Now invest in Asia's future

By Iwan J. Azis (China Daily) Updated: 2013-09-27 07:01The US Federal Reserve announcement delaying the start of a slowdown in asset purchases gives Asian markets a bit of a reprieve but does not change the basic picture that the US is embarking on a gradual normalization of its monetary policy.

The big question is whether that normalization will keep driving investors out of Asian markets, further sapping the wind from the region's economic sails and all but wrecking the most vulnerable economies, as happened in 1997 during the Asian financial crisis.

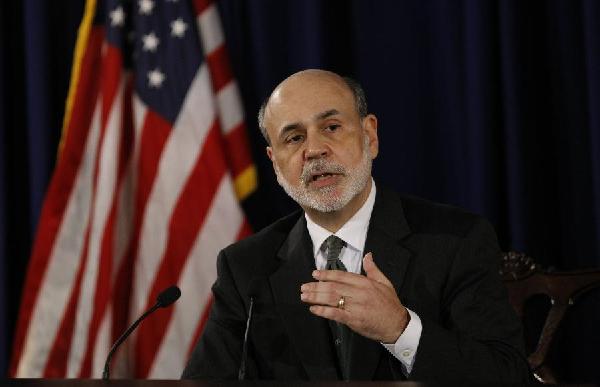

US Federal Reserve Chairman Ben Bernanke speaks at a news conference in Washington DC, capital of the United States, on Sept 13, 2012 following a two-day policy meeting. [Photo/Xinhua]

The quick answer is "no". A repeat of the 1997 crisis, when investors fled in droves and economies tanked, is not likely. Foreign exchange reserves are healthy in most countries, currencies are far more flexible, foreign debts are lower, most economies have current account surpluses and most countries have some room for monetary and fiscal adjustment should it be needed. The growing use of local currency bonds instead of foreign debt means borrowers are not as affected by currency devaluation, and longer tenors in foreign borrowing also means constant refinancing is not needed.

However, there are certainly risks ahead and markets and economies need to work now to brace themselves for a period of higher borrowing costs, some market volatility and slower economic expansion. Even before the latest market turmoil, growth was slowing, particularly in China, the world's second largest economy.

As quantitative easing begins to subside, it will be harder and more expensive for enterprises and governments to raise funds, especially in foreign currencies. That will hurt a region desperate to boost investment, particularly in the infrastructure needed to keep economies expanding.