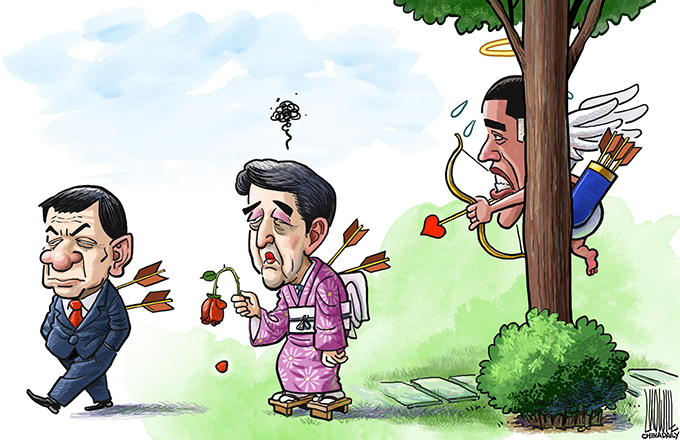

'Abenomics' will not make it

Following the Liberal Democratic Party's success in the Japanese election, it would appear that the economics of Shinzo Abe have achieved success.

So-called "Abenomics" are aimed at expanding quantitative easing, allowing the yen to depreciate and increasing public services input. The inflation rate has been set at lower than 2 percent. But whether Abe's blueprint can steer the country out of recession remains to be seen, according to an article in the 21st Century Business Herald.

Here are excerpts:

According to "Abenomics", the core problem of Japan's recession is stagflation. Citizens' confidence in the prospects for the nation's economic growth is the key to Japan overcoming the recession, as consumption and investment are the most important forces to motive economic recovery.

Although the country's central bank agreed on the inflation rate figure, the real task of implementation is mainly shouldered by the Japanese government. It is virtually impossible to raise the almost-zero gross domestic product to 2 percent purely by printing large amounts of money. It means Japan has to realize 4 percent real growth.

Yet, Japanese governments and the LDP have indicated their objectives for real growth are only 2 to 3 percent this year, which is mainly supported by the Japanese government's investment in public services. Devaluing the yen will probably be a last resort for the government to realize the economic growth target.

But this is a gamble in itself, as it will drive capital from Japan, instead of attracting it. The short-term rise in commodity prices will only result in economic bubbles.

The fundamental cause of Japan's long-term sluggish economy is financial tightening, which is mired in liquidity traps as a result of zero-interest-rate policies. Increasing production efficiency is the real solution to the problem.

The Japanese government chooses financial policies as the main means to promote the performance of the nation’s enterprises. But the real problem for Japanese enterprises is not a lack of government financial support but their lack of innovation, and reduced competency.

The yen's depreciation cannot bring real advantages and competitiveness to Japanese enterprises. The exchange rate for the yen has seen ups and downs since the 1990s, but the gross profit rate of enterprises has long been maintained at 20 to 30 percent. So the exchange rate will not increase their profits, especially when some 20 percent of Japanese enterprises' production has been moved to foreign countries.

The term "Abenomics" has been coined by Japanese media from Reganomics, which refers to the economic policies adopted by the former US president.

Everyone knows that Reganomics resulted in a huge financial deficit to the United States. Japan's State debt has exceeded 200 percent of its GDP. Once the "Abenomics" experiment fails, the consequences will be unimaginable.