new impetus to the marine and fisheries sector, but also providing the blueprint for China's sustainable development in the future.

With the global financial crisis showing no signs of receding and the vulnerable economic climate putting further strain on sustainable development plans, policymakers have come to realize that the blue economy, while opening up new avenues of growth and employment, also has answers for how natural resources can be used in an efficient and environmentally friendly manner.

The importance of the maritime sector can be gauged in the keynote address of President Hu Jintao during the 18th National Congress of the Communist Party of China in November. Hu pledged that China would enhance its capacity for exploiting marine resources, develop the marine economy, protect the marine ecological environment, and "resolutely" safeguard China's maritime rights and interests.

His statement represents the broad policy consensus among the Party leadership on the course of China's future development, and the importance of China being a maritime power.

More importantly, what this also means is that the more than 3 million square kilometers of marine area in China is poised to play an increasingly important role in the nation's economic future.

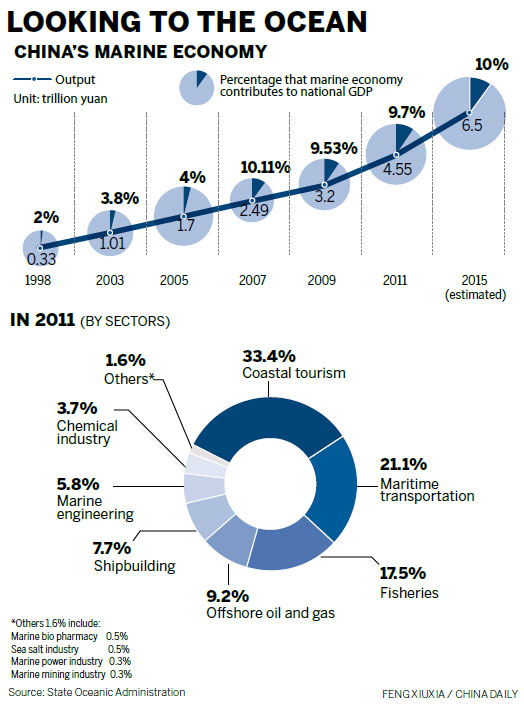

In line with these objectives, policymakers have envisaged that China's marine output will account for 10 percent of GDP by 2015, which, given current growth, is estimated to reach 6.5 trillion yuan ($1.04 trillion; 800 billion euros) by then.

The State Council, or China's cabinet, in October cleared zoning plans for eight major coastal regions during the 2011-20 period. Maritime zoning will provide a workable basis for the effective protection of China's ocean environment, as well as for the rational exploitation of related resources.

The gross output value of the marine economy reached more than 4.55 trillion yuan in 2011, up 10.4 percent year on year, according to the State Oceanic Administration.

The numbers indicate that the marine economy accounted for 9.7 percent of the country's total annual GDP in 2011, up from 3.8 percent in 1993, according to SOA statistics.

Though the numbers provide a sense of comfort, there are still several challenges before China can transform into a formidable maritime power, an SOA spokesperson says.

"The marine economy is mostly external in nature and as such affected by the international economic situation. China's marine economic growth has slowed due to the global economic crisis, and low domestic demand," the spokesperson says.

Slowing exports is another challenge for the industry and something that could hit marine economy growth rates this year, the spokesperson says.

"We are a big marine power, but not yet a strong one. A key reason for this is that we are still relatively weak in technological innovation. Technology contributes to about 30 percent of the whole marine economy in China, compared to 70 or 80 percent in some developed countries," the spokesperson says.

"We are a big marine power, but not yet a strong one. A key reason for this is that we are still relatively weak in technological innovation. Technology contributes to about 30 percent of the whole marine economy in China, compared with 70 or 80 percent in some developed countries," the spokesperson says.

Technology challenge

Industry experts agree that the low technology base is a major challenge for China as it strives to move up the maritime chain.

"The main reason for this is China's late entry," says Li Jingyu of the Pacific Society of China, a think tank on marine development.

Li says China still relies mainly on the big three traditional marine industries including transportation, fishing and salt for long-term growth. "It's not sustainable," he says.

China has a coastline of more than 18,000 km and 5,000 islands/islets in territorial waters with an area of more than 14,000 sq km.

In 1998, the country published its first white paper on marine economy, titled Development of China's Program. It notes that China's marine economy involves more than 20 sectors including the big three.

