City in Fujian tests new model

By Jenny Yao (China Daily Europe) Updated: 2017-02-19 15:24Before implementing a major reform throughout the country, China often tests policies in small regions. This gives central and regional governments experimental data and insight into the critically important details of policy. Sanming city, in East China's Fujian province, has been one of the pilot cities for healthcare reform.

The city has typical problems. Post-industrial decline is forcing many young people to leave, so the population is aging rapidly. More urgently, its social medical insurance scheme for urban employees faced a substantial deficit in 2011 of 210 million yuan ($30.5 million; 28.7 million; 24.3 million), accounting for 14.4 percent of the municipal government's revenue. Sanming's leaders decided in 2012 to implement systemic reforms to tackle the root causes and fundamental misalignments at the heart of the system.

Throughout China, public hospitals have long relied on drug markups for their profits.Physicians were encouraged to overprescribe to gain extra income. Similarly, China's highly complex drug distribution chains allowed multitudes of middlemen to mark up prices at various stages of the process.

The city initiated a four-in-one model - reforming the administration, drug procurement, social medical insurance and service providers. The core philosophy was to centralize and increase government control of public hospitals, identify inefficiencies in drug procurement and integrate insurance fund management. The goal was to find large savings that could then be reinvested into better incentives for medical service providers and better insurance coverage for residents.

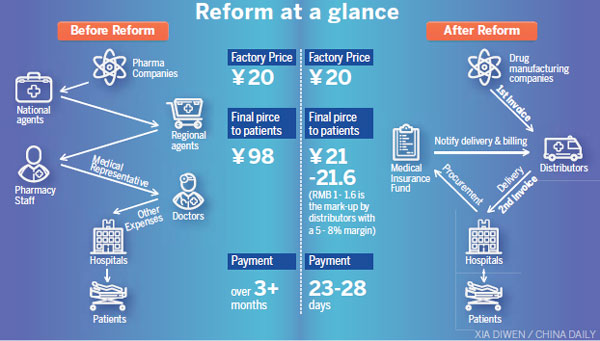

The key to success was the two-invoice system. Payment was routed through a central medical insurance fund. The fund would only pay out if two invoices were produced - from the manufacturer to the distributor and from the distributor to the hospital. Drug markups by hospitals were banned.

By implementing the "two-invoice" system, prices could be tracked at each stage of the supply chain. Once procurement had been centralized in this way, the insurance fund had a much higher degree of paying power than individual hospitals. This system has streamlined drug supply chains, cut down on fraud and exposed outlier hospitals and doctors who were likely to be overprescribing.

These controls successfully reduced drug price markups, limited opaque and opportunistic pricing of medical services, provided more equitable coverage and reduced mistrust of healthcare workers.

The urban employee medical insurance fund swung from a 210 million yuan deficit to a 130 million yuan surplus in 2015, according to a KPMG report titled Sanming: The real story of grass-roots healthcare transformation in China. The rate of growth of healthcare costs was reduced by about half. At the same time, legitimate incomes of healthcare workers more than doubled. Hospitals were put on a more sustainable business footing based on charges for services, not drug markups.

Patients also benefited. Reimbursement rates from medical insurance increased more than 10 percent, thus requiring less out-of-pocket spending from patients. Drug prices were reduced by 30 percent, and the overall use of drugs fell by 20 percent, according to data provided by Sanming . The annual growth rate of total medical spending has fallen by more than a third.

The big losers were drug companies and middlemen. Many businesses in these chains will be merged or just disappear. Pharmaceutical and medical device companies are yet to see the real impact on their market share and profit margins, and this could lead to the biggest-ever consolidation in this sector in the Chinese market.

The author is the head of healthcare, KPMG China. The views on this page do not necessarily reflect those of China Daily.

- 'Cooperation is complementary'

- Worldwide manhunt nets 50th fugitive

- China-Japan meet seeks cooperation

- Agency ensuring natural gas supply

- Global manhunt sees China catch its 50th fugitive

- Call for 'Red Boat Spirit' a noble goal, official says

- China 'open to world' of foreign talent

- Free trade studies agreed on as Li meets with Canadian PM Trudeau

- Emojis on austerity rules from top anti-graft authority go viral

- Xi: All aboard internet express