Experts weigh in on China's GDP growth

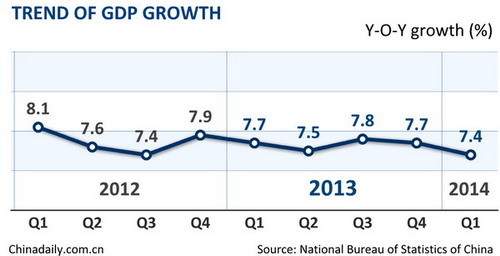

(chinadaily.com.cn) Updated: 2014-04-16 17:00China's National Bureau of Statistics released fresh economic figures for this year's first quarter today. GDP grew by 7.4 percent year-on-year in Q1, the lowest quarterly growth level since the third quarter of 2012 but slightly higher than general market expectations. Louis Kuijs, Chief China economist at Royal Bank of Scotland, and John Ross, former director of economic and business policy for the mayor of London, try to decipher the economic indicators.

Louis Kuijs, Chief China economist at Royal Bank of Scotland

The economic slowdown that started in the end of 2013 continued in Q1 2014. GDP growth slowed further from 7.7 percent year-on-year in Q4 2013 to 7.4 percent year-on–year in Q1 2014, led by weakness in real estate and exports, while consumption growth held up reasonably well. The monthly activity data suggest a slight improvement at the end of Q1. Also, the slowdown has been most pronounced in industry. Growth in the service sector has held up better, and this has helped support the labor market, judged by trends in migrant employment and wages, moderating the concerns policymakers have about the impact of the economic slowdown.

Senior leaders and policymakers are balancing considerations. The government work report of March, comments by Premier Li Keqiang and a statement of the State Council two weeks ago shows that China's leadership still attaches much importance to economic growth. But senior leaders do not want to pursue substantial stimulus, given the need to moderate credit growth and rein in financial risks and excesses in the shadow banking system, as well as the more negative connotation that stimulus has nowadays.

In this setting, the government has recently started to take some mild growth-supporting measures. In early April the government announced some steps to support growth, including accelerating the construction of infrastructure projects and supporting social housing construction. In addition, in our view the monetary stance has been eased recently. In March, total social financing, core bank lending and shadow banking, while down on a year ago, were all actually quite strong, significantly exceeding the average of the preceding six months. The evolution of interbank interest rates is in line with an easing bias. We expect this approach to continue in the coming months, with the exact policy stance and measures heavily dependent on the data.

In our view, with many domestic growth drivers still intact and amidst a gradual improving global outlook, policymakers are likely to be able to prevent growth from falling below their bottom line without implementing major stimulus. Nonetheless, with subdued growth of exports and corporate investment and the government easing macro policy, little progress is likely to be made this year with reining in the pace at which the credit-to-GDP ratio is rising. In the context of worries in financial markets about financial risks in China, this is likely to keep markets nervous. Systemic financial problems or instability remain unlikely any time soon. However, until the government becomes more forceful on reining in the pace of increase in the credit to GDP ratio, financial markets are likely to continue to remain anxious and nervous about financial risks in China, thus continuing to affect sentiment and asset prices.