The sea has played an important role in China's efforts to develop an export-oriented economy over the past three decades. More than 90 percent of China's exports are transported using the sea.

According to the white paper, in the 1980s, the marine economy had annual growth rates of around 17 percent, and this subsequently rose to 20 percent during the 1990s.

However, the growth rate of traditional marine industries has been significantly slower in recent years amid global economic turmoil.

Shipping companies listed on China's A-share market, for instance, reported total losses of 7.38 billion yuan in the first nine months of last year, according to Wind Information, a leading integrated service provider of financial data in Shanghai.

China COSCO Holdings Co Ltd, the Shanghai-listed unit of the country's largest shipping group China Ocean Shipping (Group) Co, suffered the largest loss among the more than 2,000 listed companies. It posted losses of 6.4 billion yuan for the nine months till September, according to a quarterly filing.

Marine transportation grew by 7.1 percent in 2011, according to the SOA, while the fishing and salt industries grew by just 3.7 and 0.8 percent year on year. All three sectors grew slower than the previous years.

The new thrust of China's blue economy is a combination of traditional, new and emerging industries. Power generation from the sea, for instance, grew by 25 percent in 2011, while ocean biopharmaceuticals rose by 15.7 percent.

"Unlike other sectors, marine industries are more reliant on technological development," says Guan Huashi, a member of the Chinese Academy of Engineering and a professor in the Ocean University of China in Qingdao, Shandong province.

Lin Xiufen, general manager of Xiamen Blue Bay Science & Technology, a marine biomedicine maker, says that it was a proud moment for her when the Glucosamine capsules made by her company achieved purity levels in excess of 90 percent, while the world average was about 80 percent.

She says that such a feat was possible due to the close cooperation the company had with researchers from the Third Institute of Oceanography in Xiamen. "In Glucosamine technology, China is clearly the world leader, even though it lags developed countries in overall marine biology," she says.

Blue Silicon Valley

Regional governments in China, especially those on the coastline, are now taking serious steps to shore up the marine economy.

But for the moment, all the eyes are on Qingdao, a city in the coastal province of Shandong in East China. The city is setting up the Blue Silicon Valley on a vast stretch of land from Laoshan district to Jimo county in the north of the city to facilitate oceanographic research and other high-technology development as well as commercial applications for the marine sector.

|

Thirty-three projects with a combined investment of 22.2 billion yuan is under construction or in the pipeline in Qingdao's Blue Sillicon Valley. Provided to China Daily |

Nearly 33 major projects involving a combined/projected investment of around 22.2 billion yuan is either under construction or in the pipeline in the core areas of the Blue Silicon Valley at Aoshanwei town in Jimo.

"Like the Silicon Valley in the US, we want to be a paradise for entrepreneurs and innovators," says Zhang Feng, deputy head of the administration committee of the Blue Silicon Valley. "We have set up business incubators and also plan to rope in technology brokers to enhance the commercialization of research findings."

The Qingdao campus of Shandong University commenced work in July. Phase I of the Qingdao National Laboratory for Marine Science and Technology was completed last year, and is now looking to attract renowned oceanographers from around the globe.

The area's National Deep-Sea Base made history last year when its Jiaolong deep-sea submersible broke the 7,000-meter-mark on July 16.

The national deep-sea base program is the fifth of its kind in the world after the US, Russia, France and Japan.

Other programs that will be built in the area include the National Inspection Center for Marine Equipment, Qingdao Institute of Marine Geology and the R&D Center of Beidou Navigation.

Green moves

While high-tech is the focus of the country's blue economy development, policymakers and analysts are also paying more attention to ecological protection.

Nearly 800 km to the south of Qing-dao, Jinshan in southern Shanghai is also working hard to make better use of its 23.3-km-long coastal line.

The district, called China's best "deep-sea port" by revolutionary leader Sun Yat-Sen, had in the last few years become a major center for the chemical industry in East China due to its proximity to the sea.

Despite the contributions made by the district to China's rapid economic growth over the past decade, Chen Xin'an, senior economist and member of Shanghai Jinshan New Town Management Committee, says it hopes to take a more eco-friendly path of progress.

The district wants to be a major tourist destination in Shanghai, or in other words to be a major coastal city without an attractive beach yet.

"Look at the chemical industry towns in Germany. They still offer a great living environment for their citizens. We want to be the same," Chen says.

While high-tech and environmentally friendly marine industries are finding the right momentum for growth, companies involved in the traditional marine industries are changing their strategies to survive.

Song Zhengyong, deputy production manager of Huanghai Shipbuilding Co in Shandong, says his company now has more domestic orders.

"More than 80 percent of our cargo orders used to come from abroad. This is changing and we are slowly increasing our domestic business," Song says, adding that sales reached 3 billion yuan in 2011.

China aims to increase annual sales by domestic shipbuilders to 1.2 trillion yuan by 2015 as it works toward its goal of becoming the world's leading shipbuilding nation, the Ministry of Industry and Information Technology said last year.

The country also plans to raise the value of annual shipbuilding exports to more than $80 billion (61 billion euros) by 2015, the ministry said in a five-year plan for the shipbuilding industry.

The plan provides new details regarding China's push for significant growth in domestic shipbuilding at a time when the industry already faces overcapacity.

A report by the China Association of the National Shipbuilding Industry showed that total new orders from more than 1,500 shipbuilders in China fell more than 50 percent in 2011.

To achieve these goals, the shipbuilding industry is focusing on quality over productivity and overcoming deficiencies, including worker training, retention and research and design.

"For many companies, productivity came first and quality a little bit later. But for the major shipyards, quality has remained a major part of their program and we've often seen them take huge strides," says Tom Boardley, marine director of the London-based Lloyd's Register, which provides ship classification services globally.

The company is the world's second-largest classification society and covers more than 18 percent of the global fleet. It employs 372 people in China and has a working presence in 40 of the country's 200 main yards.

The changing focus of the shipbuilding industry has also created more opportunities for overseas companies.

Autodesk, a leader in 3D design, engineering and entertainment software in the US, says that it expects more opportunities in China's developing marine economy, "particularly in the shipbuilding industry".

Autodesk reached a deal in November with Sanyang Heavy Machinery Co, producer of shipping equipment in Taizhou, a city in the coastal Jiangsu province of East China, to allow the latter to use Autodesk Inventor software in making engineering ships and equipment.

The Autodesk Inventor 3D model is an accurate 3D digital prototype that enables users to validate the form, fit, and function of a design; minimize the need for physical prototypes; and reduce costly engineering changes that are discovered only after the design is sent for manufacturing.

"Autodesk hopes to have more technology exchanges and cooperation with Chinese companies and make more contributions in line with China's plans to be a major maritime power," a company official said on condition of anonymity.

Global efforts

China is not the only country with an eye on the ocean, as others are also planning similar moves to find solutions to energy challenges.

In Europe, the agenda for creating growth and jobs in the marine and maritime sectors was adopted in early October by European ministers for maritime policy and the European Commission at a meeting in Limassol, Cyprus.

The member states and the Commission reaffirmed that a dynamic and coordinated approach to maritime affairs will enhance the development of the blue economy and ensure the health of seas and oceans, five years after the launch of the EU Integrated Maritime Policy.

The Limassol Declaration also proposes a marine and maritime agenda to back the Europe 2020 strategy. It focuses on promising marine sectors where there is a great potential for new jobs and growth.

These sectors include marine renewable energy, aquaculture, blue biotechnology, coastal tourism and seabed mining.

"Seas and oceans can play a decisive role in Europe's economic recovery. It is clear that we need to embrace the potential of Europe's blue economy," Jose Manuel Barroso, president of the European Commission, said in an earlier interview.

Maria Damanaki, commissioner responsible for maritime affairs and fisheries in Europe, says that the collective effort of all stakeholders, such as institutions, member states and regions, industry, SMEs and civil society, is necessary to unlock the true gains from the sector.

"Maritime policy is the ideal vehicle to boost the blue economy in Europe," she says.

The blue economy's value in Europe is estimated to be worth 500 billion euros, increasing to about 600 billion euros in 2020. Over the same period, people employed in the blue economy are expected to increase from 5.4 million to 7 million, according to the EU's website.

The European Commission also says that worldwide ocean energy installed capacity may double every year, while the commercialization of wave and tidal technologies will be improved through a reduction in technology costs.

According to estimates, the global annual turnover of marine mineral mining is expected to grow from virtually nothing to 5 billion euros in the next 10 years and up to 10 billion euros by 2030.

Contact the writers at zhanghaizhou@chinadaily.com.cn and mengjing@chinadaily.com.cn

Wang Qian and Xie Yu contributed to this story.